November 2021

Summary

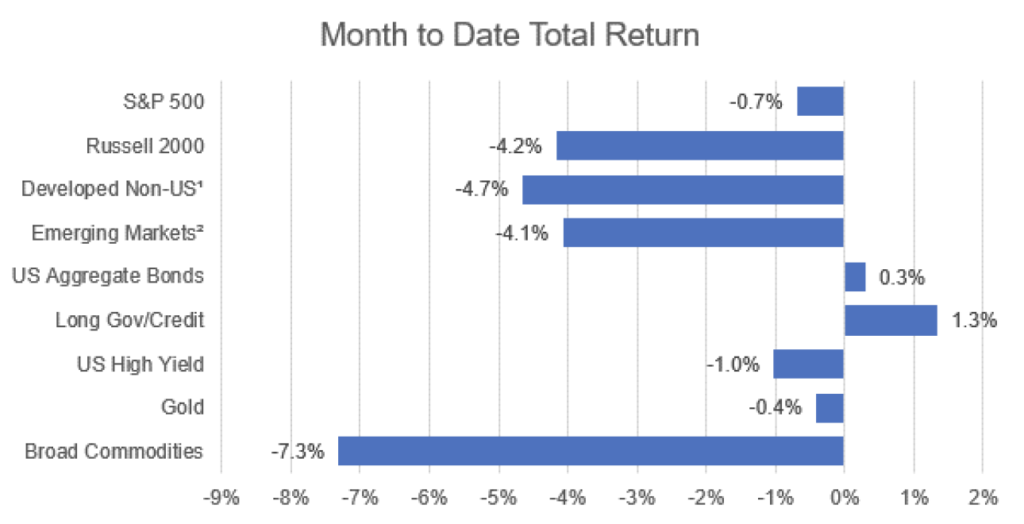

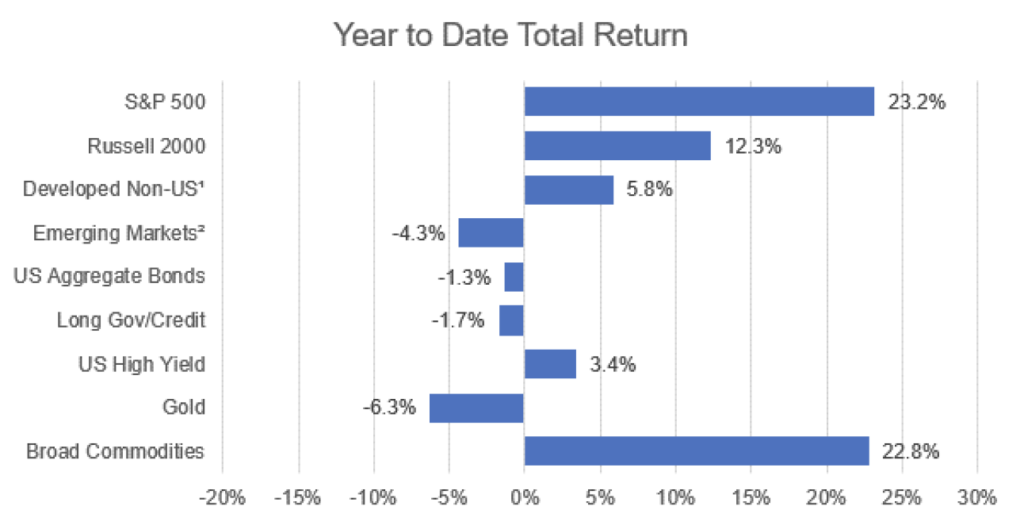

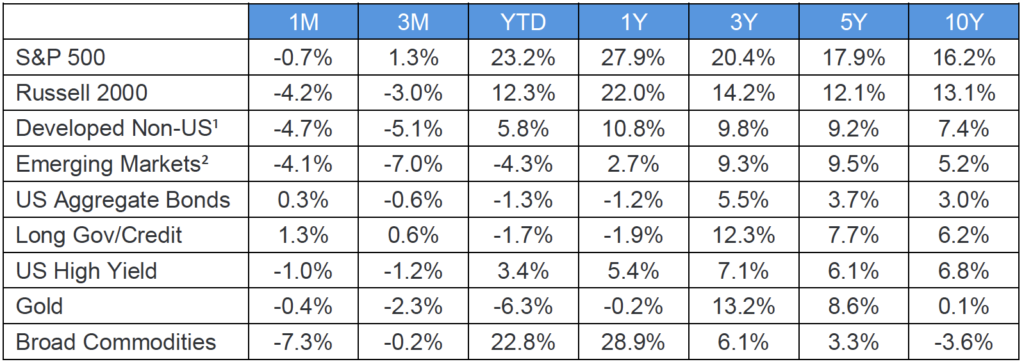

For investors, November was a tale of two months. Global equities were positive for the first three weeks, and it looked like smooth sailing headed into the holiday season. However, news of a new COVID variant and concern over the potential impact on the worldwide economy led investors to sell through the Thanksgiving holiday, erasing previous gains. Further, comments from Jerome Powell opening the door for a potential accelerated tapering in 2022 of the Fed’s bond buying program, market sentiment quickly shifted and Treasury yields fell.

Equities

Early gains for stocks were erased by a late month sell-off, which pushed global equity returns negative for the month of November. The highest year-over-year inflation report in 30 years did little to slow domestic stocks early in the month, but concern over the potential impact of another COVID surge due to the newly named Omicron variant was enough to drive investors to reverse course. Small caps fell nearly 6% in a matter of days, while markets in Europe and Asia experienced drawdowns of a similar magnitude.

Fixed Income

The shift in risk sentiment had a significant impact on the fixed income market. Treasury yields plunged with the 10-year note moving from 1.68% to 1.44% over the final trading days of the month. The risk-off trade was strong enough to offset growing sentiment that the Fed may be considering an accelerated tapering timeline, attributable to persistent high inflation data. Credit underperformed as spreads widened in sympathy with equity markets.

Commodities

Commodities continued their wild ride in November. While top-line inflation remained elevated, crude oil futures dropped 20%, gold was flat, and broad commodities were down over 7% for the month.

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.