August 2022

Summary

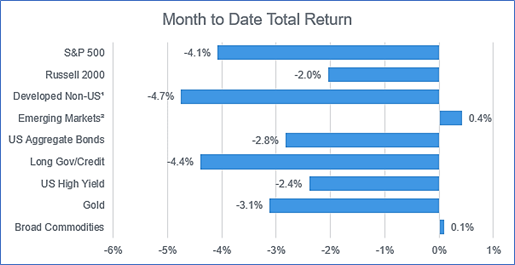

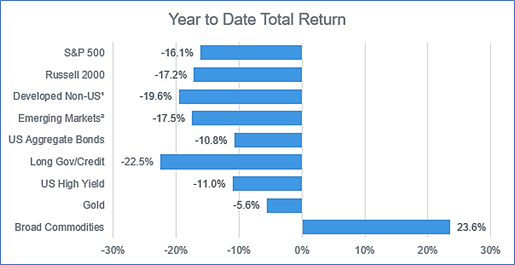

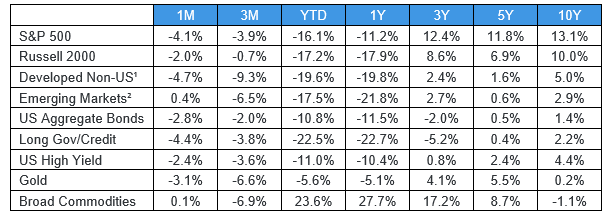

On the heels of a July that was as hot as the temperatures outside, markets entered August seeking to maintain positive momentum. But after a choppy start, equities faded and interest rates shifted upward, leading to losses for most major stock and bond indexes. While inflation fell, aided by a steep drop in energy prices, the Federal Reserve gave no indication of slowing the current tightening cycle in its commentary from August’s speech at Jackson Hole. Broad commodities continued to advance, though crude oil futures declined nearly 10% for the month.

Equities

Equity markets continued to blaze upward for the first half of August before the midsummer’s rally evaporated into a steep month-end sell-off. After topping out just above the 4,300 level (higher than the index stood on the day of Russia’s invasion of Ukraine), the S&P 500 fell nearly 8%, wiping out almost half of July’s strong returns in the process. Overseas, European economies are bracing for tighter monetary policy from central banks as inflation continues to test record levels. With the U.S. ahead of schedule by comparison, the dollar has rallied globally, pushing the Euro/USD exchange rate below parity for the first time ever. In emerging markets, where policy rates are typically higher, and currency weakening can be beneficial to exports, equities generated positive returns for the month.

Fixed Income

Interest rates took a more direct path than equities in August, rising steadily off recent lows. The 10-year Treasury yield climbed 60 basis points to finish at 3.13%, while credit spreads widened with limited volatility. As a result, bond returns came in negative for the month with high yield bonds slightly outperforming investment grade securities on the strength of higher coupon income. Though the inflation numbers for July reflected a decline month over month, Jerome Powell warned that the Fed would remain committed to forcefully quashing inflation and stay in tightening mode to avoid false starts. This message cascaded across markets as equities and bonds declined in value, and mortgage rates increased, closer to recent highs.

1 - MSCI EAFE

2 - MSCI - EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.