February 2023

Summary

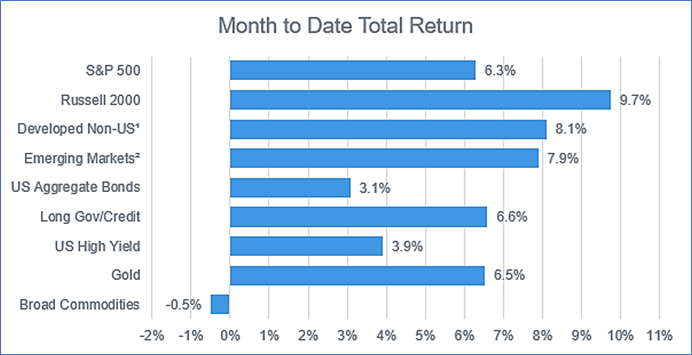

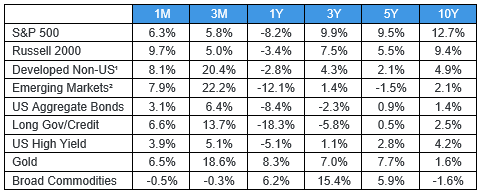

With 2022 in the rearview mirror, a year one would like to forget, markets in January kicked off afresh with positive returns across asset classes. The first inflation news for 2023 showed a continuation of the recent easing trend, as December’s Consumer Price Index (CPI) of 6.5% marked the lowest 12-month change since late 2021. Interest rates fell with the 10-year treasury yield dropping below 3.4% before settling in near 3.5% by the end of the month. Stocks were top performers, with non-U.S. equities posting the better returns versus U.S. equities in the month. While economic data was mixed, with positive corporate earnings tempered by lower forward guidance, and tight unemployment numbers interspersed with high profile layoffs from big tech names, major indexes managed to move higher on balance for January.

Equities

Global stocks finished January in the green across the board. In the U.S., investors struggled at times to process opposing macroeconomic data on growth and unemployment. Fourth quarter Gross Domestic Product (GDP) came in above expectations at 2.9%, temporarily staving off recession fears. The numbers were countered with negative forecasts from global banks and economists, who are currently projecting with near certainty a 2023 recession. Small cap stocks outpaced larger caps, while stocks outside of the U.S. managed to perform strongly, as well, with returns near 8% in January.

Fixed Income

Bonds investors looking to put the worst year in modern history in the past saw encouraging returns to begin 2023. Inflation continued its downward trajectory into the new year, heartening investors hopeful for a winding down of the latest tightening cycle by the Federal Reserve. Investment grade bonds returned 3% as interest rates and credit spreads eased slightly off 2022 levels. High yield credit outperformed and duration paid off with long bonds posting the top return for fixed income during the month.

1 - MSCI EAFE

2 - MSCI - EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.