May 2021

Summary

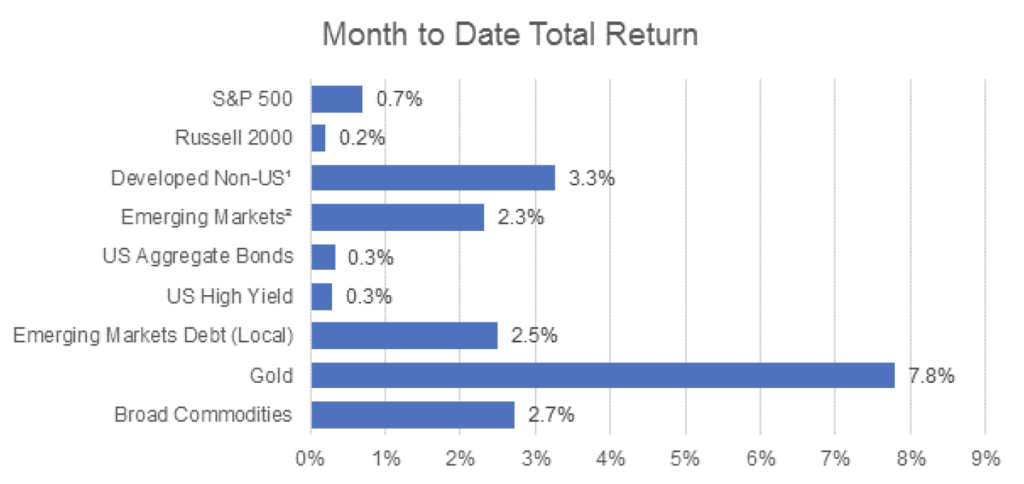

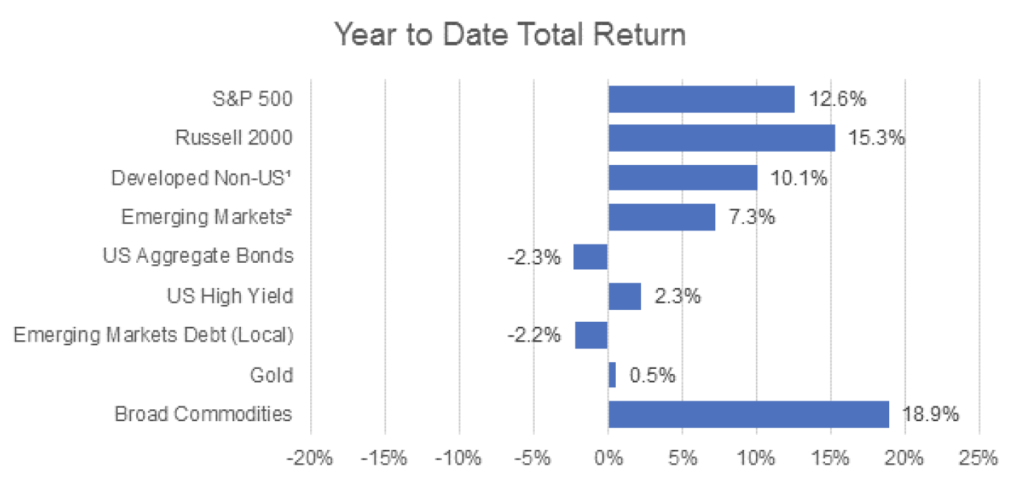

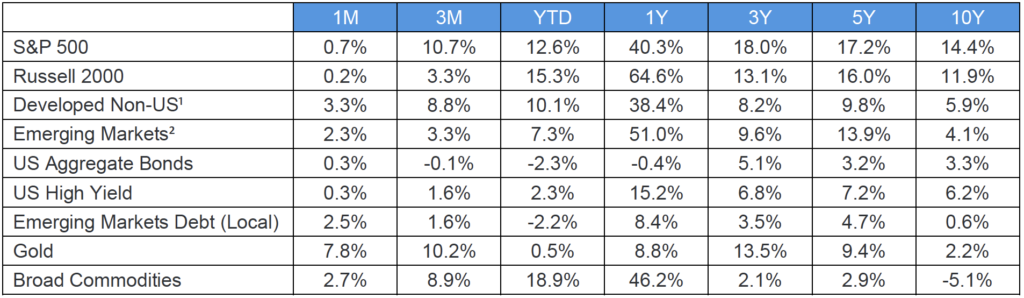

The global economy continued its uneven emergence from the pandemic, causing equity markets to remain volatile in May. In the U.S., worries of an overheated economy and possible inflation drove equity trading. However, the domestic job market continues to see elevated unemployment with emergency Federal unemployment benefits scheduled to wind down later this summer. Meanwhile, global supply chains are being pinched by shortages in key production inputs, such as microchips. Bond markets traded quietly throughout the month. Broad commodities, the price of oil, and gold pushed higher.

Equities

With macroeconomic worries driving equity volatility higher in May, domestic stocks were modestly positive for the month, while non-U.S. equities outperformed. Value stocks held up better than growth stocks, while small cap stocks underperformed. As the global economy digests the dislocations and recovery measures of the last 14 months, pockets of volatility, driven by both fundamental and technical factors, are likely to persist. While bond markets and interest rates were hit in the first quarter of 2021, equities found themselves in the crosshairs in May.

Fixed Income

Fixed income indices were positive for a second consecutive month, as Treasury rates and credit spreads remained rangebound. Emerging markets debt continued to lead the fixed income rally, returning over 2% in the month of May.

Commodities

Energy and agricultural commodities posted strong returns for the month, continuing a trend that has seen some commodity contracts rise over 50% year-to-date. Another significant commodity story for the month was the rise in gold, long seen as a safe haven and store of value in the face of inflationary uncertainty. Gold prices advanced nearly 8% in May, a second consecutive month of gains after declines in 7 of the prior 8 months.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.