January 2021

Equities

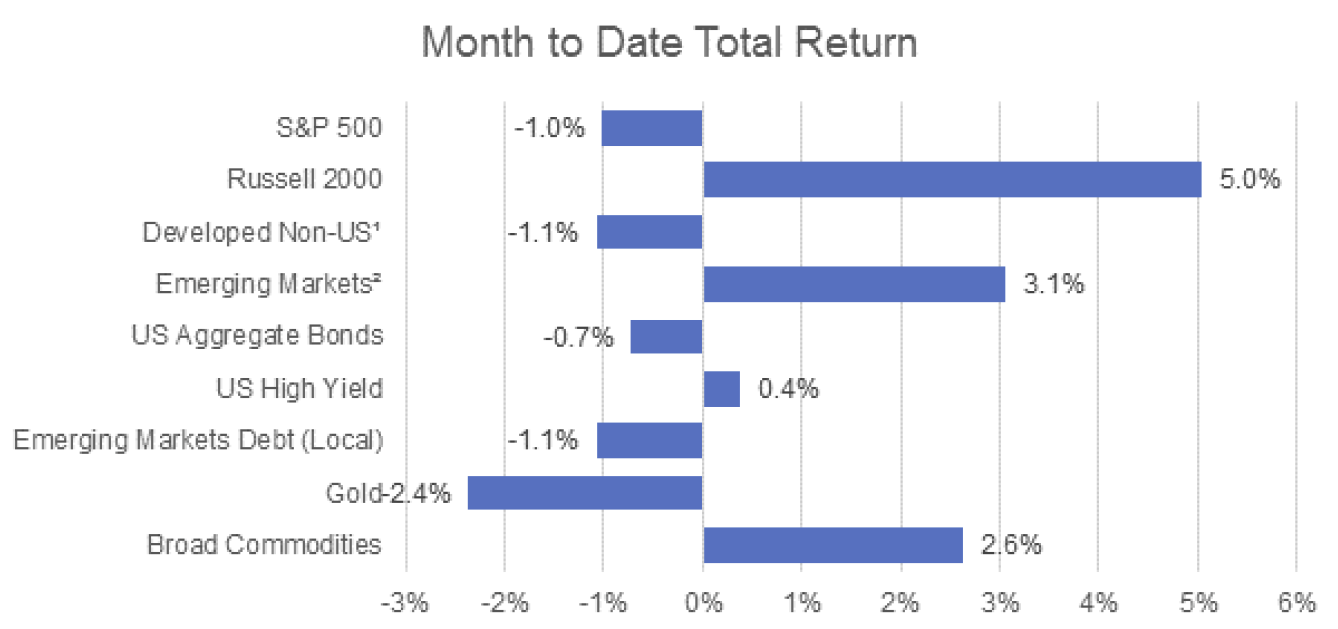

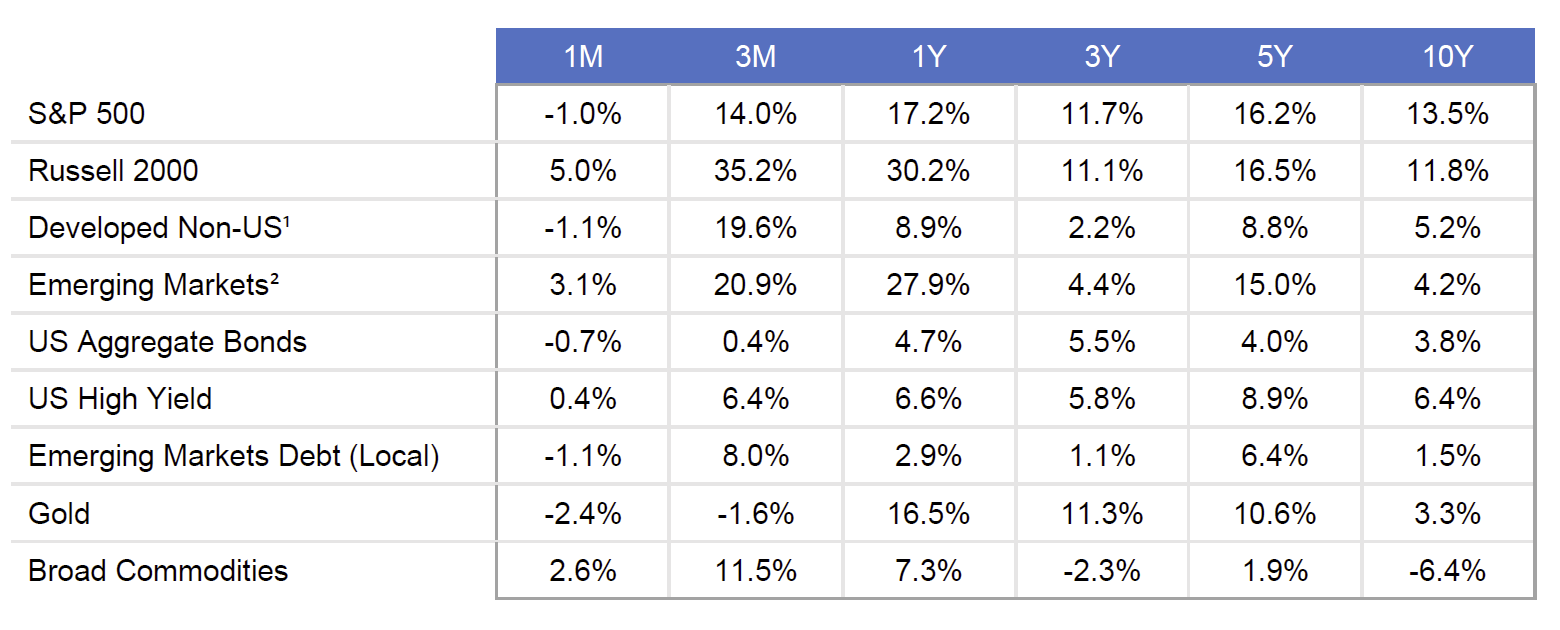

Global stock indexes were mixed to open 2021. While the rollout of the long-awaited COVID-19 vaccine hit its share of snags, in the U.S., the expectations for re-opening continued to favor small cap stocks, earning the top return for January. Outside the U.S., emerging markets stocks benefitted from similar expectations, as optimism for areturn to normalcy and rebounding global economic growth pushed returns intopositive territory. Upward pressure on commodity prices further fueled the rally inemerging markets stocks.

Fixed Income

The yield curve steepened in the U.S. with intermediate and long rates rising 20 basis points, while rates at the short end remained anchored near zero. Meanwhile credit markets remained resilient, with U.S. high yield outperforming core bonds.

Foreign Exchange

The dollar strengthened against broad currencies, with emerging markets foreign exchange absorbing the biggest hit, while U.S. inflation expectations crept higher, finishing the month north of 2%.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.