September 2021

Summary

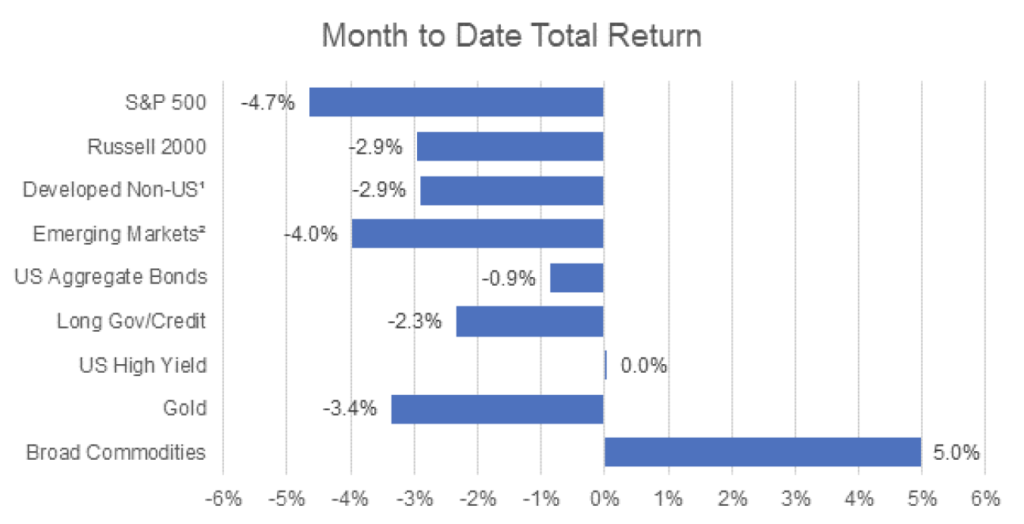

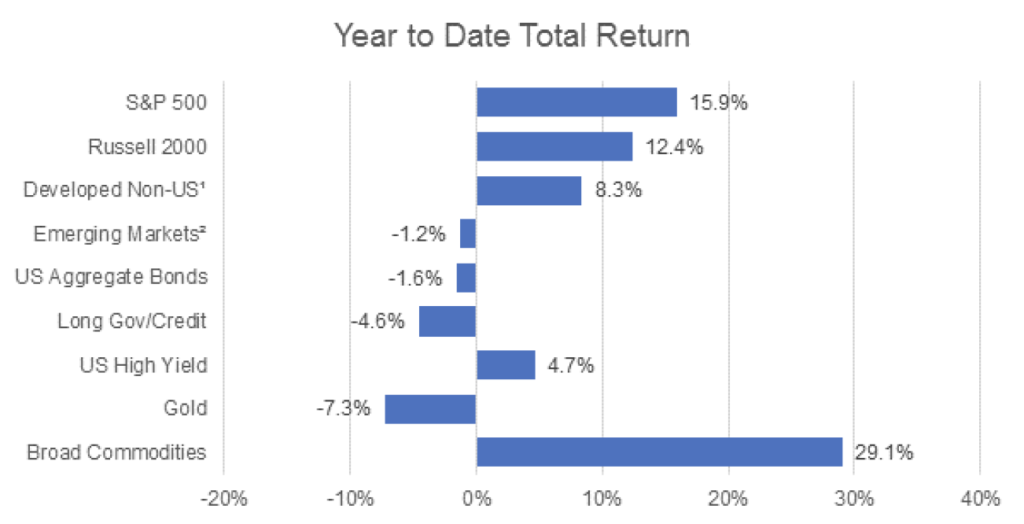

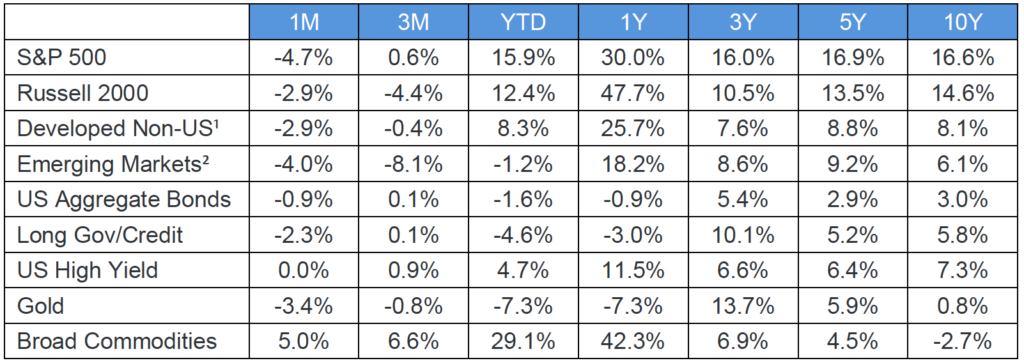

Global markets experienced turmoil across the board in September, as equities fell, credit spreads widened, and even favored safe havens, like Treasuries and gold, incurred losses in a wild month of trading. Equity and credit markets were spooked by concerns over the looming default of Chinese real estate developer Evergrande. The Federal Reserve’s comments on tapering, reducing stimulus provided in response to the pandemic, led bond investors to reassess their outlook on interest rates heading into quarter end, and pushed Treasury yields higher.

Equities

Stocks declined in September with heightened volatility throughout the month. Typical September dynamics were on display as banks and traders closed out the summer and shifted focus toward year-end. With equity returns in developed markets well ahead of forecasts year-to-date, investors seemed well positioned for taking profits. A weak August jobs report also primed markets for tough sledding ahead.

Additional headwinds emerged mid-September with the prospect of the default from Evergrande, a Chinese real estate giant. While Evergrande’s trouble was not surprising, it raised concern over possible contagion and forced investors to reconsider economic growth prospects. This broad-based reevaluation of equity risk impacted markets across the globe.

Fixed Income

Fixed income markets provided little diversification benefit in September, as credit spreads and Treasury yields both marched higher. September’s Fed meeting signaled that the tapering of the current asset purchase program could begin as early as November and lead to rate hikes throughout 2022. Investors responded by selling longer-dated Treasuries pushing the 10-year yield over 1.5%. Credit markets saw spreads widen slightly but held up well considering the turmoil in risk assets and Treasuries, with US high yield finishing the month flat.

Commodities

Inflation pressures eased slightly with August’s CPI report showing a slight decline from July and precious metal prices fell, with gold prices dropping over 5% in September. Disruptions in the global supply chain persist as a mini crisis in the UK fuel supply helped to push oil prices higher for the month of September.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.