May 2022

Summary

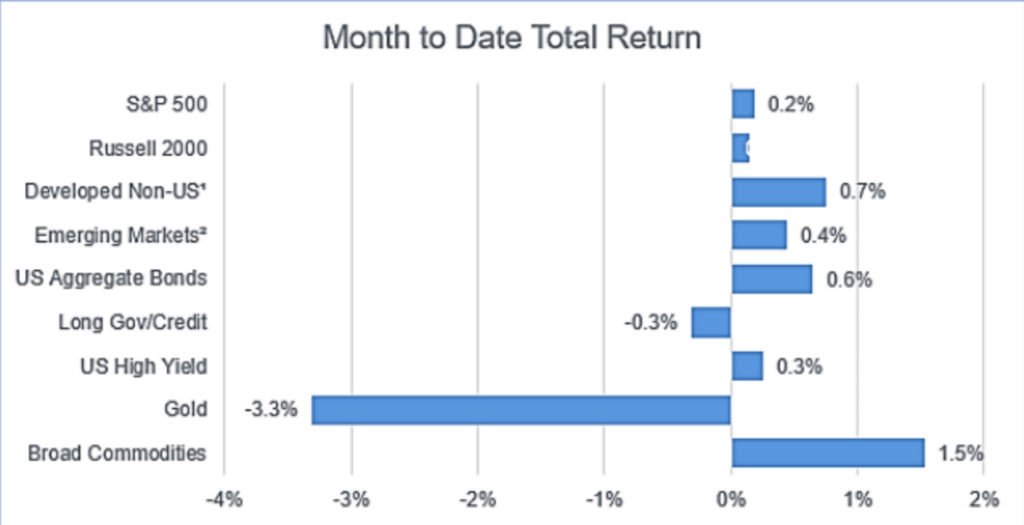

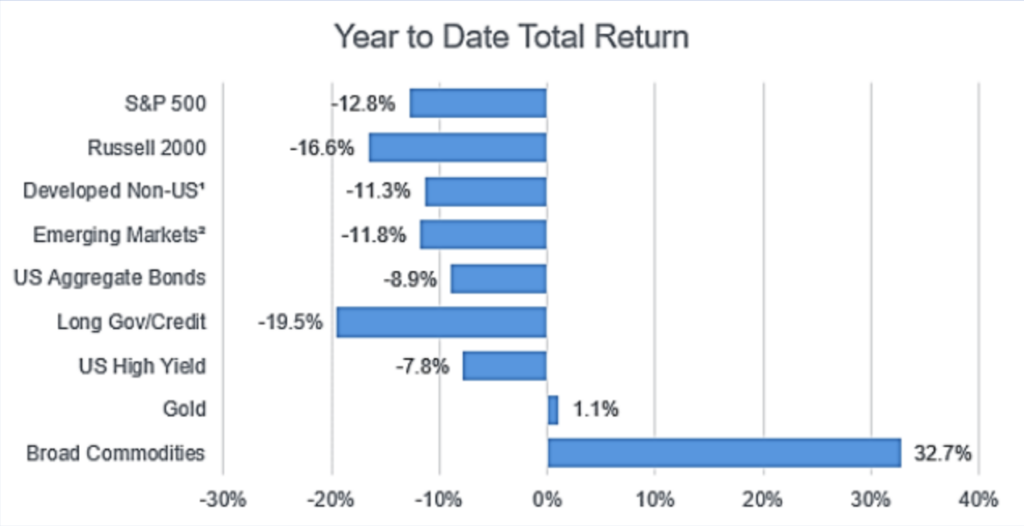

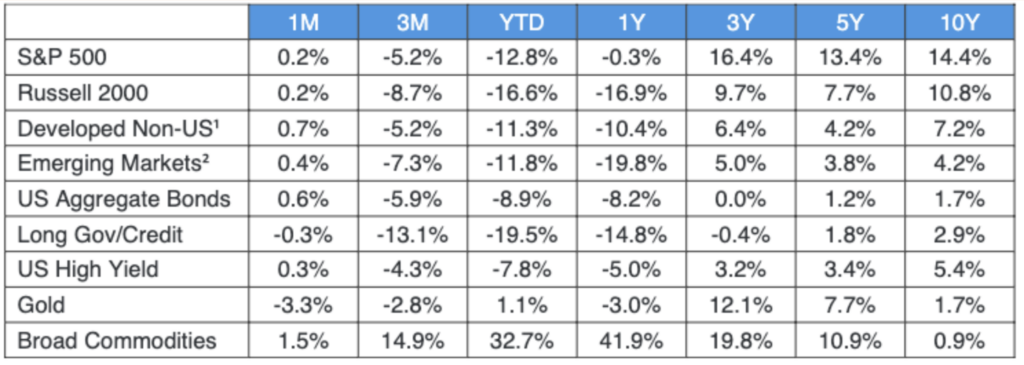

After a dismal April, and a late May rebound, U.S. markets ended May almost flat. Developed equities shrugged off global recession concerns to rally strong into month-end, erasing earlier losses. Emerging markets continued to be weighed down by China’s aggressive COVID lockdown measures. Interest rates reversed trend and declined in May, giving bonds their first positive monthly return for 2022. Inflation remained high, though April’s final number came in below the prior month, kindling hope that inflation may have peaked.

Equities

On the heels of their worst month since the onset of the COVID pandemic, U.S. stocks continued to slide for most of May before reversing course and rallying strongly into the Memorial Day weekend. The S&P 500, small cap stocks, and developed international stocks finished higher for the month. Recession remains a major concern for investors, as the war in Ukraine stretches into its fourth month, and Shanghai remains under lockdown in accordance with China’s zero-COVID policy. All of this is straining an already fragile global economy grappling with soaring inflation and tight labor markets.

Emerging markets were unable to keep pace with developed equities, finishing lower in May. With Chinese stocks representing nearly a third of the EM index, the spillover from COVID-related economic restrictions were too much to overcome.

Fixed Income

Bonds generated their first positive month of the year in May, despite a 50 basis point rate hike from the Federal Reserve. The 10-year treasury yield touched a 3-year high of 3.15% early in the month, then fell 40 basis points, as investors were buoyed by the possibility of the lower future inflation. April’s CPI number of 8.3% came in over the market’s expectation but below the March 8.6% rate, sparking hope that the U.S. has passed peak inflation. Corporate credit underperformed as credit spreads widened for the month.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.