October 2020

Summary

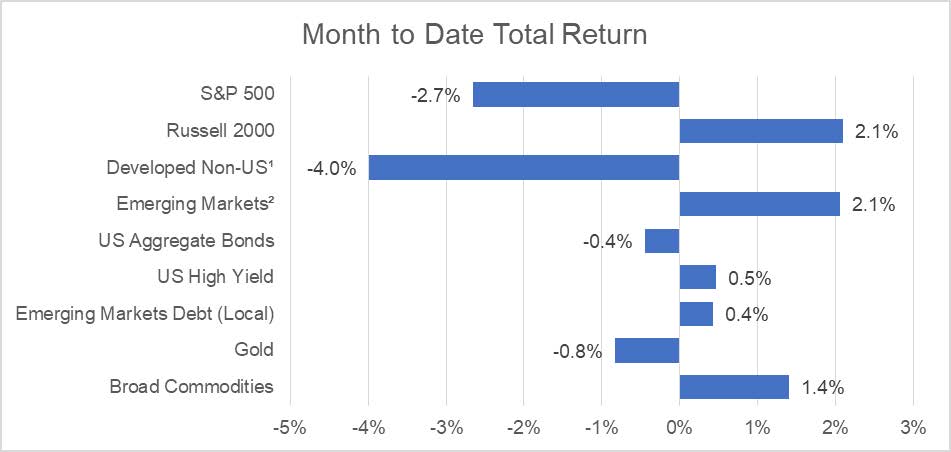

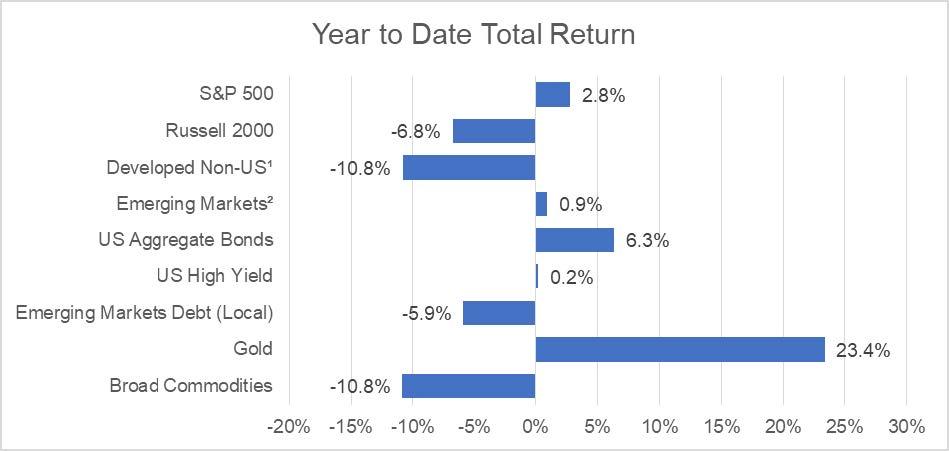

Major market indexes declined in October as economic and geopolitical uncertainty weighed on investors. Rising global coronavirus cases and uncertainty around U.S. elections and the next stimulus package overshadowed broadly positive economic news.

Equities

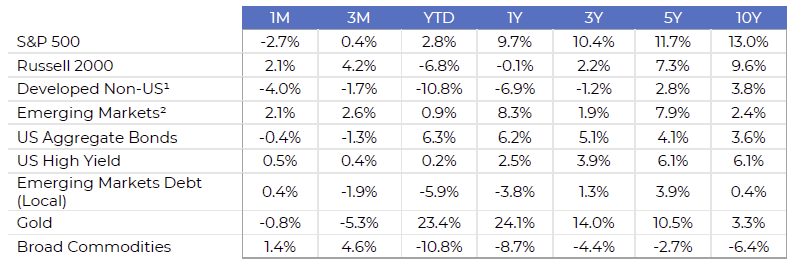

Large cap U.S. equities declined to end the month of October, with the S&P 500 finishing in negative territory. Domestic small cap stocks fared better on the back of outsized positive returns in the first half of the month. Earnings reports were strong, and U.S. gross domestic product expanded at a record 33%, but macroeconomic uncertainty managed to turn investor sentiment negative.

Developed non-U.S. equities were negatively impacted in October as positive COVID-19 cases rose rapidly throughout Europe, rekindling talks of shutdowns. Emerging markets equities continued a trend of surprising resilience, returning 2.1% for the month despite broadly negative currency returns.

Fixed Income

The U.S. bond market was also negative, as the Treasury yield curve steepened in October. Long Treasury interest rates rose 20 basis points. The 10-year Treasury yield finished the month at 87 basis points, the highest mark since late March, with the exception of the brief spike in early June. Short rates remained anchored and credit spreads tightened slightly in advance of the U.S. election.

Market Trends

1 – MSCI EAFE

2 – MSCI – EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.