How the Ivies Grow

Over the last five years, when the average college endowment fund earned an annualized 5.9%, a typical investor choosing a low-cost 60-40 index fund realized an average return of 8.2 %, a difference of 2.3%. So why weren’t more endowment funds passively managed? Why not park those billions in an index fund?

That’s a question raised (and criticism implied) of the Ivy Leagues’ largest endowments from their own graduates and investment gurus like Warren Buffet in his 2016 investor letter.

The Leader’s a Lightning Rod

Indeed, the difference in five-year returns is significant (to the tune of $5 billion) when the fund totals $37 billion like world’s largest endowment fund at Harvard. Until recently, the fund was managed by as many as 230 employees at the in-house investment firm called Harvard Management Company (HMC).

The company has come under fire in recent years for reasons including:

- Staff Compensation: HMC has been criticized for compensation. As a group, the employees were paid $242 million from 2010 through 2014. Consider the compensation in light of figures from the annual NACUBO-Commonfund Study of Endowments released in January 2018: There are more than 2,000 four-year colleges in the U.S., a majority of which don’t have endowments at all. Of 800 colleges that participated in the study, the median size is about $128 million. Compensation levels at HMC were bound to be a lightning rod—especially when returns suffered as they have in recent years.

- Underperformance: In 2016, Harvard lost $2 billion in value and posted a 10-year average return of 4.4%, the worst performance among its peers.

- Write-Downs in Natural Resources Alternatives: HMC dedicated 10% of the endowment to alternative investments like Central American teak forests, an Australian cotton farm, a eucalyptus plantation in Uruguay, timberland in Romania, and an agricultural development project in a remote part of Brazil that produced tomato paste, sugar, and ethanol. They exited that Brazilian project, taking a loss of $150 million.

For all of this, Harvard received some harsh criticism including that from a finance professor at the University of Washington. Bloomberg interviewed Thomas Gilbert quoting him as saying, “Harvard made many mistakes over the last decade, but almost all of them boiled down to a single miscalculation: the belief that its top money managers were smarter than everyone else and could handle the risks almost all other endowments avoided.”

Defended by an Unlikely Ally

Dr. Gilbert and gurus like Warren Buffet would criticize Harvard for relying on active management policies instead of directing donor dollars to index funds. Interestingly enough, among the first to defend HMC (albeit unwittingly) was David Swensen, the investment manager for the last 32 years at Harvard’s rival, Yale. In Yale Endowment’s 2017 Annual Report, Swensen wrote of the effectiveness of “high-quality investment professionals overseen by impressive committees of fiduciaries”:

For the twenty-year period ending June 30, 2017, Yale produced a 12.1% return, outpacing the 7.5% return of the Wilshire 5000 Stock Index, the 6.9% return of a classic 60% U.S. equity and 40% U.S. bond portfolio….In terms of impact on the university, Yale’s 5.2% incremental return over the classic 60/40 portfolio added $27.5 billion in the form of higher levels of support for the operating budget and increased Endowment values.

About his peer group, including Harvard, Swensen wrote this:

The results of the top ten performers amaze. Their well-diversified portfolios crush the returns produced by U.S. stocks, adding untold billions of dollars to support the educational missions of their institutions….Not only has the model worked for the past two decades, it will work for decades to come.

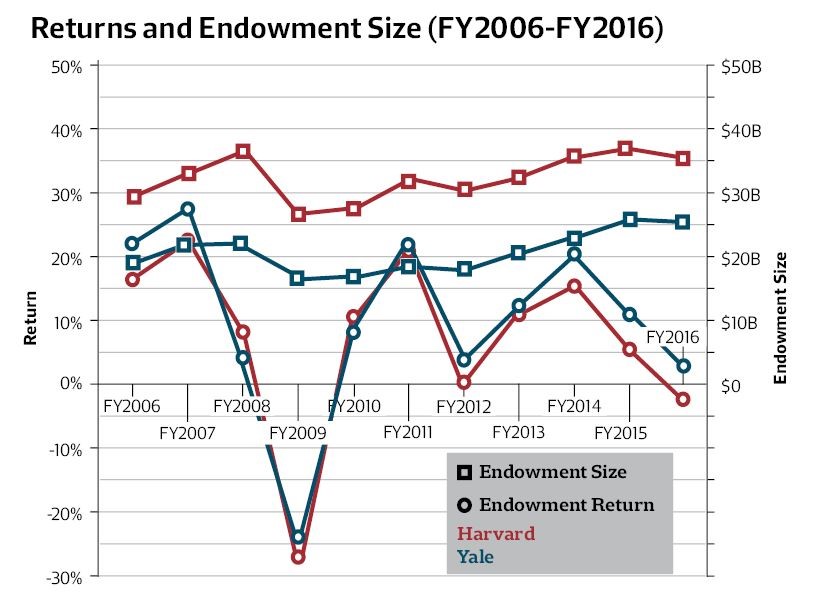

A look at the investment returns of the two Ivies demonstates their relative success. Yale’s high marks have been higher than HMC’s and their low marks have not been as low, but both have grown over a 10-year period.

(Source: The Harvard Crimson)

(Source: The Harvard Crimson)

A Friendly Rivalry

While Harvard and Yale may be rivals, that hasn’t stopped Harvard from adopting some of the practices of its fellow Ivy. In September 2016, HMC appointed “Narv” Narvekar to run the endowment fund. Narvekar previously managed Columbia University’s endowment for 14 years (where its $9 billion endowment posted annualized returns of more than 10 percent during the last decade).

In his short time at the helm, Narvekar has cut HMC staff by 100, and implemented a strategy like Yale’s, relying more on outside managers and a generalist approach that levels silos and compensates managers for growth across the entire portfolio.

Lessons for Everyone

Though Harvard has received public criticism for its investment management in recent years, colleges and universities like Harvard can’t be faulted for holdings in illiquid assets and alternatives that have the potential to deliver higher returns for a generational timeframe. And yet, misjudgments and the losses that can result aren’t merely expressed on paper—they’re experienced by college students who will pay increasingly high tuition, scholars who will receive fewer scholarships, researchers who will lack funding, and campus facilities that may fall into disrepair.

Our nation’s colleges and universities are respected the world over. Their investments deserve to be managed by stewards who see within their investment portfolios the faces of the donors who have entrusted their gifts and the beneficiaries who depend on them. No one knows that better than the endowment managers appointed to guide their success.

The hallmarks of Yale Investments Office’s perennial success include its clear investment strategy, partnership with trusted advisers, rigorous research and debate on fund managers, and low-turnover among its staff. In addition, the head of the department, Dr. David Swensen (who took an 80% pay cut leaving Wall Street to return to his alma mater), has always viewed his job as a means of service. Of his long tenure and that of his colleagues Swensen has said, “Managing an endowment is a position of trust, not a steppingstone.”

Highland Consulting, with a 25-year history of serving its foundation and endowment clients as a co-fiduciary, has built its business on trust and respect. You can rely on Highland’s team of professionals with advanced designations and an average length of service of 26 years to advocate on your organization’s behalf.

Let’s talk about your goals for your organization’s investments. We’d be delighted to have a conversation.