February 2022

Summary

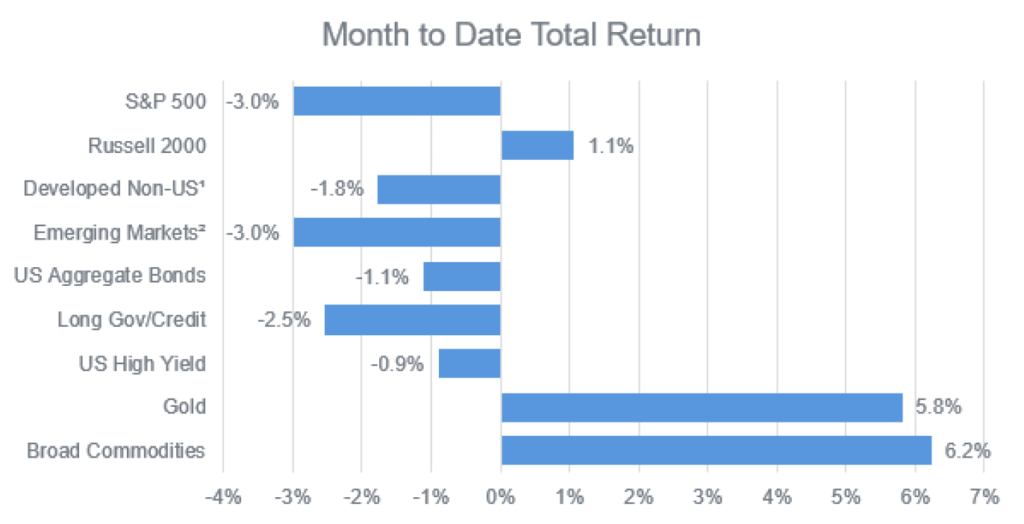

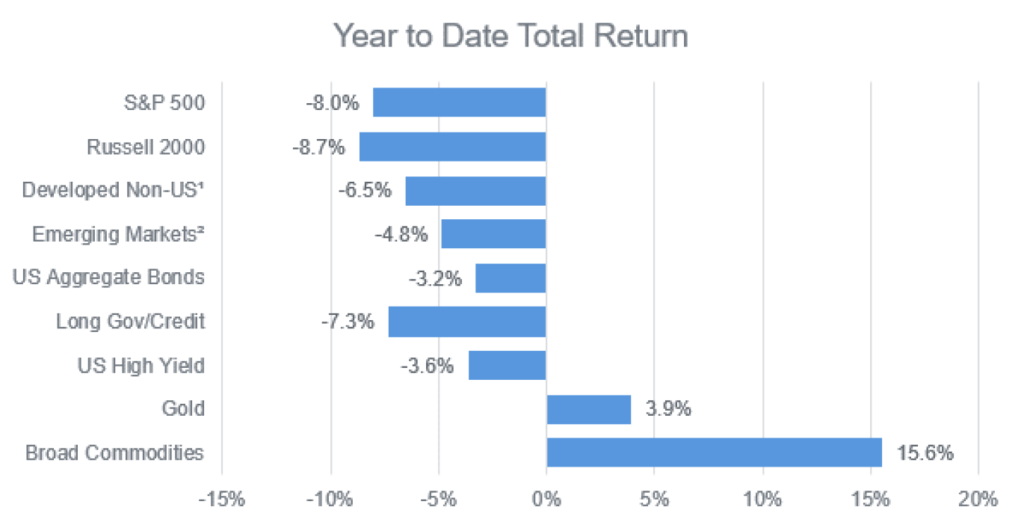

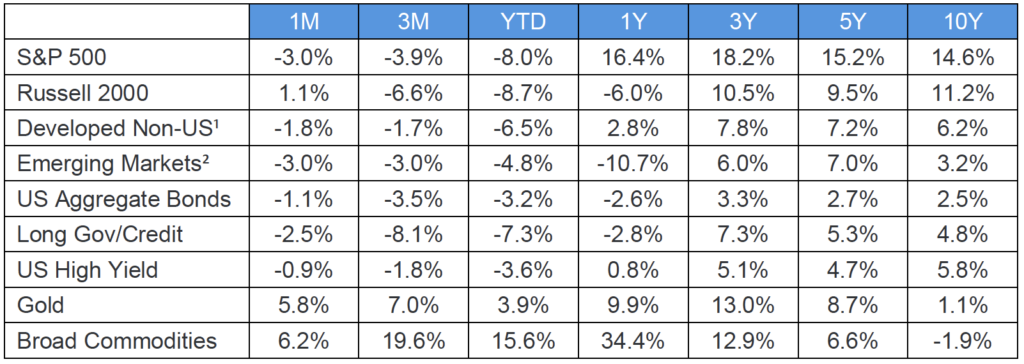

February was an eventful month across global markets. Both stocks and bonds reeled and rebounded with inflation, central bank policy, and geopolitical strife driving a continuously changing risk dynamic throughout the year’s shortest month. Another white-hot inflation report of 7.5% continued to put Fed policy in the spotlight, with the central bank communicating that rate increases should be expected to commence in March. Markets grappled with the implications of anticipated Fed actions and speculated on the pace and magnitude of future rate increases.

The tense situation along the Russia-Ukraine border was set to boil over. Rhetoric and posturing devolved into a full military invasion, followed by massive global economic sanctions. This caused the focus to shift from Fed policy to foreign policy. With the U.S. and European Union aiming to stifle Russian force by non-military means through stiff economic penalties, markets eased concern of an overly aggressive Fed tightening cycle leading to a brief retracing of the month’s earlier losses. In the end, though, major equity and fixed income indices finished in the red, while commodities rallied.

Equities

Stocks took a wild ride during February, with the S&P 500 diving on the troubling inflationary news, then sliding even further as Russian military forces multiplied near the Ukrainian border. The actual invasion, however, was met with a brief rally, as the market’s outlook on Fed policy changes in March became more muted. Outside of the U.S., positive returns gave way to sharp declines due to Russia’s actions, as developed international and emerging indexes finished lower for the month. U.S. small caps posted the best performance for equities, finishing little changed from January.

Fixed Income

Interest rate sensitive securities spent the month trying to price in future Fed actions. While early-month inflation data raised the specter of an accelerated tightening pace, or larger rate hikes, geopolitical events caused traders to apply the brakes. The result was a volatile month that saw the 10-year Treasury yield trade between 1.74% and 2.06%, widening credit spreads, and a late-month pause in corporate bond issuance by several large issuers. On balance, rates and spreads ended the month higher, the yield curve flattened, and fixed income returns were negative for February.

Commodities

Commodities benefitted from heightened uncertainty and elevated inflation. Gold performed well in February, serving as a store of value in the face of persistently high global inflation, and as a safe haven from geopolitical turmoil and potential central bank tightening. Energy also rallied with oil prices touching $100 a barrel, given Russia’s status as a major global crude exporter. Broad commodities finished higher for the month, as well.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.