December 2021

Summary

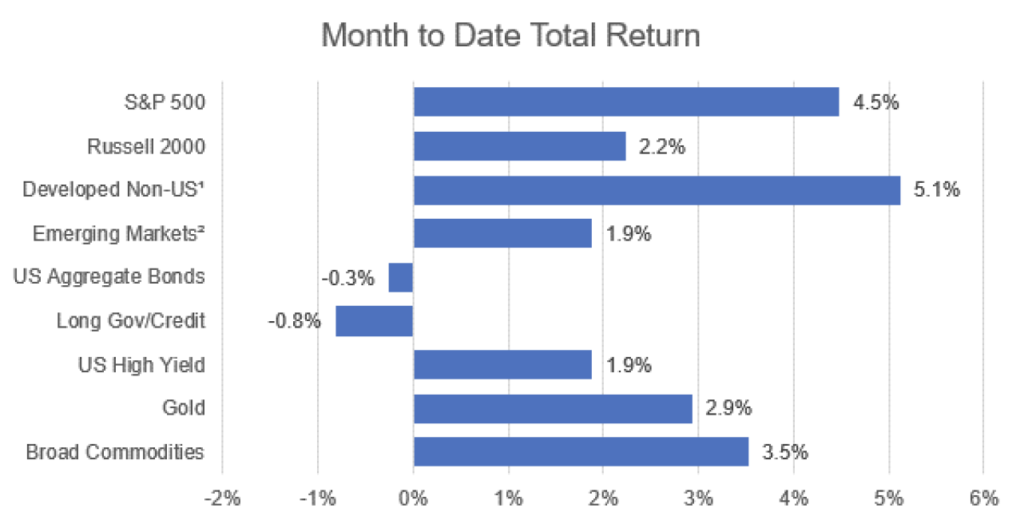

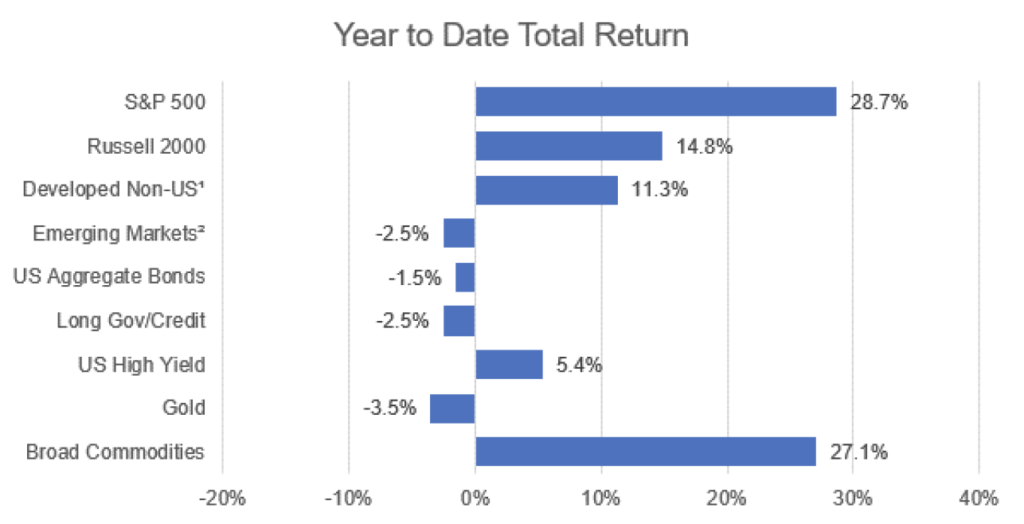

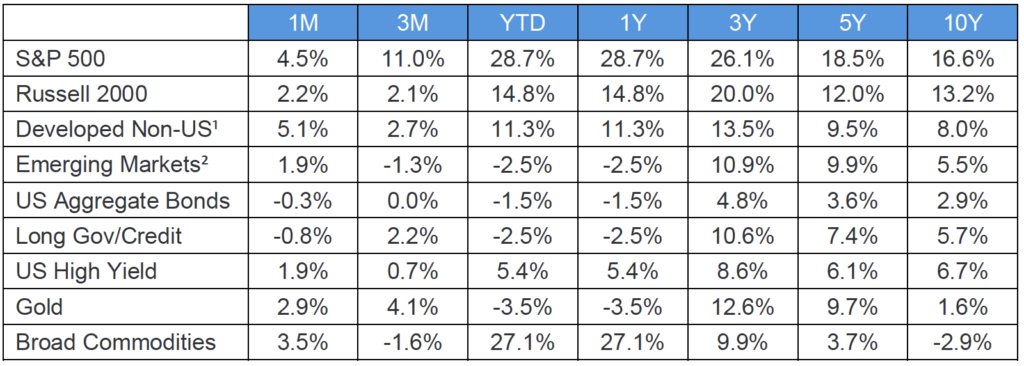

Equity returns, commodity prices, and interest rates finished up in the final month of 2021. Markets were touch and go with choppy trading throughout December as new information on the impact of the Omicron variant of COVID-19 continued to sway market sentiment day to day.

Equities

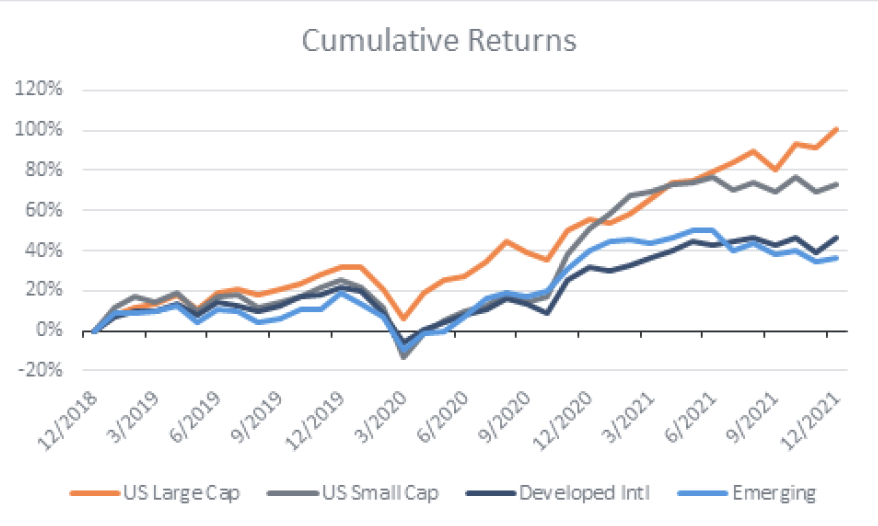

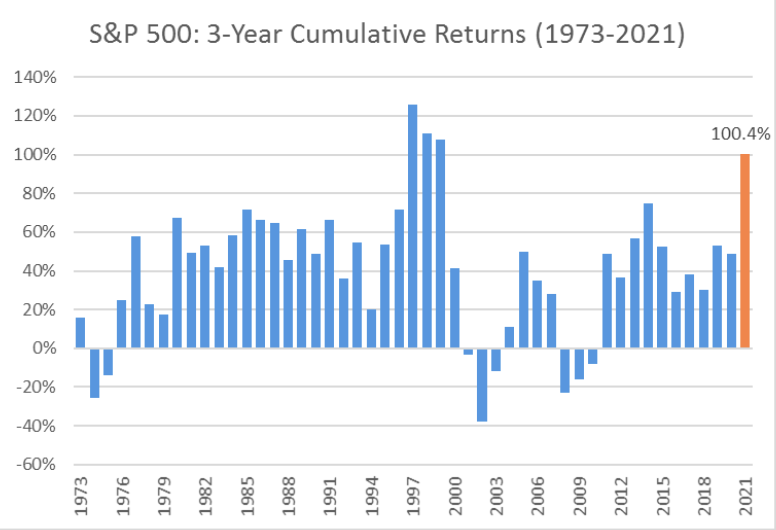

Developed international equities outperformed for the month of December, and emerging markets lagged. Meanwhile US stocks continued to climb to new highs, and as corks popped to ring in 2022, the S&P 500 settled just below its all-time high mark, recording a full-year total return of nearly 29%. After closing 2018 down 4%, U.S. large cap stocks have doubled in 3 years; in the last 50 years this run is only rivaled by the dot com boom of the late 1990s.

Fixed Income

While stocks rallied, fixed income indexes were mixed as U.S. government bond yields ticked higher and credit spreads tightened in December. The U.S. 10-year Treasury yield finished the year just over 1.5% after trading near 1.3% the first week of December with the onset of Omicron. As concerns over another phase of potential lockdowns waned, and macroeconomic indicators surprised to the upside, investors rotated back into credit. High quality bond indexes finished lower as the yield curve steepened.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.