Pooled Employer Plans

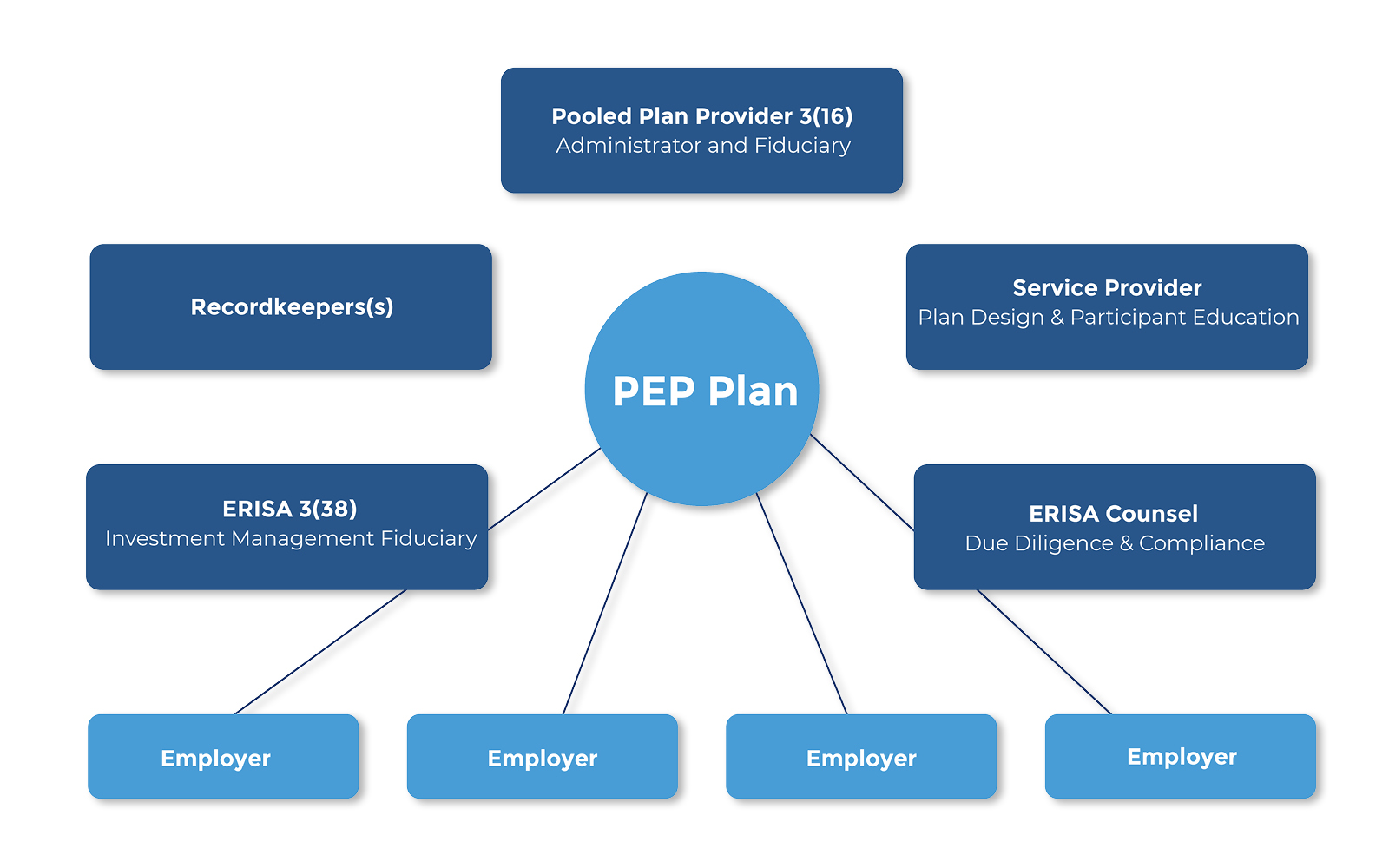

PEPs have the potential to provide fiduciary relief, cost savings and access to a broader array of investment options. Some providers are bundling their own investment products and services within the plan. These bundled structures may diminish the PEP’s benefit to your organization and employees. A PEP structured with independent firms to provide services may be established in this form:

The potential benefits of a PEP are contingent on factors beyond the control of the employer/plan sponsor considering them, including:

- Will the asset pool be large enough to effect meaningful cost reductions?

- Is the Planned Pool Provider experienced to effectively direct a PEP and administrative demands and fulfill its fiduciary obligations?

- Is the PEP offering bundled products and service providers that might limit the benefit you and your employees expect to receive?

- Are the fund options, plan features, and participant education experience robust enough to enhance the retirement readiness of workers the plan is created to help?

If you’re considering a PEP, consider enlisting help from Highland, an independent, objective team of advisors who can guide your evaluation.