March 2022

Summary

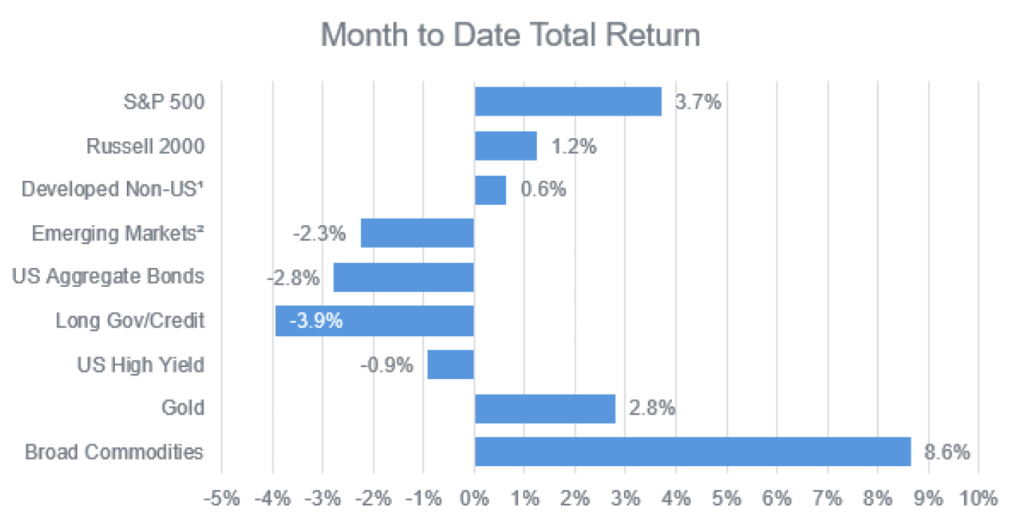

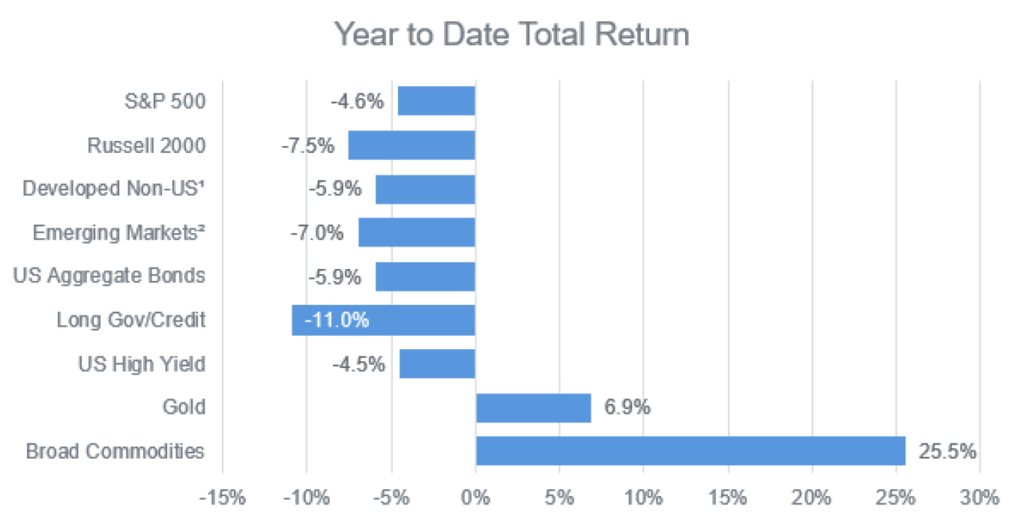

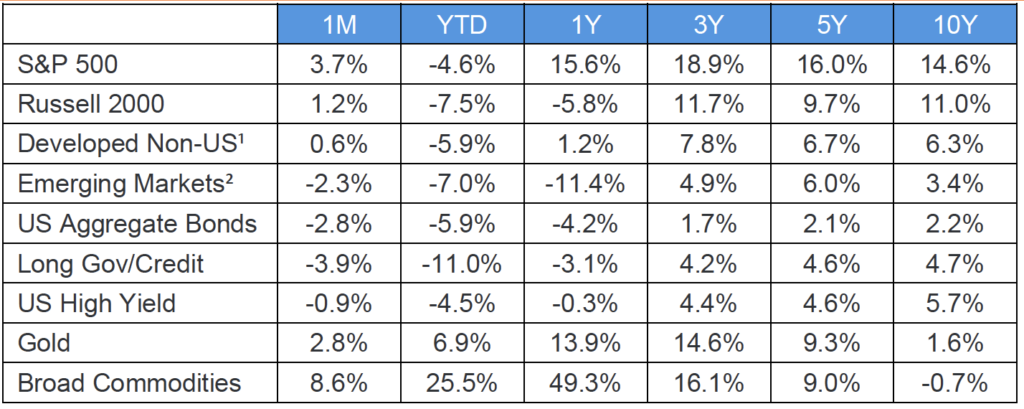

The first quarter of 2022 concluded on a positive note for developed equities, while bonds continued to decline, and March brought the first Fed rate hike since 2018. Commodities continued to rally and emerging markets were unable to keep pace, as developments in Ukraine continued to move markets daily.

Equities

Stock indexes in the U.S. and developed international markets earned positive returns in March, while markets remained volatile. Growth stocks and the energy sector outperformed, and the S&P 500 rebounded from its early 2022 losses. Emerging markets did not participate in the March rally and fell 2.3%, due in part to spillover from the ongoing Russian invasion of Ukraine. Global stocks remain negative year-to-date despite the March rebound.

Fixed Income

Bond markets continued to decline, as interest rates rose in March. The Fed met market expectations by raising the policy rate 25 basis points. It was the first of what the market anticipates will be several moves, as fighting inflation remains the priority in the near term. By month-end, increases in short-term yields were pronounced enough for the 2-year Treasury to match the 10-year rate at 2.34%. Credit spreads widened and mortgage rates breached 5%, as fixed income markets offered no shelter to investors through quarter end.

Commodities

Commodity markets remained red-hot in March. Crude oil oscillated between $90 and $120 per barrel before finishing the month 5% higher than February near $100 per barrel. Agricultural commodities also accelerated month-over-month, as rising costs and concerns over shortages pushed prices for most crops higher.

Russia and Ukraine

Developments surrounding the war in Ukraine wielded far-reaching influence over markets in March. Emerging markets equity and debt markets faced downward pressure, as investors experienced an example of “emerging markets risk” and pared their exposures. Russian markets were frozen by sanctions coming from the U.S. and Europe. By mid-March Russia had been removed from major EM equity indexes, and investors holding Russian sovereign debt were compelled to write down those holdings to zero. While the Kremlin was able to avoid default in March, the immediate future remains unclear, with larger payments due in April and additional sanctions looming.

Meanwhile, the global economy, still grappling with supply chain issues wrought by the COVID-19 pandemic, was forced to deal with additional commodity pricing pressures. Energy markets were the first to respond, as Russian presence, as a global supplier of crude oil and natural gas, forced prices to increase in the early stages of the invasion. As the conflict drags on, the supply crunch has spilled over into agricultural markets, as both Russia and Ukraine are significant suppliers of wheat, as well as chemicals required for fertilizer, causing farmers to re-assess near term plans and boosting prices for wheat and corn.

As the situation evolves and talks continue intermittently through the conflict, markets continue to weigh developments heavily, leading to swings in sentiment, affecting overall risk posture, interest rates, and the outlook for inflation and global growth. While resolution may unpredictable, Russia has effectively extricated itself from the global economy, an act that it is unlikely to be able to quickly reverse.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.