September 2022

Summary

Markets concluded a volatile third quarter with another negative month. The steady drumbeat of stubborn inflation, rising interest rates, and underwhelming earnings led to selloffs across risk assets. Many major indexes were plumbing new lows for the year by the close of September. Rhetoric was not encouraging, with the Federal Reserve remaining steadfastly committed to the mission of fighting inflation, and dour economic warnings from FedEx and Nike bookended September’s earnings updates. Outside of the States, Japan began to maneuver in the foreign exchange markets to support the Yen, while China indicated they could be following a similar path shortly as the globe grapples with a rapidly appreciating US dollar. In the United Kingdom, the unveiling of a plan for unfunded tax cuts to support citizens facing an uncertain winter and a pending energy crisis triggered a massive surge in long gilt yields, which required a swift and sizeable intervention from the Bank of England to stabilize.

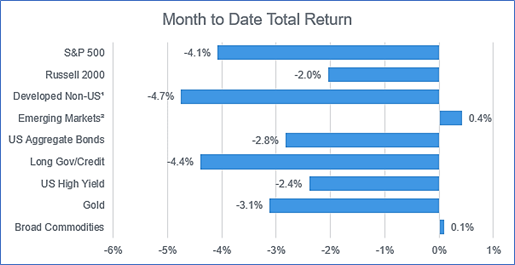

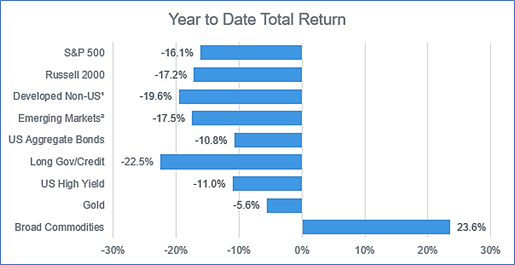

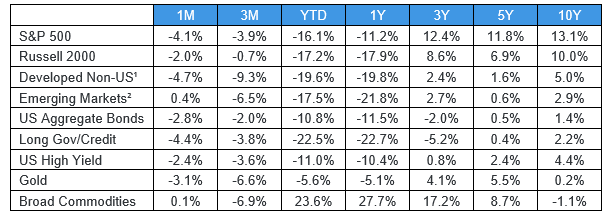

Equities

Stocks skidded to 2022 lows in September. August CPI came in at 8.3% year-over-year, and a modest 0.1% monthly increase from July, but markets were hoping for more improvement. By the time the Fed made September’s rate hike official, the S&P 500 had erased earlier gains en route to a 9% monthly drawdown. Small caps finished the month 10% off August levels, and international stocks fared even worse, as developed economies continue to wrestle with rising inflation, weakening currencies, and the consequences of the ongoing war in Ukraine. In an effort to support the economy in the face of a dire natural gas shortage for the coming winter, new UK Prime Minister Liz Truss and Chancellor Kwasi Kwarteng put forth a plan to cut taxes and cap energy bills, financed by deficit spending, to support British consumers. With the UK battling its own inordinately high inflation, the plan was not well received by markets, and the Bank of England was forced to intercede by buying UK gilts before the panic could spill over into British equities. The pound flirted with parity to the dollar before rebounding to 1.10 thanks to the BOE’s rescue.

Fixed Income

US treasury yields shifted higher during September, with the 10-year yield briefly topping 4%, its highest level since 2008, before ending the month at 3.8%. CPI increased by 0.1% from July to August, but most of this moderation was attributable to falling energy prices as Core CPI (which excludes food and energy) ticked up 0.6% month-over-month. The Federal Reserve’s preferred inflation gauge, core PCE, was also up 0.6% for the month, leading to another 75 basis point hike to the Fed Funds rate. Higher rates are beginning to put pressure on the housing market, as mortgage rates climbed to 6.7% according to data published by Freddie Mac. Credit spreads widened and high yield bonds underperformed as traders shed risk in favor of high quality, short duration paper.

1 - MSCI EAFE

2 - MSCI - EM

Source: Bloomberg

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.