March 2021

Summary

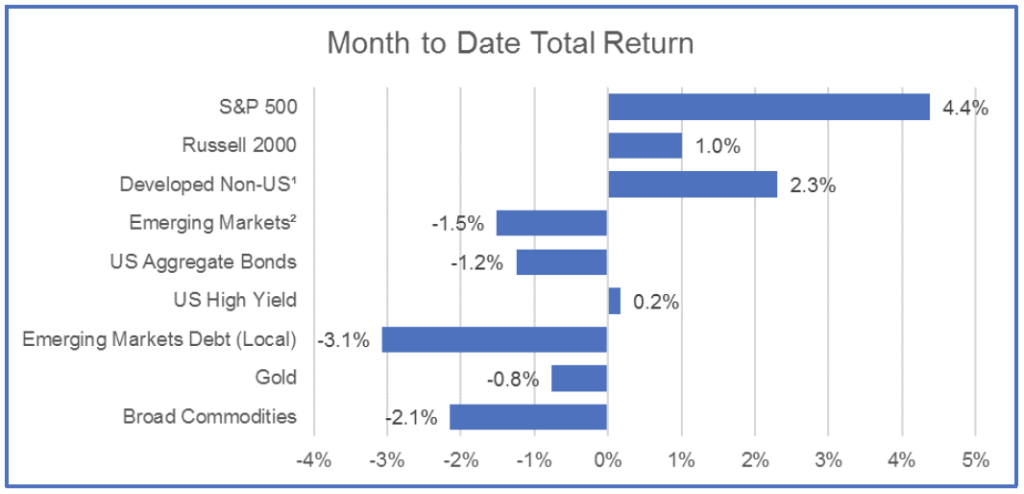

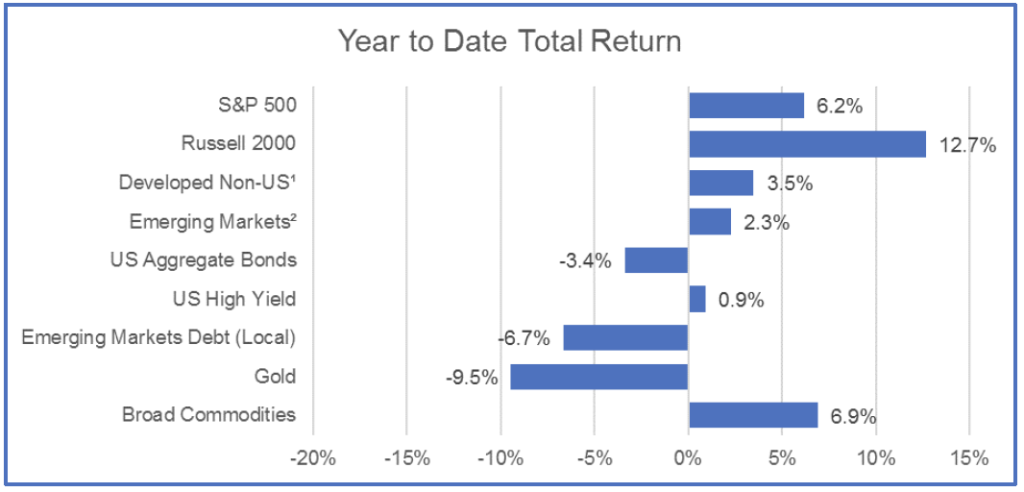

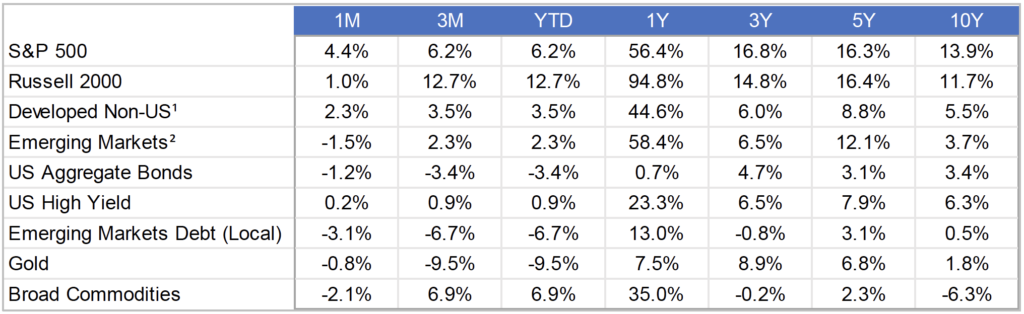

Equity indexes across developed markets posted modest gains for the month, while bonds sold off on higher interest rates, driven primarily by inflation concerns.

Equities

Despite an early-month dip, the S&P 500 finished March at a record high. Value stocks outperformed, and names that suffered from 2020’s economic shutdown measures continue to rebound as the U.S. moves closer to re-opening. Overseas, markets are experiencing similar trends, but on a more muted scale, which can be attributed to the pace of vaccine roll-outs across Europe lagging the U.S.

Fixed Income

Treasury rates continued to rise in March. The 10-year Treasury bond rose over 30 basis points as investors eye the potential for near-term inflation pressure. A coordinated accommodative fiscal and monetary stance from Washington has put the rates market on edge, and a steepening yield curve has been the product. Corporate credit spreads were little changed, with high yield bonds and floating rate debt finishing flat for the month.

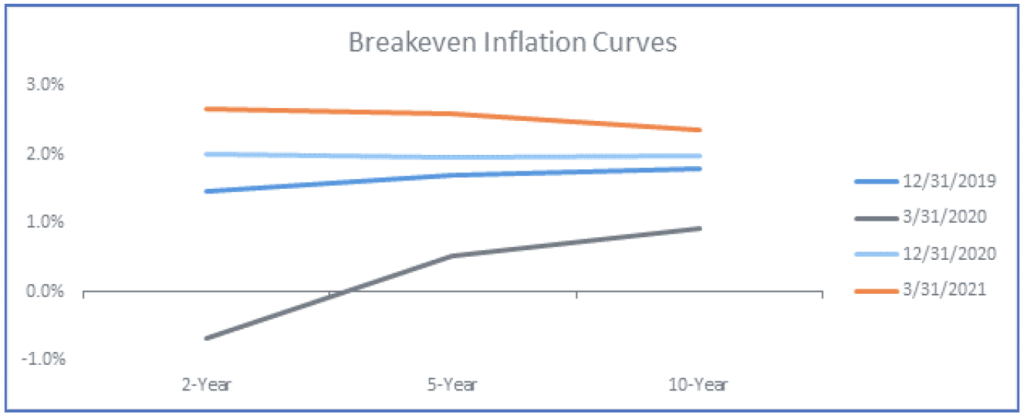

Inflation

While investors eye recent economic stimulus and dovish Fed policy as a source of potential inflation, market data shows that the concern is near term in nature. While Treasury rates at the long end of the yield curve have nudged upward year to date, long-dated inflation expectations, as implied by the U.S. TIPS market, have experienced a smaller impact. Rather, the change has been most notable on the shorter-term part of the TIPS curve.

Economic data also bears this out; the latest CPI rate came in at a benign 1.7%, and though the next data release is expected to be substantially higher, the result will be skewed by the comparison to the depressed values of March 2020. Other factors that could drive long-term inflation higher, including wage growth, may be of limited concern, as the post-COVID economy is still emerging and top-line unemployment remains elevated relative to pre-pandemic levels. So, while inflation maybe top of mind for investors, persistent elevated inflation appears less likely for now.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.