October 2021

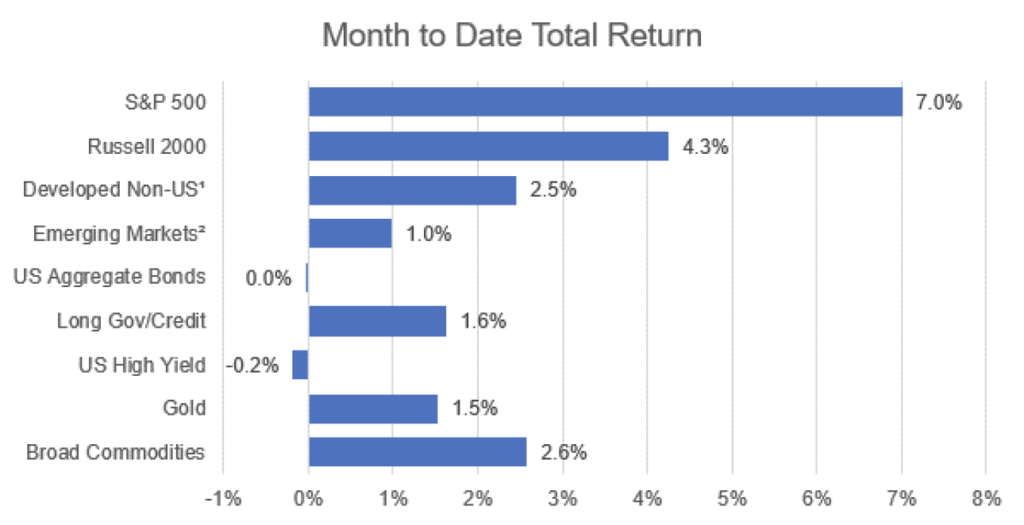

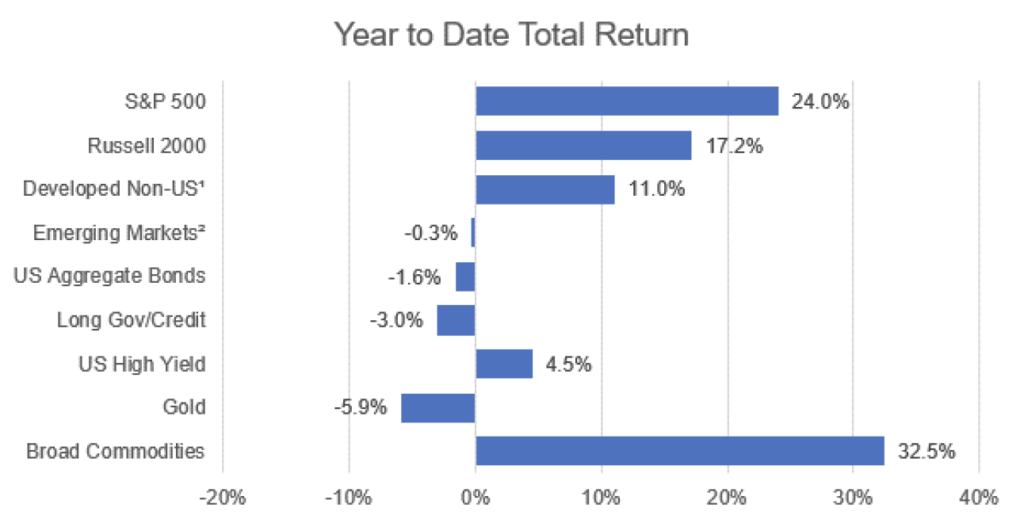

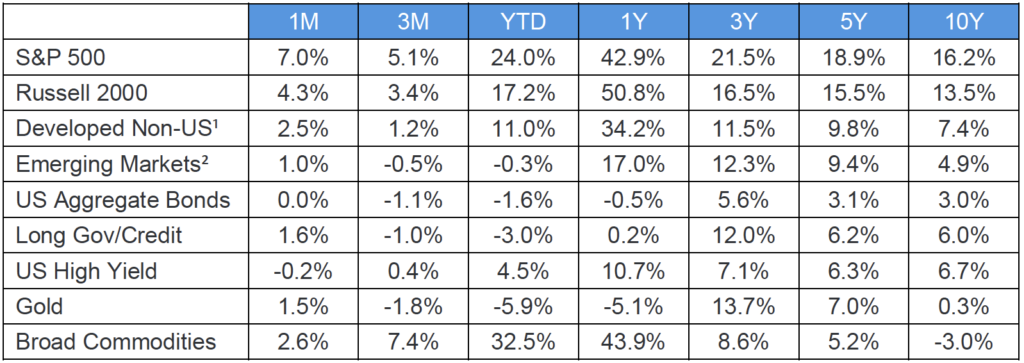

Equities

Equity markets rebounded from September. Large cap U.S. companies led the way. Stocks overcame an increasingly gloomy macroeconomic picture; the U.S. jobs report missed expectations for the second consecutive month and the Atlanta Fed’s Q3 GDP forecast sunk to 0.2%, a steep decline from August’s 6.3% projection. Measures of consumer confidence and manufacturing activity also continued along downward trends. Corporate earnings were strong, however, emboldening investors to “buy the dip” after September’s sell-off and push global equity indexes higher in October.

Fixed Income

Treasury yields were mixed, and credit spreads widened, producing uneven returns for fixed income. Long bonds outperformed, as the 30-year Treasury yield fell 11 basis points for the month, while shorter dated yields rose modestly. High yield spreads shifted upward by 20 bps, producing negative returns for credit. Inflation concerns continue to weigh on investors, as September’s CPI report remained at 5.4% annualized.

Commodities

Commodities gained in October with oil and gas leading the way. Concerns over possible global shortages for natural gas heading into winter have pushed prices higher across Europe with carryover into U.S. markets. Supply chain disruptions remain pervasive, and agricultural commodities, industrial metals, and gold all showed price gains for the month.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.