March 2023

Summary

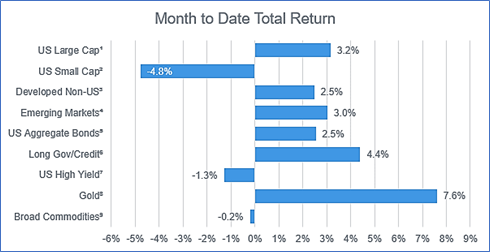

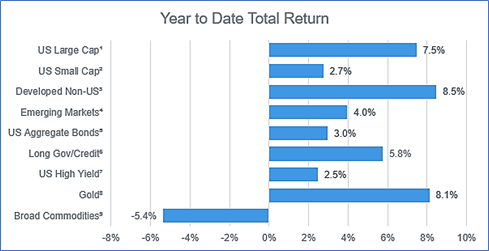

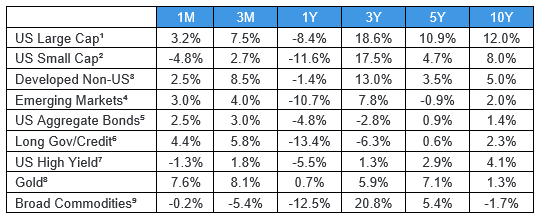

The Federal Reserve’s quest for a soft landing hit a pocket of turbulence in March, with trouble in the banking sector clouding the outlook for interest rates and economic growth. For a few banks with concentrated high-dollar depositors and mismatched asset portfolios with unrealized losses from low-yielding legacy treasury bond exposures, the pressure of the current tightening cycle resulted in a series of negative events. Depositor runs, fueled in part by the ease and convenience of digital banking, coupled with falling collateral values, led to the failure or closure of Silvergate Bank, Signature Bank, and Silicon Valley Bank (the last being the second-largest failure in U.S. banking history). This prompted the Treasury and FDIC to enact emergency measures in an effort to contain a broader banking contagion. Despite the turmoil, major asset classes held up well for the month, with the notable exception of smaller cap equities, where banking and financial services companies experienced the most pain.

Equities

Stocks were mixed in March, with large blue-chip names holding up better than smaller companies. The small cap index was dragged lower by a 10% weight to regional banks, which were hammered by investor worries about potential for further bank runs. The possible impact on future credit availability, specifically access to credit by small and mid-sized businesses, drove most small cap names lower for the month. Meanwhile, Europe experienced its own banking drama, as UBS acquired long-troubled Credit Suisse at the behest of Swiss regulators. While the deal itself was hurried to avoid the troubles manifesting themselves across the Atlantic in the U.S., the issues at Credit Suisse were widely known, and constituted less of a shock to the system. Developed international equities were positive for the month, led by emerging markets with a return of 3%.

Fixed Income

Lower quality corporate bonds sold off as investors fretted over a potential slowdown in credit availability in the wake of stress in the banking market. Investment grade corporates and other high-quality credit weathered another rate hike from the Fed, albeit only 25 basis points, as bond investors favored safety over yield. After opening March above 4%, the 10-year U.S. treasury traded below 3.3% intra-month before settling at 3.49% to end the first quarter. Inflation momentarily stepped out of the spotlight, falling to 6% annualized, while employment remains extremely tight. The fed funds rate now sits at 4.75%, and the Fed is faced with a more delicate balancing act of steering the economy toward lower inflation and slower job growth, while remaining cognizant of systemic risks in the areas of lending and finance.

1 – Russell 1000, 2 – Russell 2000, 3 – MSCI EAFE, 4 – MSCI Emerging Markets, 5 – Bloomberg US Agg, 6 – Bloomberg US Long Gov/Credit

7 – Bloomberg US Corporate High Yield, 8 – Bloomberg Gold Subindex, 9 – Bloomberg Commodity

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Disclosure Statements

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “ LSE Group” ). © LSE Group [year]. FTSE Russell is a trading name of certain of the LSE Group companies. “ FTSE®” “ Russell®” , “ FTSE Russell®” are trade mark(s) of the relevant LSE Group companies and are used by any other LSE Group company under license. “ TMX®” is a trade mark of TSX, Inc. and used by the LSE Group under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

Copyright MSCI 2017. Unpublished. All Rights Reserved. This information may only be used for your Internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. This information is provided on an "as is" basis and the users of this information assumes the entire risk of any use it may make or permit to be made of this information. Neither MSCI, any of its affiliates or any other person involved in or related to compiling, computing or creating this information makes any express or implied warranties or representations with respect to such information, or the results to be obtained by the use thereof, and MSCI, its affiliates and each such other person hereby expressly disclaim all warranties (including, without limitation, all warranties of originality, accuracy, completeness, timeliness, non- infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall MCSI, any of its affiliates or any other person involved in or related to compiling, computing or creating this information have any liability for any direct, indirect, special, incidental, punitive, consequential or any other damages. The MSCI information is the exclusive property of Morgan Stanley Capital International ("MSCI") and many not be reproduced or redisseminated in any form or used to create any financial products or indices without MSCI's express prior written permission. The information is provided "as is" without any express or implied warranties. In no event shall MSCI or any of its affiliates or information providers have any liability of any kind to any persons or entity arising from or related to this information.