November 2020

Summary

November began under a cloud of uncertainty. U.S. elections were viewed by many as a toss-up, and rising numbers of COVID cases set the stage for market volatility. As the month passed, however, uncertainty gave way to optimism as risk markets rallied to huge gains on the back of vaccine progress and the prospects of divided government.

Equities

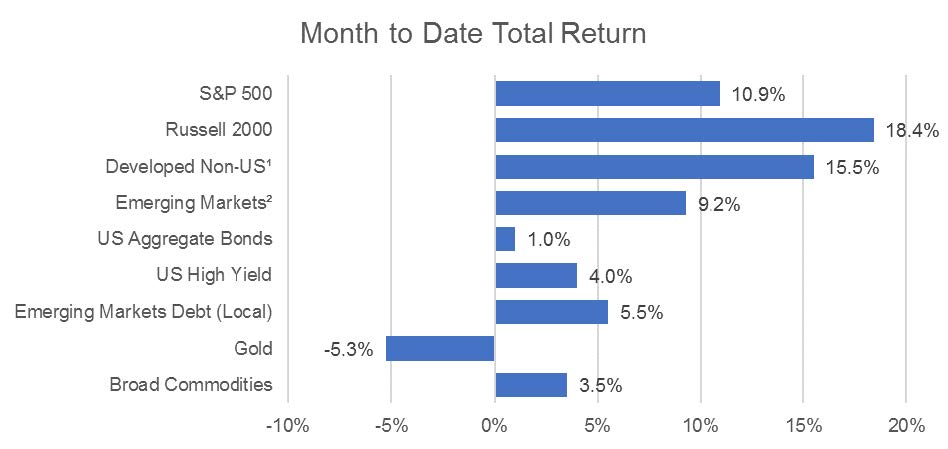

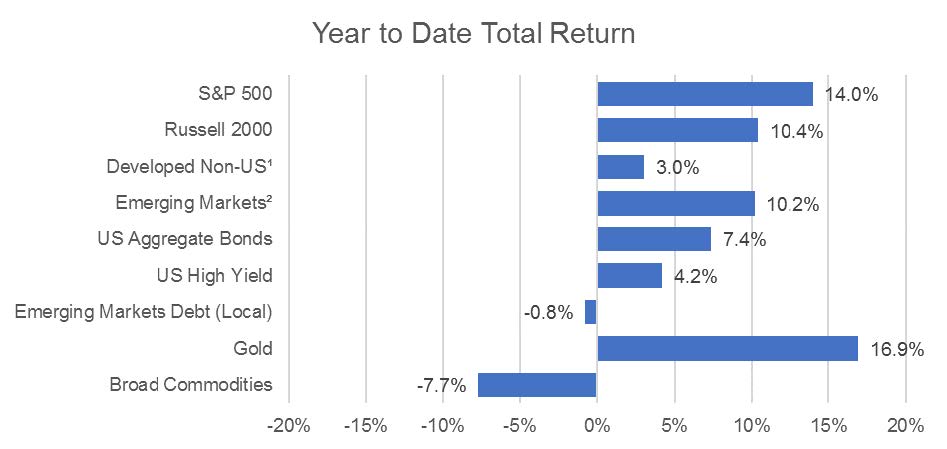

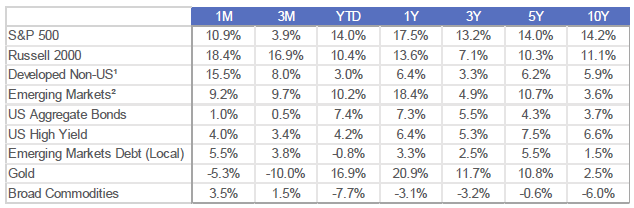

The S&P 500 produced double-digit returns and small cap stocks were the biggest winner of the post-election interest in risk assets, rising nearly 20% for the month. Value stocks benefitted from positive vaccine news, and the Dow Jones Industrial Index broke 30,000 for the first time. (As a point of reference, it took just over 120 years for the blue-chip index to break 20,000 in early 2017.) Outside of the U.S., stocks rallied similarly on prospects of a vaccine, buoyed additionally by a weakening dollar. The potential re-opening of businesses was viewed positively in international markets as well, with value stocks outperforming across developed and emerging markets.

Fixed Income

U.S. treasuries experienced increased volatility at the outset of November and flowed through to a steepening yield curve. As it became evident that a divided Congress might result from the 2020 elections, concerns over outsized, debt-financed stimulus spending waned, and yields returned to October levels. Ten-year treasury yields traded into the high 90s before ending the month at 88 basis points. Credit was also rewarded in November with high yield and emerging markets as the top performing fixed income asset classes.

Commodities

Crude oil prices jumped 27% with the rebound in some commodities, while spot gold fell as investors reduced election-driven inflation trades and rotated into equities.

Market Trends

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.