October 2022

Summary

With macroeconomic news continuing to dominate the headlines in October, investors became comfortable with rotating back into riskier assets, pushing domestic stock indexes higher. In anticipation of another Fed rate hike in November, Treasury yields rose. Inflation (high), unemployment (low), and growth (positive) data provided a cushion for policy makers wary of causing a recession. While September’s CPI came in above expectations, equities and credit rallied, with sentiment driven by optimism that the current monetary tightening cycle is nearing its end. Globally, inflation remains a major problem – Eurozone inflation was reported at 10.7%, the highest level since it began being tracked in 1997. German inflation, with a longer data history, hit 11.6%, a rate not seen in over 70 years.

In October, geopolitical winds shifted briefly from the war in Ukraine and turned toward the United Kingdom. The resignation of Prime Minister Liz Truss on October 20th brought the curtain down on the shortest-serving administration in the history of the post, as attempts to walk back September’s fiscal policy misstep that roiled British markets were ultimately unsuccessful. Meanwhile, 3 days later and thousands of miles away, Chinese President Xi Jinping secured re-election as head of the Communist Party. While the result was not unexpected, the economic and political implications remain to be seen, and at the very least the two seem likely to be intertwined.

Equities

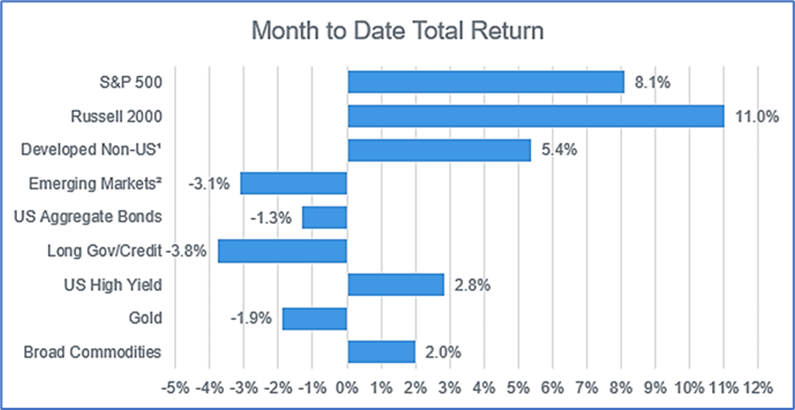

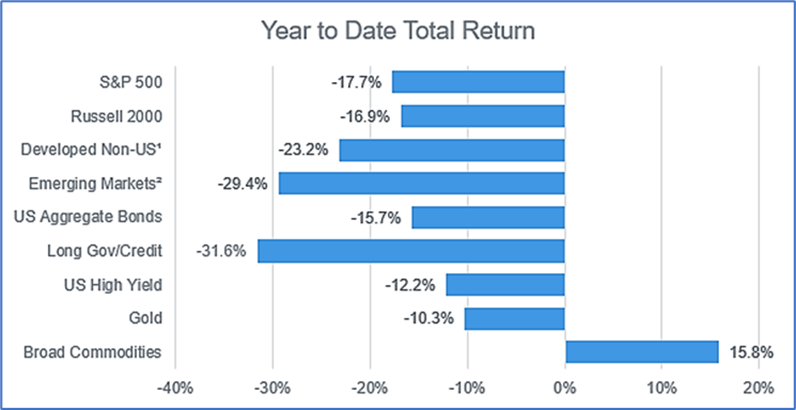

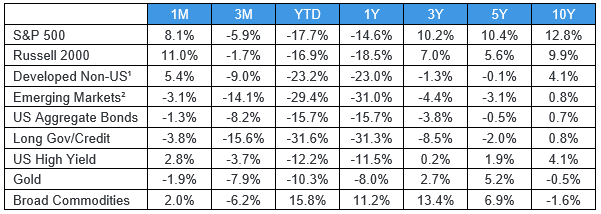

U.S. equity markets opened the fourth quarter of 2022 with strong returns, albeit with wide dispersion. Tech stocks were broadly disappointing in terms of earnings and guidance. Meta, Alphabet, Microsoft, and Amazon combined to lose $350 billion in market cap in less than a week. Despite the big tech selloff, the S&P 500 total return was in excess of 8% for the month of October. Overseas activity was more muted, though returns were positive in developed Europe and Asia. Emerging markets equities fared even worse, realizing a 3% loss for the month, as emerging currencies continue to be overpowered by the strong U.S. dollar.

Fixed Income

Fixed income markets were mixed for the month, as Treasuries and high-quality debt lost ground, while high yield bond returns were positive. A disappointing inflation rate for September cemented an expected 75 basis point hike at the November Fed meeting, and the U.S. 10-year Treasury yields jumped over 50 basis points intramonth, topping out at 4.33% before settling in at 4.07% to enter November. With further hikes on the table, markets were heartened by softened language in some Federal Reserve Board members’ comments suggesting that the size and pace of additional rate hikes maybe moderating in the near future. Their primary mission remains, however, to tame inflation, and the future path of interest rates will be heavily influenced by the change in the prices of goods and services in the near future.

1 - MSCI EAFE

2 - MSCI - EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.