April 2021

Summary

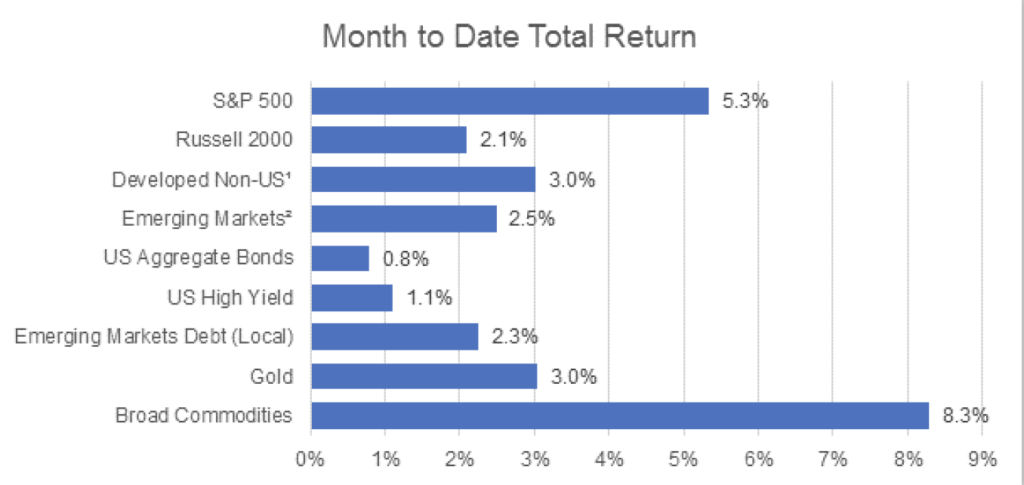

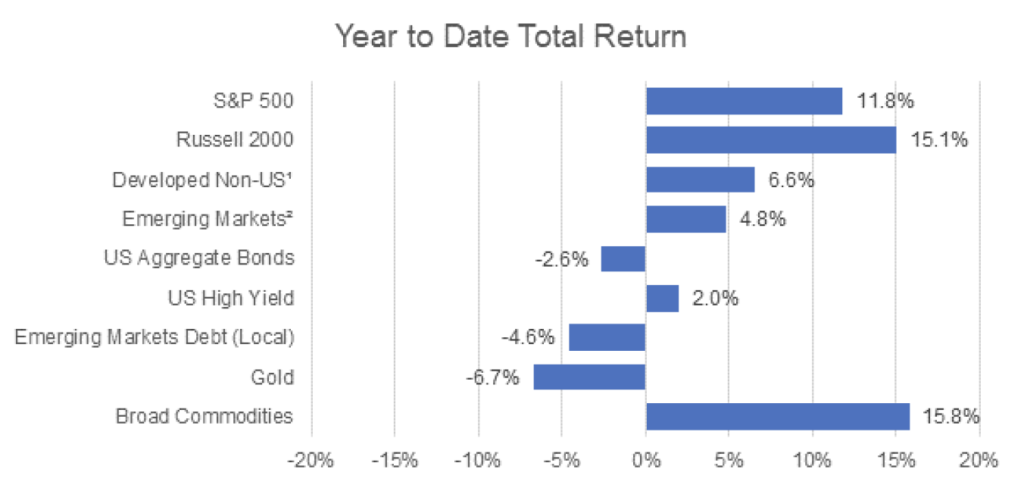

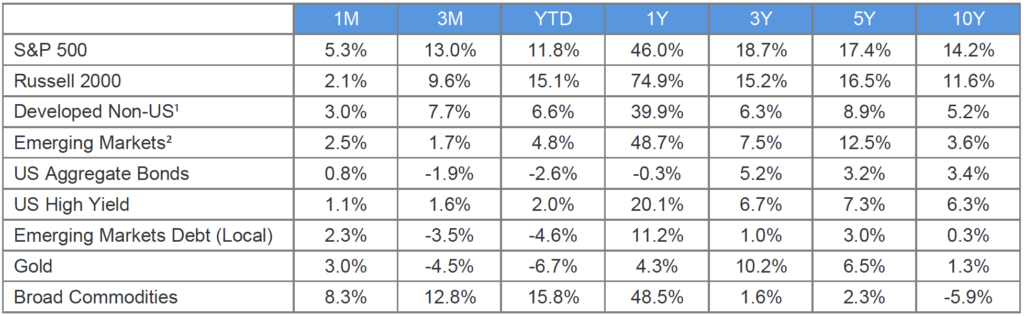

Major stock indices rose in April, while interest rates stabilized leading to positive fixed income returns.

Equities

In the U.S., better than expected new jobless claims and strong first quarter corporate earnings from major banks and mega-cap tech companies pushed the S&P 500 index to new highs. Small cap stocks kept pace as optimism surrounding the re-opening of COVID-shuttered segments of the economy continues.

Outside of the U.S., positive returns were tempered on news that vaccines from AstraZeneca and Johnson & Johnson were being examined (and in some cases paused entirely) due to reported incidences of rare but severe blood clots resulting from the vaccines. AstraZeneca’s shot has been widely disseminated in Europe, and the suspension caused the continent to fall further behind schedule relative to the U.S.

Emerging markets are dealing with different COVID-related problems with severe outbreaks in South America and Southeast Asia putting pressure on countries lacking the funds to purchase, and infrastructure to administer vaccines on a large scale. EM equities gained in the face of these headwinds, though the problem has continued to grow into the end of the month.

Fixed Income

After rising steadily in the first quarter, interest rates were widely flat in April. With limited interest rate movement and modest credit spread changes, fixed income indices edged higher, as the Bloomberg Barclays Aggregate Bond Index posted its first positive monthly return of 2021.

The month concluded with remarks from Federal Reserve Bank Chair Jay Powell indicating, that while the current state of the economic recovery is encouraging, it is too early to consider a shift away from the current accommodative monetary policy.

Capital Gains

Capital gains tax rates made their way into the spotlight in April. Early details on President Biden’s $1.8 trillion spending plan identify as a major funding source a near doubling of the capital gains tax rate for those earning more than $1 million annually. While this proposed rate hike has yet to be debated and determined, the news caused the market to retrace briefly and consider the potential impact in light of recent and substantial appreciation in stock market darlings like Tesla and Amazon.

Any tax rate changes will present a challenge for wealthy taxable investors and could motivate investors to sell appreciated positions before the higher tax rate is imposed. Of course, a tax hike would magnify the importance of thoughtful estate planning and tax minimization strategies. The formal proposal will likely require a number of iterations before passage, but the capital gains rate has become the opening salvo lobbed by an administration that has pledged to increase taxes on the wealthy to fund additional investment social programs.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.