July 2022

Summary

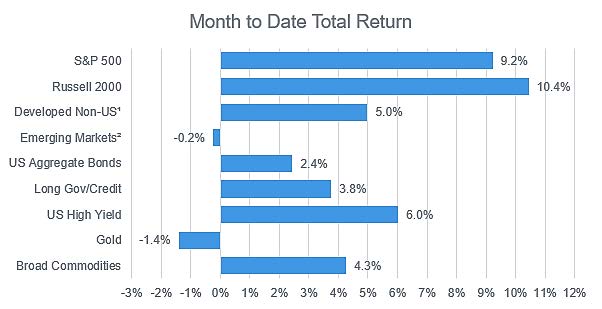

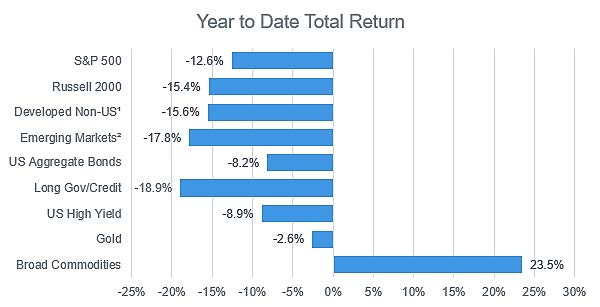

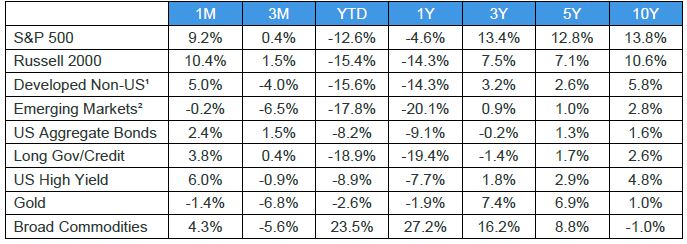

July brought a sizeable rebound for both stocks and bonds as mixed news and cloudy economic outlooks gave way to optimism, with equity markets and interest rates rallying to the end of the month. The month began with more tough inflation news as the June CPI exceeded 9%, and while corporate earnings for the second quarter were solid to strong, forward guidance was mixed, as businesses grappled with inflation pressuring consumer spending, signs of a slowdown in the red-hot housing market, and a continuation of supply chain disruptions. By the time the Federal Reserve met and announced a 0.75% interest rate increase, though, investors’ sentiment had improved for the first time this year.

Equities

The S&P 500 returned its best month of the year by a wide margin, advancing 9.2% in July. The index has now recovered nearly half of its 2022 drawdown and sits at -12.6% year-to-date through July. Small-cap stock returns exceeded 10% for the month, while non-US equities lagged, facing dual headwinds of recession risk and a strong US dollar. Emerging markets equities were negative for July. Though recent US economic activity has been far from spectacular, with GDP contracting for the second consecutive quarter, investors seem to view the domestic economy as further along the path toward recovery than its European and Asian counterparts.

Fixed Income

The Federal Reserve raised the Fed Funds rate another 75 basis points in late July, to 2.25% as the battle against inflation rages on. June’s CPI rate showed a 9.1% increase in prices year-over-year, the largest in the US since 1981. However, some easing in energy prices, and slowing in home price appreciation gave bond investors confidence that high inflation and the Fed’s tightening cycle is nearing its last throes. The yield curve inverted, and the 10-year yield fell to 2.65% by the end of July, 23 basis points lower than the 2-year Treasury. Corporate credit outperformed with high yield spreads tightening nearly a full percent for the month.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.