Your Goals Drive Our Priorities

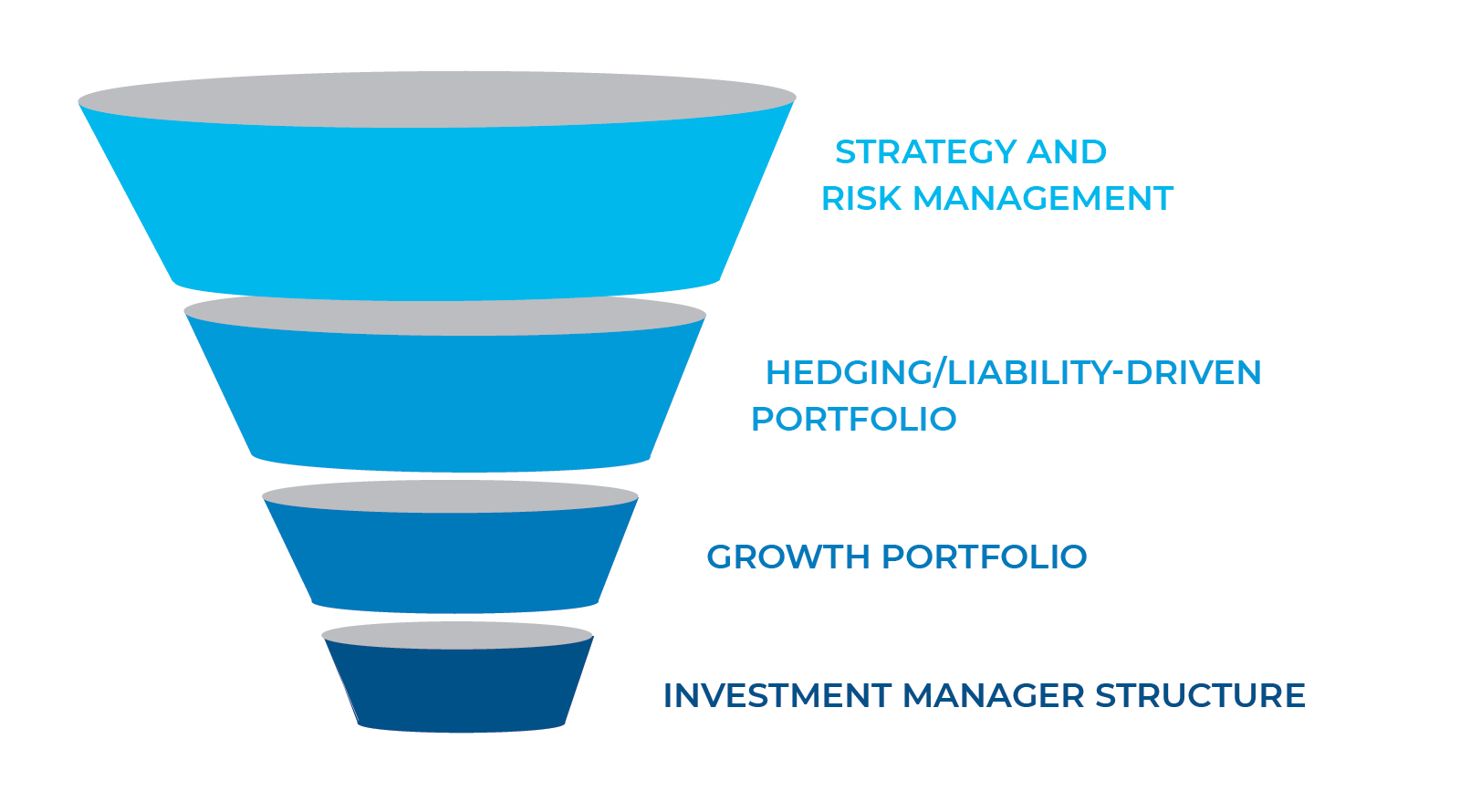

Too often, conversations begin with investment manager performance when, in fact, that may have little material impact on your end goal. Instead, Highland starts with your end goal as our first priority.

With clarity about your objectives, we can construct a customized policy prescription that generates portfolio efficiencies and more predictable outcomes.

Governance

We review your current investment guidelines and make sure they align with your goals. We can advise and train your committee members or staff, and we’ll regularly review and report on your adherence to these foundational policies.

Fiduciary Support

Let us help shoulder the burden of compliance. Our processes, reports, checklists, and in-person meetings give you the tools and confidence that you are fulfilling a fiduciary’s duty.

Custom Research Tools

Highland invests heavily in firm-developed systems. Our rigorous analyses identify vetted investment options at carefully managed costs.

Tailored Portfolios

Our credentialed in-house investment team curates one-of-a-kind investment portfolios based on your organization’s pension plan goals, objectives and tolerance for risk.

Manager Search, Selection, and Monitoring

Highland conducts due diligence and annually participates in hundreds of meetings with managers. With contact, our database is updated with notes, documents, ratings, and supporting analytics in order to construct portfolios with a target mix of styles, approaches, and desired exposures.

Useful Reporting

We customize reporting in response to your information needs. Highland's reporting tools, fine-tuned to your requirements, help you gain the clarity that improves decision-making.

Fee Reviews

Plan sponsors are required to know what fees they’re paying and whether those are reasonable. Highland analyzes relevant data from our large client base, external resources, and ongoing search activity to measure and benchmark vendor fees in real time to help you assess their reasonableness and value to you.

Highland Investment Research

Highland’s approach to research is grounded in our philosophy and activated through our commitment to independent and analytical evaluation for client-first results.

Invigorate What’s Often Overlooked

As companies deemphasize DB plans and even work toward terminating them, strategies that were once appropriate may no longer meet your current goals, objectives, and tolerance for risk. Legacy fee structures persist. The composition of plan assets seldom changes, and the plan’s investment strategy can become stale. You and your organization should expect a consulting relationship that offers fresh thinking and objectivity and an agile strategy working on your behalf to achieve more.

No Base Plus

Highland’s comprehensive service allows our clients greater confidence in more predictable in outcomes. Because we’ll champion your plan, you’ll have more time for the many other demands competing for your attention. Continual monitoring and refinement, and regular reporting --that’s what our fee covers. That and more. When you have need of additional advice or input, we’ll provide that too, for the fee we’ve agreed to and not for an a la carte, additional cost.