August 2021

Summary

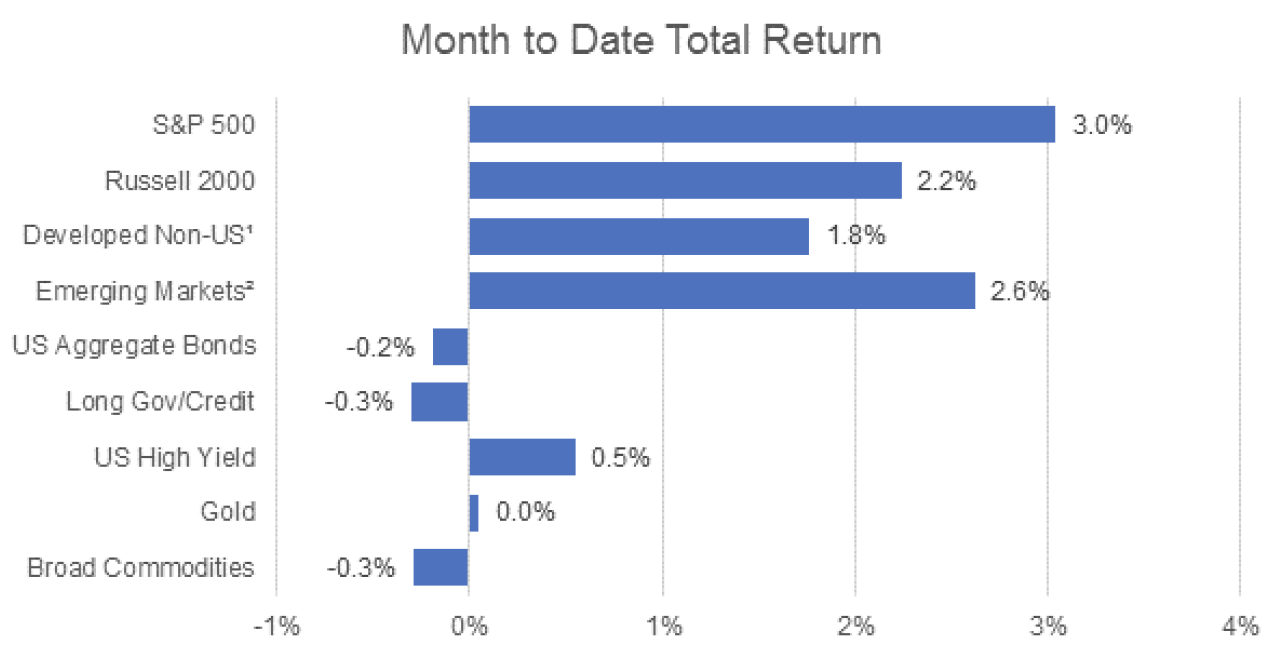

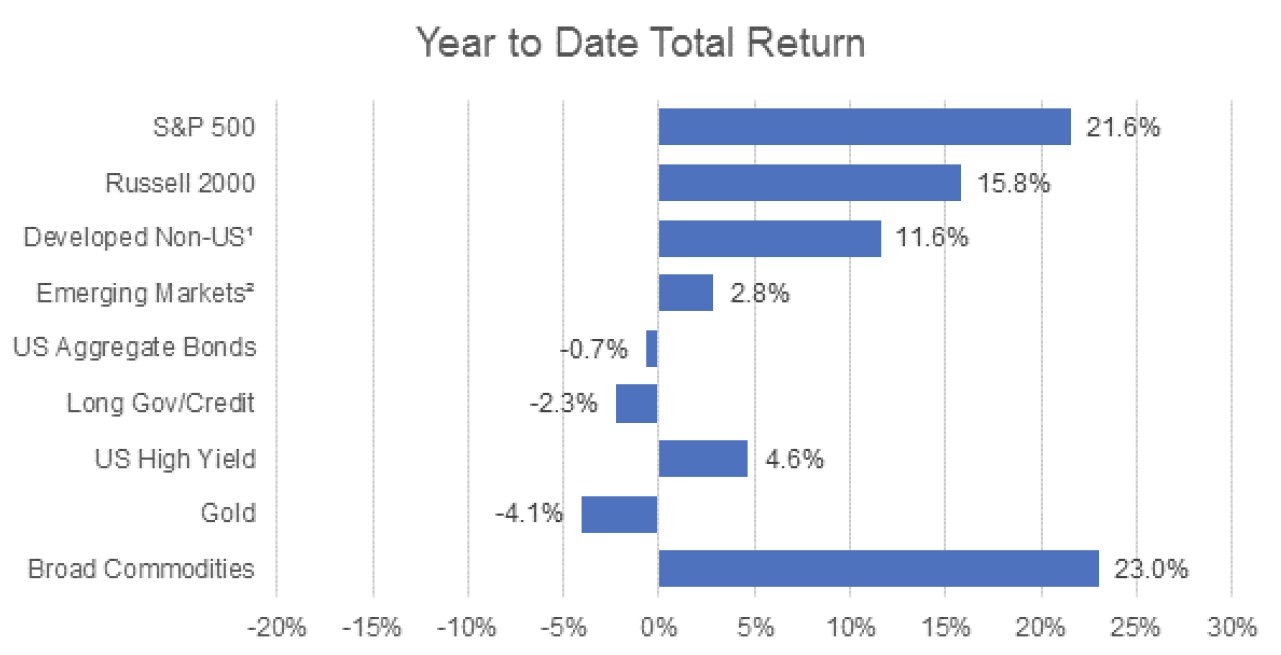

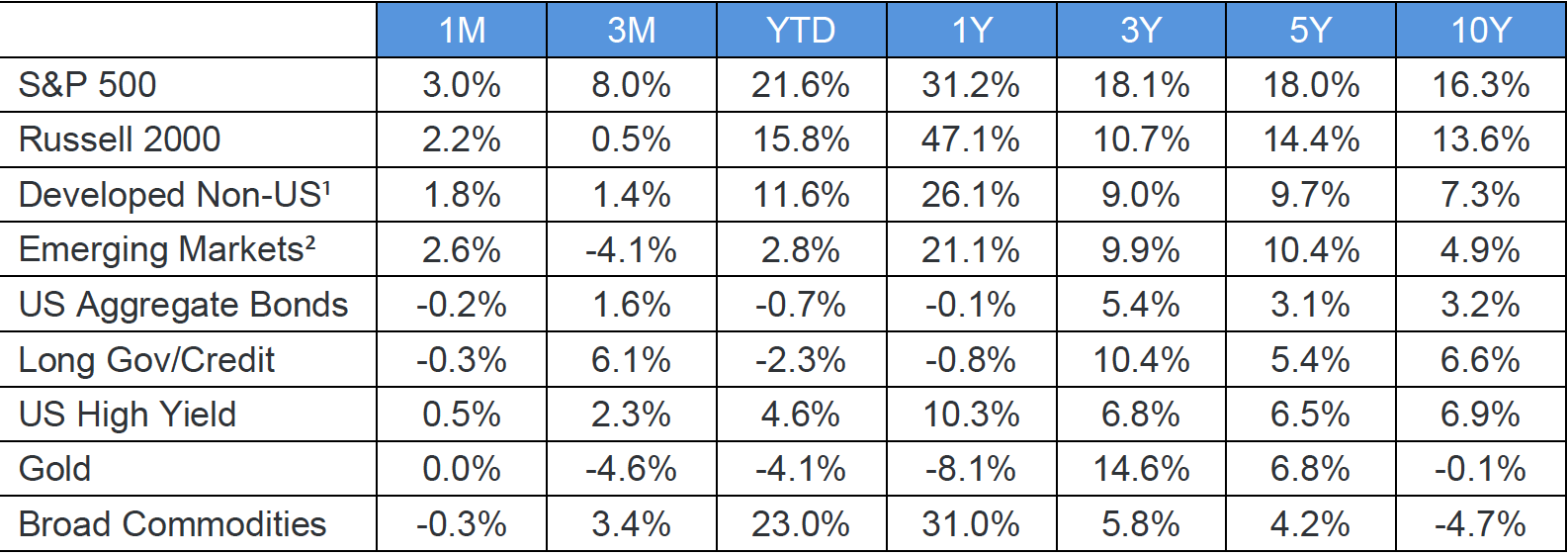

US stocks rebounded from a mid-August decline, rallying to finish a positive month. Investors were encouraged by the news coming out of the Fed’s annual Jackson Hole meeting, which was held virtually this year. Fed Chair Jerome Powell communicated to markets that any tapering of bond purchases would be communicated well in advance of implementation, easing market fears, and pushing the taper timeline out to late 2021 or early 2022.

Outside of the US, the Chinese government continued their regulatory tightening of big tech companies, passing new laws on data protection. China continues to weigh negatively on emerging markets equities, which lagged their developed counterparts for a third consecutive month.

Equities

U.S. stocks traded through volatility to finish higher for the month. US equity investors grappled with elevated inflation and the potential policy implications, as well as an uncertain economic growth outlook driven by rising COVID cases. In the end, markets shrugged off concerns of slowing growth and were appeased by a dovish message from the Federal Reserve Bank.

The late month rally boosted small cap stocks and allowed emerging markets to overcome earlier losses and finish the month flat. Chinese regulatory uncertainty continues to weigh on EM, and the spread of the Delta variant adds an unwanted wrinkle to a group of economies dependent upon global growth.

Fixed Income

Treasury yields rose, with the 10-year Treasury trading between 1.13% and 1.37%, before finishing the month just below 1.3%. Credit spreads tightened and high yield bonds outperformed, while TIPS continued to ride persistently high inflation data to beat duration-matched Treasuries.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.