Posts by Highland

Times Are Changing – Should You?

photo credit: Pixabay In recent years, cash has enjoyed a period of higher yields, thanks to recent central banks’ aggressive interest rate hikes aimed at curbing inflation. This has made cash and cash-equivalents—such as savings accounts, money market funds, and short-term government securities—more attractive than they have been in over a decade. However, with rate…

Read MoreSeptember 2024

Summary Markets rallied across the board in September as the Federal Reserve made good on a well-telegraphed rate cut, trimming the Fed Funds rate by 50 basis points. The 2-year Treasury rate dipped below the 10-year yield for the first time since the summer of 2022, U.S. stocks marched higher, and the dollar weakened, providing…

Read MoreAugust 2024

Summary August typically brings calmer markets and light trading volumes, with investor interests skewed more towards wrapping up the last of summer vacations. In this sense, August 2024 was anything but typical. Surprise activity from the Bank of Japan thrust global markets briefly into chaos before a just-as-abrupt rebound. Cooler inflation and negative jobs revisions…

Read MoreJuly 2024

Summary July was a remarkable and volatile month, as stocks were mixed and bonds generated positive returns. Large cap stocks saw their first 2% single-day drawdown of the year and many of the big tech names which drove 2024’s AI-fueled rally sold off during July, while the Russell 1000 still managed to finish the month…

Read MoreJune 2024

Summary Stocks were mixed in June and interest rates rallied in the month to what’s becoming a familiar tune – data indicating a slowing economy and inflation that is gradually declining. In the U.S., unemployment ticked up slightly and the housing market continued to cool, leading markets to price in more optimism for a Fed…

Read More100% ESOP!

Highland became a 100% ESOP company January 1, 2024. We believe this structure directly aligns us with our clients and their objectives. Our non-hierarchal structure cultivates a client-centered, team-oriented environment where Highland consultants, research analysts, client service associates and reporting team collaborate in all areas of client service and research. This team philosophy and culture…

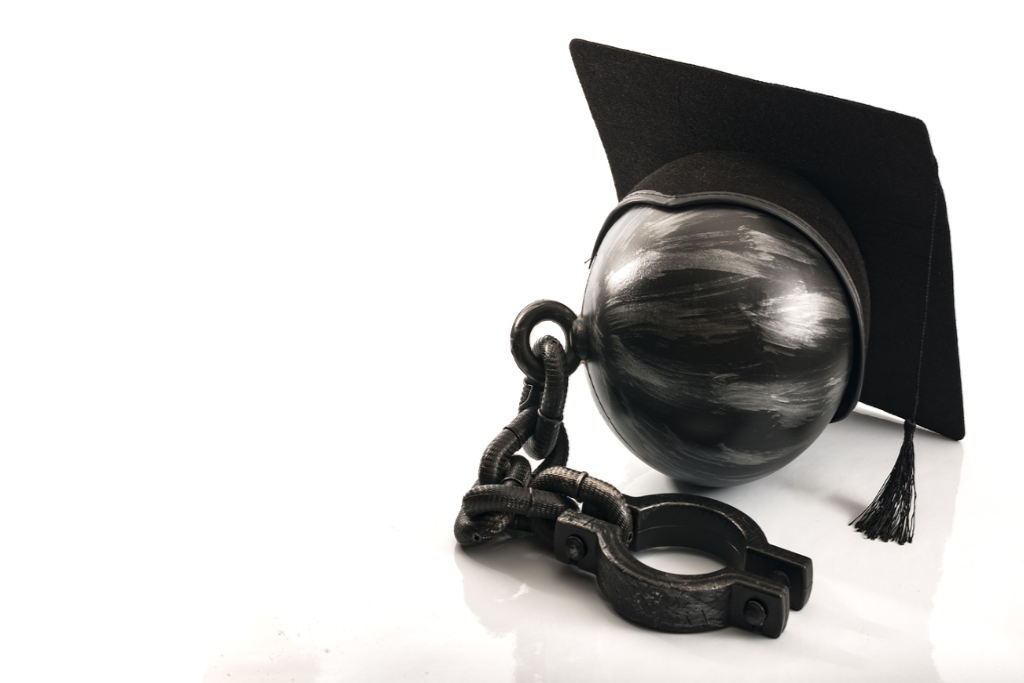

Read MoreSecure Act 2.0 Student Loan Match – Lightening the Student Debt Load to SECURE a Better Retirement

photo credit: istock “A hundred wagonloads of thoughts will not pay a single ounce of debt.” – Italian proverb As of 2023, 43 million Americans held $1.6 trillion[i] in student loan debt. That’s a wagonload of debt accumulated in the pursuit of higher thought. That burden of student loan debt is hindering retirement savings. Case…

Read MoreMay 2024

Summary Investors who chose to follow the old market adage of “Sell in May and go away,” ended up disappointed, as stocks and bonds rebounded with strong performance following April’s selloff. With inflation and economic data cooling, interest rates moderated and equities rallied during the month. Equities Stocks bounced back in May as global equities…

Read MoreApril 2024

Summary After a robust start to the year, stocks pulled back for the first time in April. The broad selloff was fueled by diminishing hopes for Fed interest rate cuts, geopolitical worries, and a lower than forecast level of GDP growth in the first quarter. Interest rates moved higher for the month as bonds continue…

Read MoreMarch 2024

Summary Returns were positive across the board for major global asset classes in March. For large cap developed markets stocks, the close of the first quarter of 2024 marked the 5th consecutive month of positive returns, while for bonds, March offered some welcomed relief after a slow start to the year. The rally was truly…

Read More