January 2022

Summary

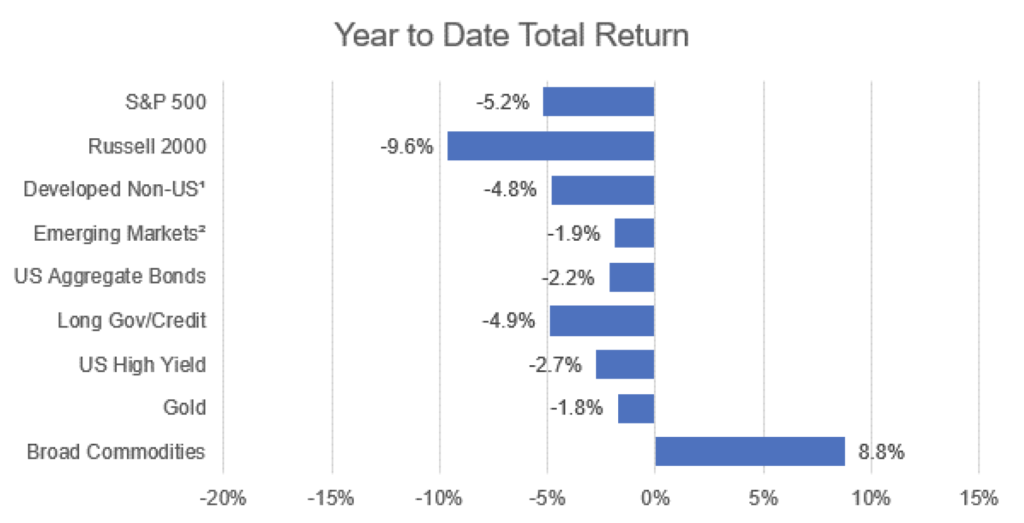

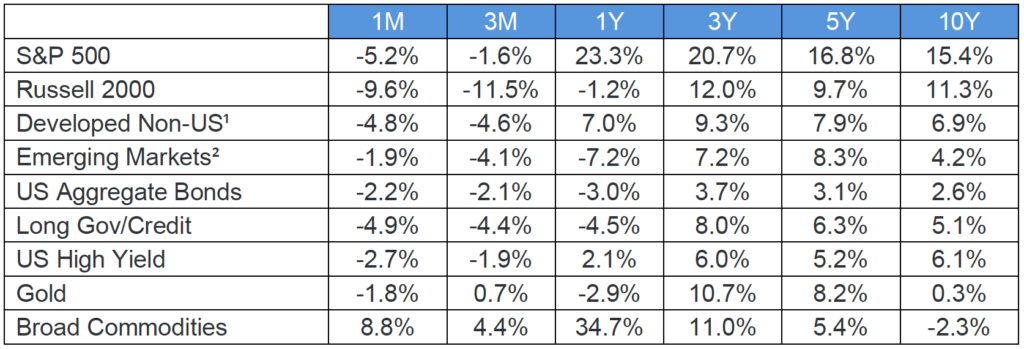

Markets opened the new year grappling with multiple headwinds. The specter of rising rates, persistent inflation, and warnings of an overbought equity market coming off a torrid stretch of outperformance, led to a dour outlook from investors across both stocks and bonds. Broad commodities rallied, led by oil and gas, while gold also finished the month lower.

Equities

The S&P 500 fell over 5% in January, the swiftest monthly decline for the index since March of 2020 and the onset of the coronavirus pandemic. 2022’s opening month also marks the worst start to the year since 2009. Small caps sold off sharply, booking nearly a 10% drawdown. Non-U.S. equities outperformed marginally, but still posted negative returns.

Fixed Income

Interest rates rose and the yield curve flattened in January as bond markets face the reality of Fed tightening. The question of a Fed hike has transitioned from if to when to how much, with forecasts ranging across frequency and magnitude. The January meeting notes point toward a first hike in March, with the consensus pointing to a 0.25% increase, although a bigger hike has been posited by economists and some Fed officials. The 10-year Treasury yield increased by 27 bps to end the month at 1.78%, and the spread on the yield between the 2 and 10-year bonds slimmed to 60 basis points, nearly a full percent lower than 2021’s peak.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.