November 2022

Summary

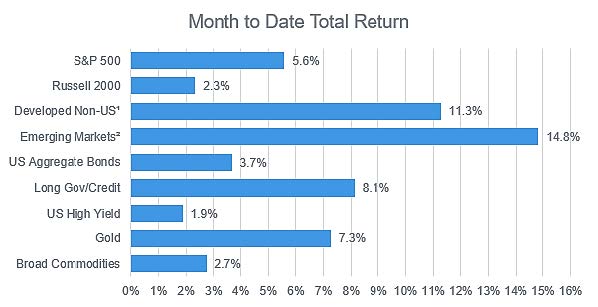

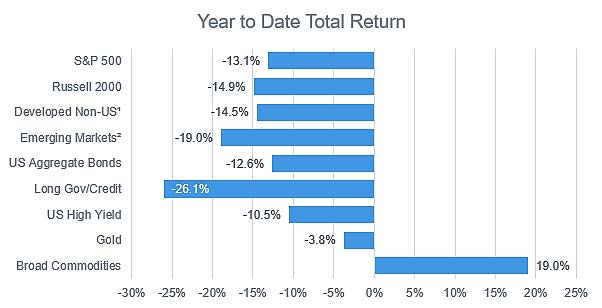

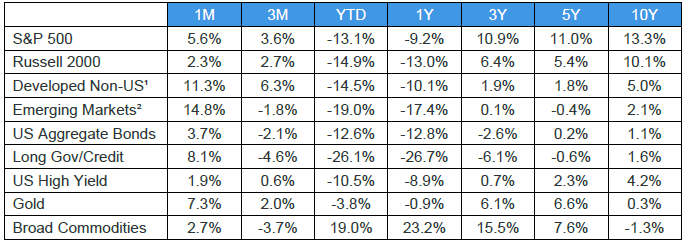

Stocks and bonds were broadly positive in November as inflation slowed, with the Consumer Price Index (CPI) coming in at +7.7% year-over-year and below market expectations (+8%). Treasury yields declined and stocks rallied, as investors took the positive inflation surprise as a signal that the Federal Reserve would likely begin scaling back their tightening cycle. The sentiment spilled onto the currency markets, taking some steam out of this year’s massive dollar rally, and supporting non-US dollar assets. Black Friday/Cyber Monday retail data suggested that consumer spending was off to a solid start for the holiday season, and Q3 GDP estimates were revised higher, while equity returns were dampened late in the month on concerns over civil unrest in China.

Equities

U.S. equity markets finished the month with positive returns, albeit via a circuitous path. A steep drawdown to begin November was erased in midmonth on the back of a more rosy revised October CPI print than economists expected. The rally slowed after the Thanksgiving holiday when news of large-scale protests in China, due to its zero-COVID policy tempered enthusiasm. Dovish comments from Federal Reserve Chair Jerome Powell on the final day of the month sent stocks soaring once again. The S&P 500 increased by 5.6% in November, while small cap stocks ended the month 2.3% higher.

Good news on the U.S. inflation front spelled relief for international equities as the Euro, Yen, and Pound all gained by roughly 5% in November, after being battered for most of the year. Emerging markets currencies gained as well, though the overall margin was lower than what was experienced in developed countries. Bolstered by currency effects, international stocks were the top performers for the month, earning double-digit returns and narrowing the year-to-date performance gap versus domestic equities.

Fixed Income

Interest rates declined across the board with inflation surprising to the downside, and investors forecasting an abating in the Fed’s anticipated rate hikes. Entering the last month of 2022, the market is now pricing in a 50 basis point rate increase in December, a reprieve from the 75 basis point hikes of June, July, September, and November. The yield on the 10-year U.S. Treasury ranged between 4.24% and 3.69%, finishing the month near the bottom of that range. Investment grade credit spreads tightened while high yield spreads were static month-over-month. The moves helped generate positive returns and soothed some of the damage absorbed by bond markets thus far in 2022, though major indices remain down by double digits for the year.

1 - MSCI EAFE

2 - MSCI - EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.