December 2020

Summary

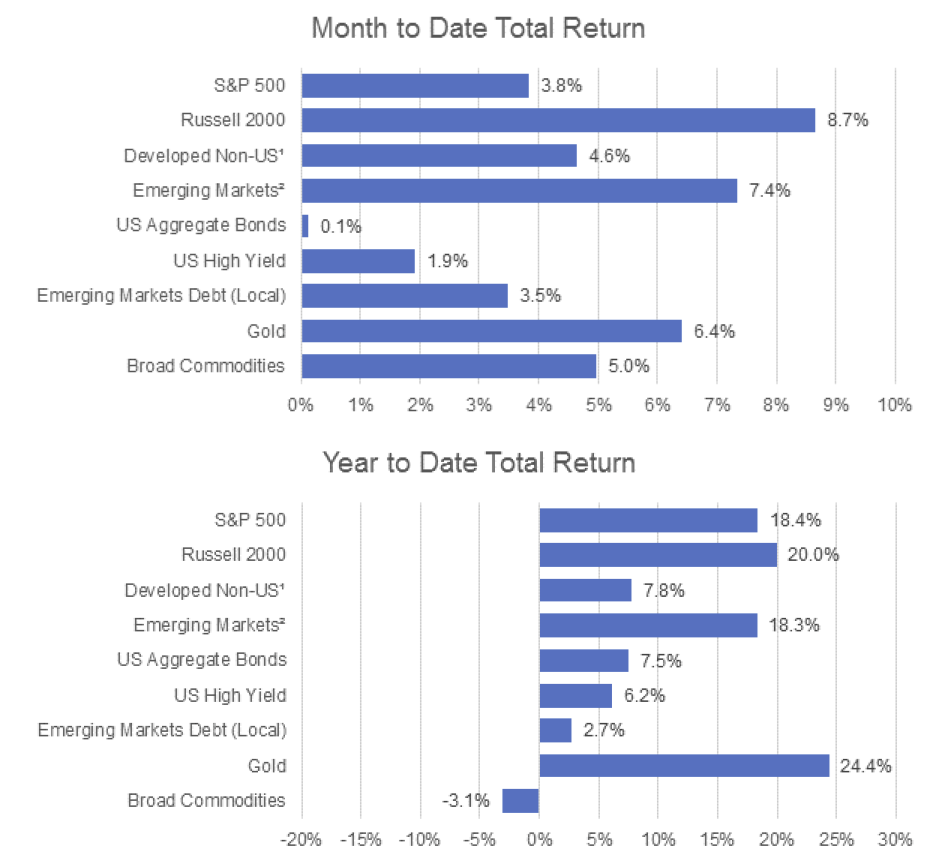

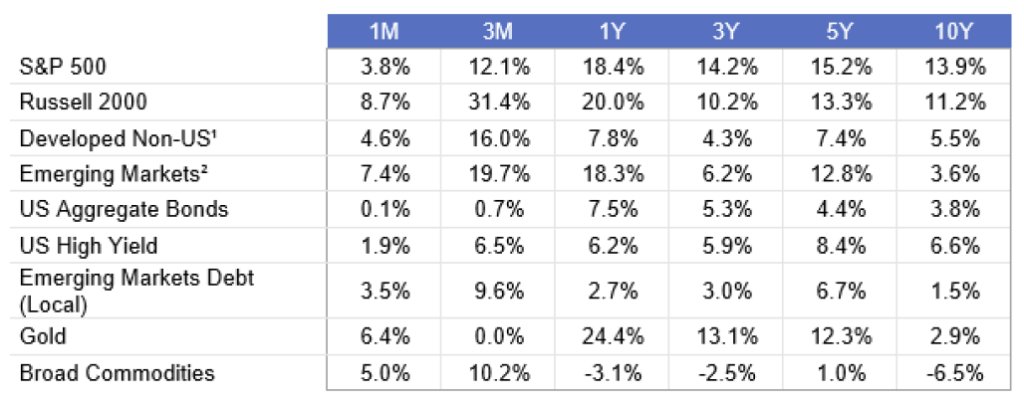

An eventful year concluded on a high note for markets, with stocks and bonds generating positive returns in December. The S&P 500 and Dow Jones Industrial Average closed 2020 at all-time highs, and credit spreads continued to grind tighter, finishing just off year-opening levels, as the long-anticipated arrival of multiple COVID vaccines pushed risk assets higher.

Small cap stocks were the top performers for the month and for the full year as well. Equity markets capped off a year of exceptional resilience, which saw global economies disrupted as never before. No doubt, some of that resilience can be traced back to aggressively accommodating Federal Reserve Bank activity, which also benefited fixed income investors riding rate cuts and liquidity injections to higher returns after a market-wide selloff in March.

Outside of the U.S., emerging markets capped off a strong year, with equities rising 7.4% and local currency bonds gaining 3.5% in December. A weakening dollar aided foreign exchange broadly and commodities concluded a rocky year gaining 5% for the month and just over 10% for the quarter.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.