July 2021

Summary

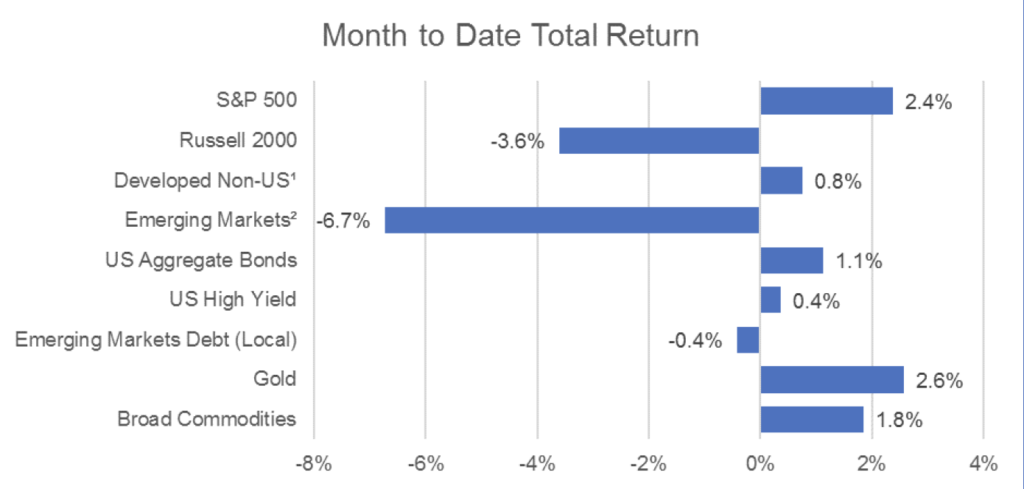

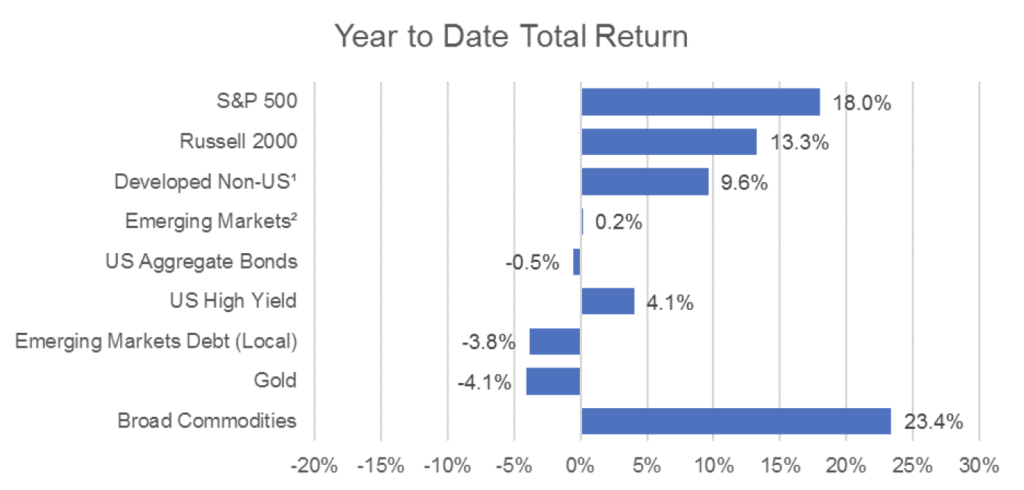

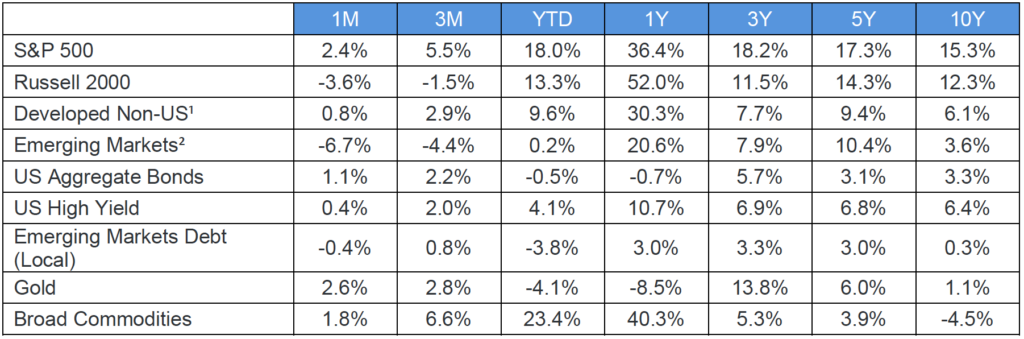

Equity and credit markets were mixed in July as the market struggled to reconcile competing macro issues. While data on inflation continues to come in higher than expectations, the emergence and spread of the Delta variant of COVID-19 in the U.S. has threatened to slow the pace of economic recovery.

Equities

Domestic stock performance remained linked to the near-term outlook for the economy. Growth projections reversed in July with resurgent COVID caseloads and plateaued vaccination rates threatening to delay or diffuse the economic recovery stateside. Investors rotated out of cyclical stocks and small caps for the safe haven of defensive names and large caps, producing gains for the S&P 500, while small caps finished negative for the month of July.

Outside of the U.S., emerging markets suffered due to escalating crackdowns by the Chinese government on tech stocks listed on U.S. stock exchanges. Chinese stocks fell over 10% for the month, and emerging markets tracked lower, lagging other major indices.

Fixed Income

The market’s rotation to safety was on display in fixed income markets as well, with the U.S. 10-year treasury yield declining 20 basis points in July, touching lows last seen in early February. Credit spreads widened, but high yield bonds still managed to generate modest positive returns. International bond markets favored developed issuers over emerging markets, with non-U.S. returns bookending domestic fixed income gains.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.