December 2022

Summary

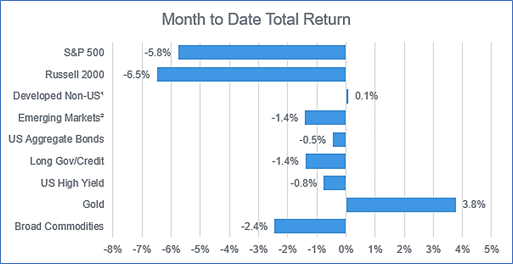

Markets closed out a difficult year by finishing lower in December. After a late year rally, stocks slid, with the S&P losing 5.8 percent for the month. The Federal Reserve raised rates by 50 basis points mid-month, a slight reprieve from the series of 75 basis point moves earlier in the year and bond markets finished December slightly negative.

Broad economic data was encouraging, with third quarter U.S. GDP growth revised upward to 3.2%, November’s unemployment showed a consistently tight labor market, and CPI coming in at 7.1%, its lowest level since the end of 2021. However, for investors who have grown accustomed to reading tea leaves to educe the Fed’s next move, healthy economic readings translated into prognostications of more rate hikes in the new year.

While U.S. headline inflation data was lower than expected for the month, global central banks continued their hawkish policy moves. And with China’s re-opening off of lifted COVID restrictions, there is added uncertainty surrounding global inflation entering 2023.

Equities

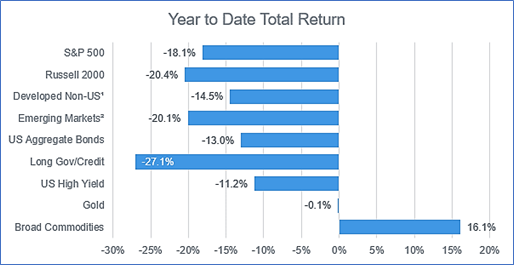

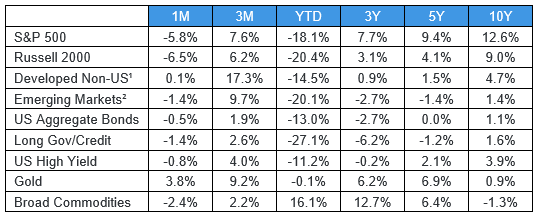

Equities were broadly lower as investors trimmed riskier assets into the year end. The S&P 500 ended the month 5.8% lower from November’s close, and small caps sold off even further, dragging 2022’s total return below -20%. After climbing higher most of the year, the dollar reversed in December providing a significant boost to non-USD assets. With December’s drawdown, U.S. stocks posted their worst calendar year performance since the global financial crisis (GFC).

Fixed Income

Bonds realized modest losses in December, as interest rates increased and credit spreads widened off November levels. The Federal Reserve Bank raised its policy rate by half a percent to 4.5 percent, in line with market expectations. Inflation fell to its lowest level of the year, but commentary from the Fed was clear, that tightening is not over. With concern from investors abounding that rate hikes will likely end in a recession, macroeconomic data suggests there is plenty of breathing room for the Fed to continue further down the current path. The 10-year Treasury yield edged higher into month-end finishing at 3.88%, after entering the year at 1.5%. Core bonds, as represented by the Bloomberg Aggregate Bond Index, closed out is worst year since the index was formed over five decades ago, losing nearly 13% for 2022.

1 - MSCI EAFE

2 - MSCI - EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.