April 2022

Summary

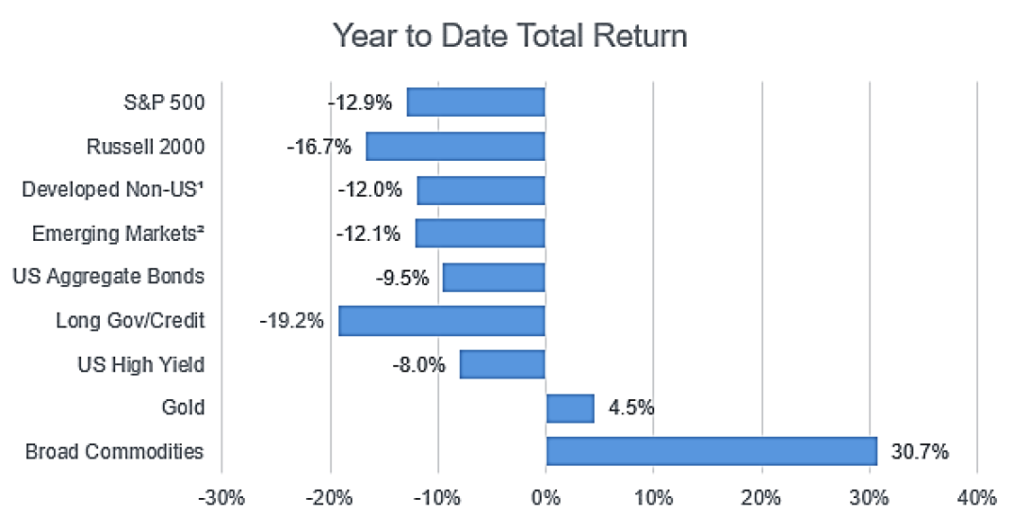

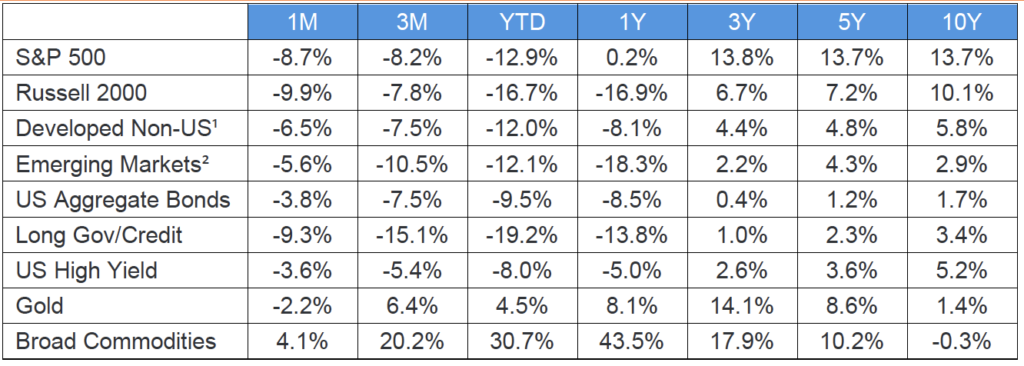

The first quarter of 2022 concluded on a positive note for developed equities, while bonds continued to The second quarter of 2022 opened with a continuation of the dominant themes from the first three months. Elevated inflation and increasingly hawkish commentary from the Fed pushed interest rates higher, while the war in Ukraine escalated throughout the month, severely impacting risk sentiment. While reported earnings for the first quarter were generally positive, notable misses from large cap index companies, such as Netflix, were met with massive sell-offs. Commodity prices continued to rise, negatively impacting consumer spending and global economic growth.

Equities

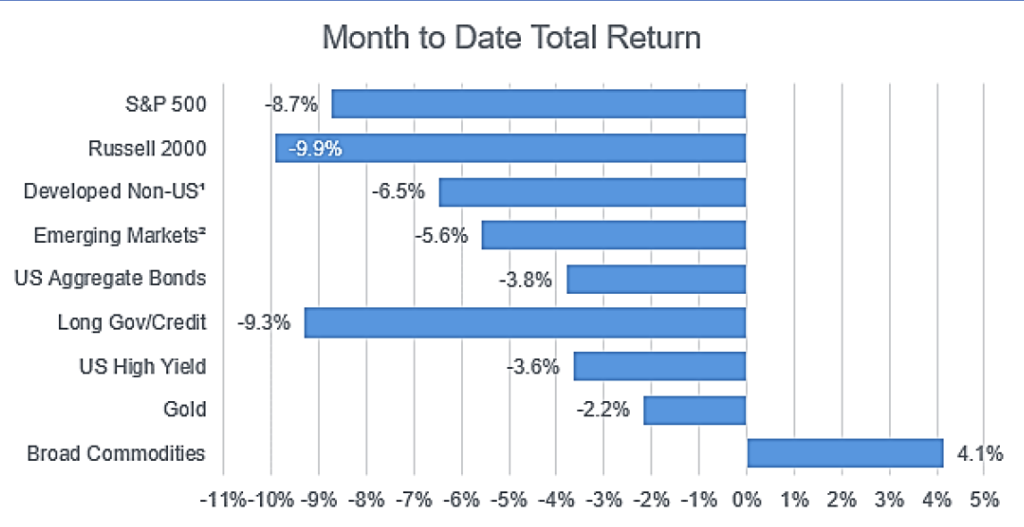

Stocks declined significantly as April ended, and finished sharply lower for the month. The S&P 500 fell 8%, while small cap stocks (-9.9%) were hit even harder. Investors experienced negative stock returns outside of the U.S. as well, with recession fears intensifying across Europe, exacerbated by escalating rhetoric around the possibility of a sweeping cessation of Russian natural gas exports to the west. Emerging markets also experienced shocks, as ongoing lockdowns in major Chinese cities, driven by a zero-tolerance COVID policy, threaten to become a major economic disruption.

Fixed Income

Interest rates retained their upward trend in April with the 10-year U.S. Treasury yield rising approximately one-half percent, finishing near 2.9%. Credit spreads widened for both investment grade and high yield bonds, and mortgage rates reached 5% for the first time since 2010. The Treasury yield curve remained flat, as bond traders priced in an expected May rate hike from the Fed. Year-over-year inflation for the end of March rose to 8.5%, a level not seen since 1981. This triggered sentiment that increasingly aggressive measures by the Fed will be required to reduce rising prices.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.