February 2021

Summary

Continued progress on US vaccine rollout initiatives and expanded economic stimulus paved the way for continued optimism on an economic return to normalcy. Equity markets and interest rates rose in February, with investors favoring cyclical stocks amid creeping inflation concerns.

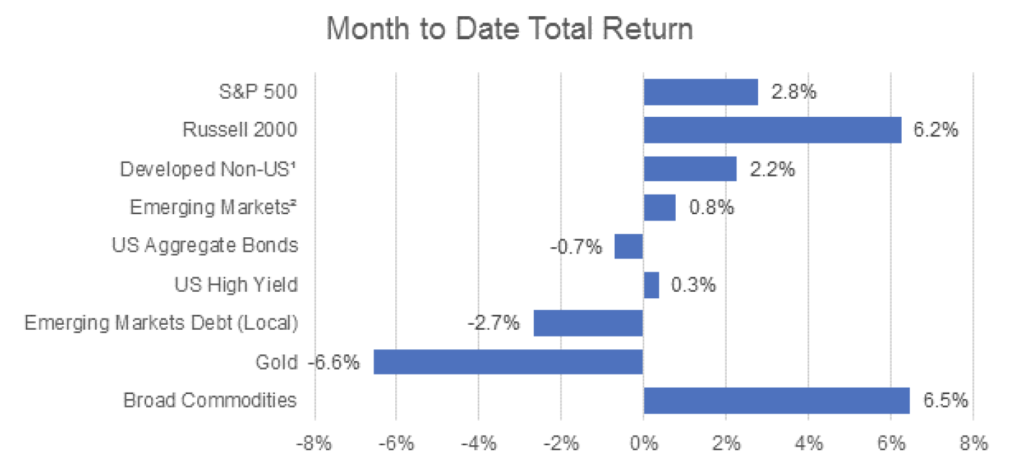

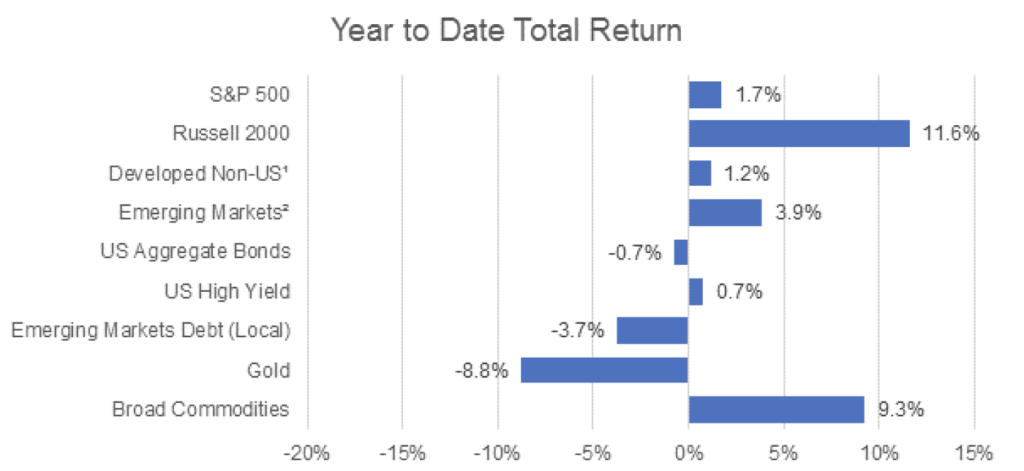

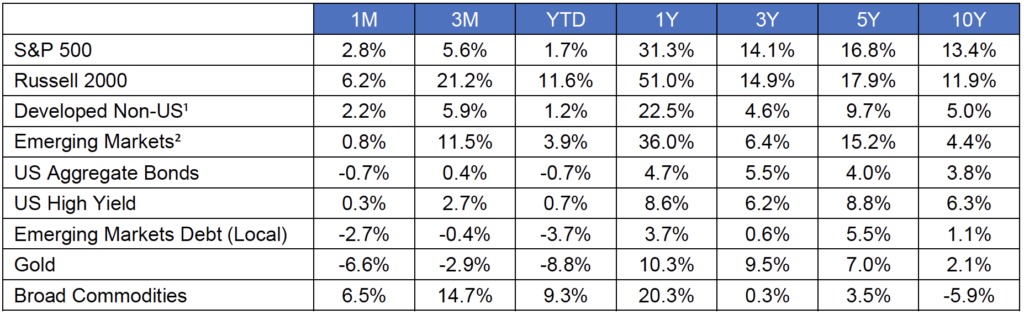

Equities

Equities generated positive returns despite a late-February retracement with continued outperformance from small caps. The expectation for re-opening continued to buoy smaller stocks, as the vaccine rollout picks up the pace in the States. International stocks were also positive for the month – developed economies led emerging markets, where currency detracted from equity returns.

Fixed Income

Treasury rates rose sharply in February before settling off highs at the close of the month. The US 10-year Treasury touched 1.55% but finished the month at 1.40%, a 33 basis point rise from January. Similar increases in the 5 and 30-year Treasury rates produced negative returns for the investment-grade bond market, though modest spread tightening offset some of the losses in fixed income. High yield bonds saw more aggressive spread compression to generate positive returns for the month. Inflation breakevens rose slightly, as real yields realized most of the monthly gains.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.