June 2022

Summary

Investors entered June with optimism, the previous month had provided hope that inflation

may be easing, perhaps giving the Fed some breathing room to slow the pace of the

tightening cycle, and markets had produced positive returns in May. Perhaps the worst was

over? Instead, it was more bad news, as inflation came in higher than expected, forward

earnings guidance was slashed, and the Fed increased short rates by 75 basis points, the

largest upward move since 1994. Hope of a quick recovery for stocks quickly faded into

recession fears, as slowdowns in the hot housing and employment markets, and a possible

pull back in consumer spending materialized on the horizon during the month.

.

Equities

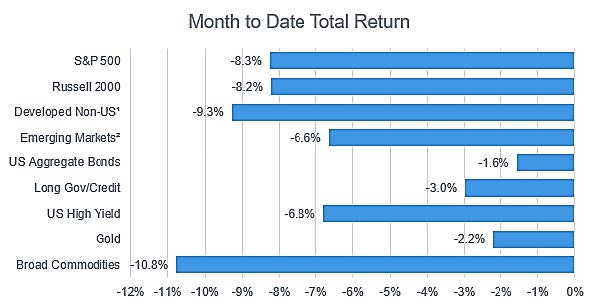

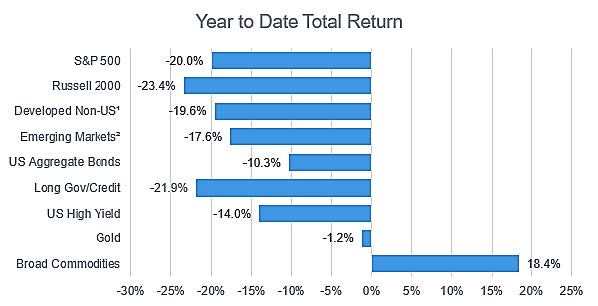

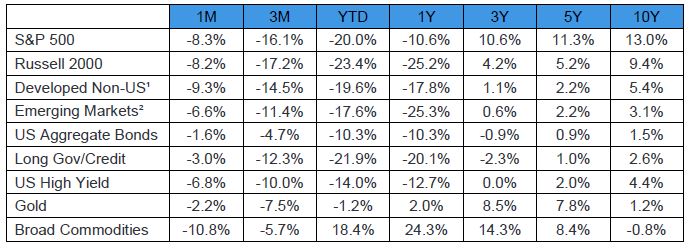

The S&P 500 closed out the worst first half for stocks in over 50 years, plummeting over 8% in

June. While corporate earnings were in line with expectations, forward guidance became

increasingly dour as the month progressed, and investors began pricing in a recession as

early as the second half of this year. Inflationary pressures continued to wreak havoc

overseas, with eurozone inflation hitting 8.6% amid an energy crunch exacerbated by the

continued embargo on Russian exports, and the United Kingdom realized a 9.1% increase in

consumer prices, the highest rate seen there in 4 decades. Against this backdrop, global

stocks faded in lockstep with domestic markets, developed stocks declined by 8%, while

emerging markets sold off to a 6.6% loss.

Fixed Income

Interest rates took a wild ride in June, spiking mid-month as the Federal Reserve lifted the

short rate to combat inflation, before dropping into month-end on recession fears. The tenyear

Treasury yield traded as high as 3.5% before finishing June near 3%. Credit spreads

widened throughout the month, ending at their highest levels since the onset of the COVID

pandemic. Credit and duration continued to underperform amidst these headwinds, with

the high-yield bond index dropping nearly 7% for June. The Bloomberg Aggregate Bond

Index concluded its worst first half in its 46-year history, declining 1.6% for the month.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.