Defined Contribution Plans

Count on Highland

Since 1993, Highland has been advising retirement plan sponsors. We’ve guided clients through market challenges and opportunities over many decades and you can count on us to do the same for you today. We’re equipped to help. Here’s how:

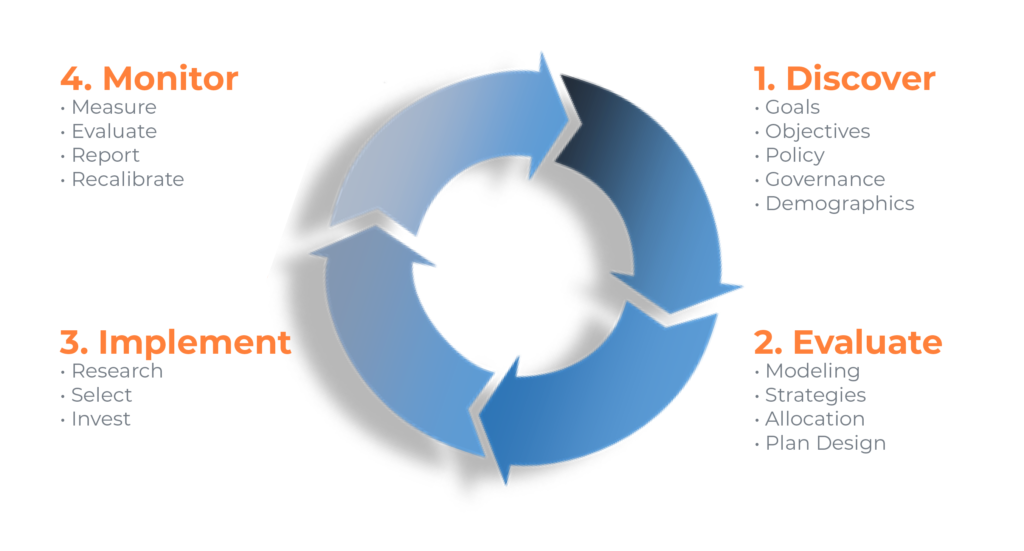

Our time-tested investment management process leads us to Discover your goals and policies; Evaluate opportunities with rigor and independent analysis; Implement strategies with practiced expertise; and Monitor results and changing markets to maintain portfolio alignment with your goals.

Our investor advocacy allows you to focus on your financial and human resource management priorities with the assurance that as your independent advisor and co-fiduciary, Highland is committed to you and your plan’s success.

Governance

We review your current investment guidelines and make sure they align with your goals. We can advise and train your committee members or staff, and we’ll regularly review and report on your adherence to these foundational policies.

Fiduciary Support

As your co-fiduciary, we don’t shy away from plan complexities. Our processes, reports, checklists, and in-person meetings give you the tools and confidence that you are fulfilling your fiduciary duty.

Plan Design

The successful defined contribution plan not only measures investment results, but focuses on participant outcomes also. Often, simple changes like auto features can dramatically improve participant success.

Participant Engagement

Highland assists clients with strategies to improve participant engagement. Employee education, thoughtful plan design and tailored communications can all play a role. Often, strategies can be tailored around a plan’s participant demographics to maximize effectiveness.

Manager Search, Selection, and Monitoring

Highland conducts due diligence and annually participates in hundreds of meetings with managers. With every contact, our database is updated with notes, documents, ratings, and supporting analytics in order to construct portfolios with a target mix of styles, approaches, and desired exposures.

Fee Reviews

Plan sponsors are required to know what fees they’re paying and whether those are reasonable. Highland analyzes relevant data from our large client base, external resources, and ongoing search activity to measure and benchmark vendor fees in real time to help you assess their reasonableness and value to you.

What’s the Plan?

With decades of experience serving as co-fiduciaries to retirement plans including 401(k), 403(b), non-qualified, and multiple and pooled employer plans (MEPs & PEPs), we have deep knowledge of what matters to plans sponsors and the factors that contribute to plan success.

Highland Research

Highland’s approach to research is grounded in our philosophy and activated through our commitment to independent and analytical evaluation for client-first results.

Your On-Staff, Off-Site Resource

Periodic meetings are a given, but relationships are built in the time between. That’s when issues arise and solutions are delivered. Highland’s client-first commitment invites you to lean on us.

Consider us your trusted colleague—on your side and just a phone call or email away.