Defined Benefit Plans

Your Goals Drive Our Priorities

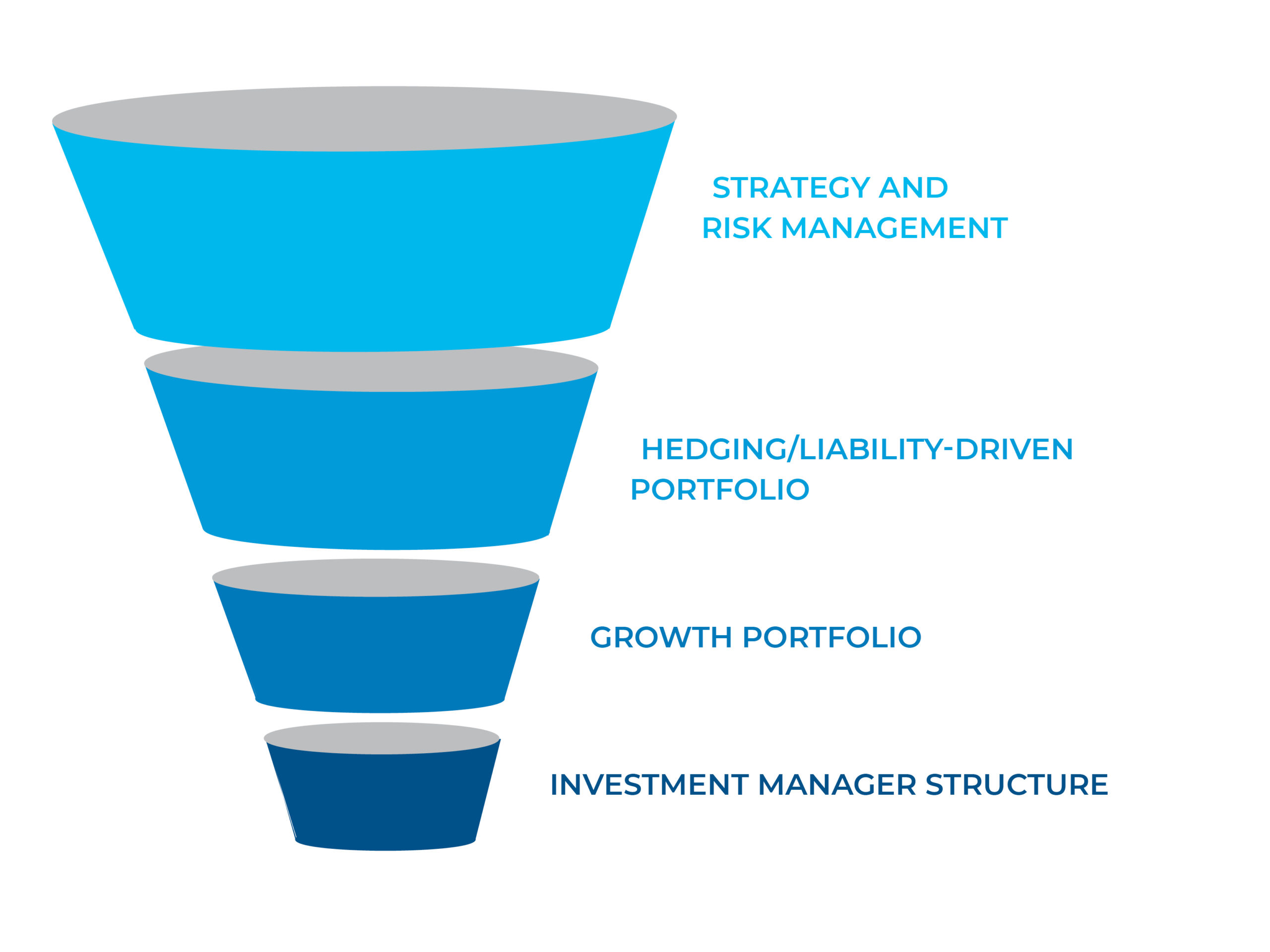

Pension plan reviews often begin with investment manager performance. Highland suggests starting with your end goal as the priority.

With clarity about your objectives, we can construct a customized policy prescription that generates portfolio efficiencies and more predictable outcomes.

Governance

We review your current investment guidelines and make sure they align with your goals. We can advise and train your committee members or staff, and we’ll regularly review and report on your adherence to these foundational policies.

Fiduciary Support

As your co-fiduciary, we don’t shy away from plan complexities. Our processes, reports, checklists, and in-person meetings give you the tools and confidence that you are fulfilling your fiduciary duty.

Propriety Research Tools

Highland invests heavily in firm-developed systems. Our rigorous analyses take into account your plan’s liabilities and obligations relative to your funding goals.

Tailored Portfolios & Reporting

Our investment team creates one-of-a-kind investment portfolios tailored to your organization. Highland’s reporting, fine-tuned to your needs, helps you gain the clarity that improves decision-making.

Manager Search, Selection, and Monitoring

Highland conducts due diligence and annually participates in hundreds of meetings with managers. With every contact, our database is updated with notes, documents, ratings, and supporting analytics in order to construct portfolios with a target mix of styles, approaches, and desired exposures.

Fee Reviews

Plan sponsors are required to know what fees they’re paying and whether those are reasonable. Highland analyzes relevant data from our large client base, external resources, and ongoing search activity to measure and benchmark vendor fees in real time to help you assess their reasonableness and value to you.

Invigorate Dated Strategies

As organizations deemphasize DB plans and many even work toward terminating them, strategies that were once appropriate may no longer meet your current goals, objectives, and tolerance for risk. Legacy fee structures persist. The composition of plan assets seldom changes, and the plan’s investment strategy can become stale. You and your organization should expect a consulting relationship that offers fresh thinking and objectivity, and an agile strategy working on your behalf to achieve more.

Full Service and Full Disclosure

Because we’ll champion your plan, you’ll have more time for the many other demands competing for your attention. Our comprehensive service structure includes continual monitoring. When you have need of additional advice or input, we’ll provide that too, for an agreed-to fee.

Highland Research

Highland’s approach to research is grounded in our philosophy and activated through our commitment to independent and analytical evaluation for client-first results.

Your On-Staff, Off-Site Resource

Periodic meetings are a given, but relationships are built in the time between. That’s when issues arise and solutions are delivered. Highland’s client-first commitment invites you to lean on us.

Consider us your trusted colleague—on your side and just a phone call or email away.