June 2021

Summary

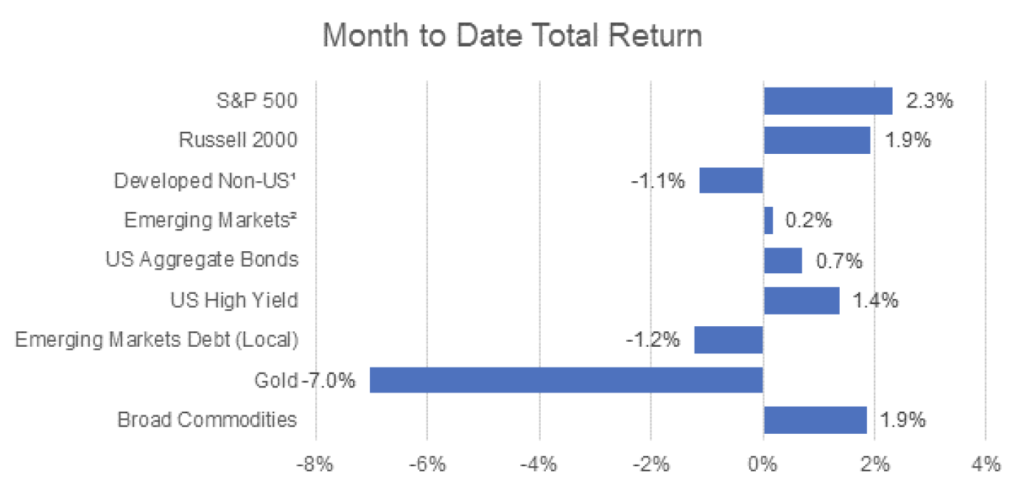

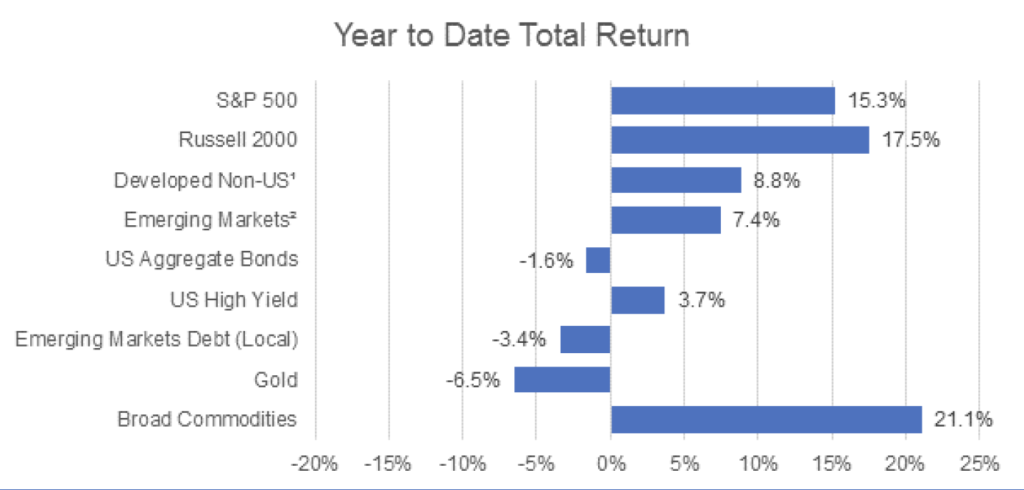

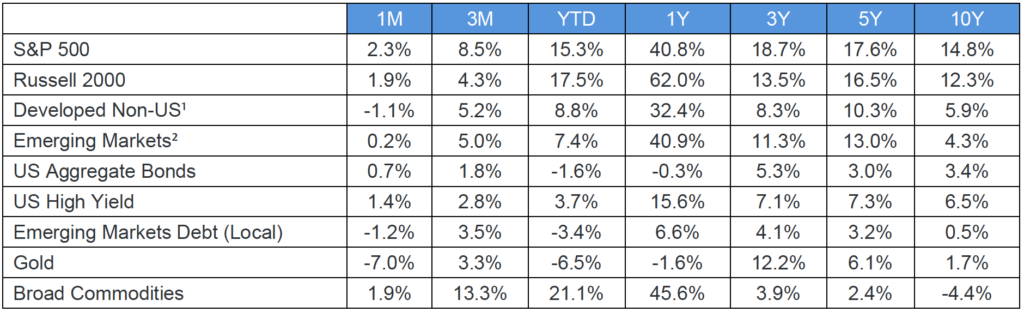

The month of June opened with an unexpectedly weak jobs report, followed by a higher than anticipated May CPI release. Despite this news, capital markets responded with resiliency with stocks and bonds gaining through the first half of the month. On June 16th, the Federal Open Market Committee (FOMC) responded to the economic data by adjusting the forecast for future rate hikes, adding an additional increase in 2024. Investor response was less positive, with interest rates rising and equities declining sharply. Ultimately, though, broad markets rebounded into month end, producing modest positive returns for June.

Equities

Equities finished the month broadly positive despite volatility around the Fed’s mid-June meeting. Domestic stocks outperformed as the dollar appreciated against most foreign currencies. Small caps and growth stocks were favored by investors, while developed foreign markets underperformed.

Fixed Income

Interest rates finished slightly lower for June, after jumping in the wake of the Fed’s adjusted outlook. Inflation for the prior month was 5% annualized, slightly higher than market expectations. Credit outperformed and investors were paid to take duration risk, while a strengthening dollar drove international bond markets lower during the month.

Commodities

Broad commodities rose in June, oil advanced by roughly 10%, and gold prices declined despite continued inflation concerns.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.