2022 Inflation and Investments

There’s no dodging inflation. But investors can hedge against it.

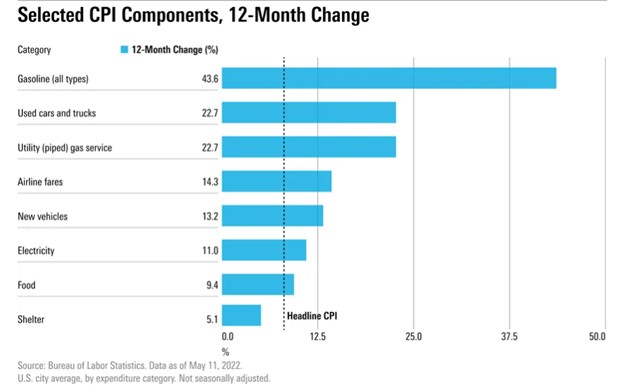

If you drive a truck or SUV, no one needs to tell you that inflation has risen to uncomfortable heights—heights not seen in 40 years. A tank of regular gasoline that cost an SUV driver $114 last year, as we enter the summer vacation season, at $4.88 a gallon, now costs $195. (U.S. Energy Information) Despite a slight dip in the annual inflation rate to 8.3% in April from 8.5% in March, consumers are feeling pain at the pump and elsewhere. The chart below shows where increasing prices among certain components of the consumer price index (CPI) are driving the inflation rate upward. Fuel, vehicles and food costs are chief among the contributors.

Short-Term Pain. Long-Term Gains?

Managing a monthly budget as food and fuel prices soar can be a source of stress and worry, but what about inflation’s impact on the money you’re saving for the future? Does the loss of purchasing power today mean that investors will also lose value in what they’ve set aside in their retirement accounts? Not necessarily.

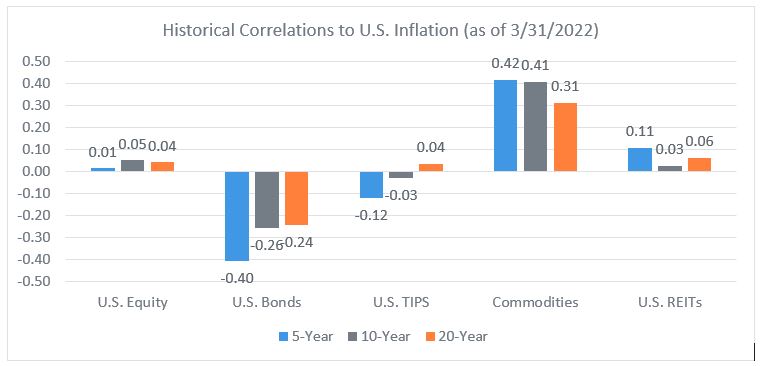

While there are no perfect inflation hedges, there are investment strategies that have tended to perform well in higher inflationary periods. The chart below shows how various asset classes track with inflation.

Historical correlations for commonly used inflation hedges (TIPS, Commodities, REITs)

Let’s consider some of the correlations:

U.S. Bonds. Not surprisingly, fixed income instruments have a negative correlation to inflation. When inflation rises, returns on bonds become negative because rising yields (led by higher inflation expectations) reduces their market price. So, investors can expect to lose capital because of price declines and because the real value of the portfolio will be eroded by inflation.

TIPS –Treasury Inflation Protected Security. TIPS are bonds issued by the US Treasury whose principal (the final payment) increases with the CPI. By design, they should hold their value no matter the level of inflation. In practice, however, the correlation between TIPS prices and inflation isn’t what you might expect. TIPS offer lower yields than their non-inflation-protected equivalents. During inflationary periods, that yield can be negative. So, investors may keep up with official inflation rates, but the negative yield can result in a loss. Moreover, TIPS tend to outperform general Treasury securities when the stated CPI is higher than what the market anticipates, which is seldom the case.

U.S. Equities. As the chart indicates, equities generally correlate with inflation. Moderate inflation can be good for equities because it can be associated with positive economic growth, rising profits, and stock price gains. But when inflation increases at a surprisingly high rate and the economy overheats, the market can retreat. Certain sectors will outperform, of course. And in today’s market, energy and gas stocks have been top performers in the S&P.

U.S. Reits – Real Estate Investment Trusts. REITs, especially in the shorter-term, can pace well with inflation. In 2021, with inflation rising at a pace not witnessed in decades, REITs outperformed the S&P 500 by 12.6 percentage points. (Reit.com) This can be attributed to the nature of REIT holdings. Shorter-term leases can be adjusted to current price trends, while long-term leases typically have inflation protection built-in. Together, as a portfolio, some of the holdings can be renegotiated to track with inflation. The last contributor to value is the appreciation of the assets themselves. Home buyers and renters have no doubt experienced this rise firsthand.

Commodities. Commodities tend to be one of the asset classes most positively correlated with inflation, particularly in the shorter term. The CPI incorporates the prices of commodities like crude oil, natural gas, and agricultural commodities. These prices typically rise when inflation is accelerating. In fact, increases in commodity prices can be a leading indicator of inflation. As prices to make goods rise, so will prices of the goods themselves. As inflation persists (and expectations of continuing inflation are factored into prices), commodities’ positive correlation to inflation decreases.

A Portfolio Plan for Inflation

The rate of inflation is high and seems alarmingly so. The last time inflation hit such heights, it was 1982: Ronald Reagan was president and David Letterman had just begun his “Late Night” run of 33 years. Although much has changed in the years that have followed (think the internet, smart phones, Amazon, and globalization) what hasn’t changed are the availability of tools in the investment arsenal that can help mitigate inflation’s impact on investment portfolios. Highland can assist retirement plan sponsors, plan participants and other investors with:

- Education to better understand what inflation is and why it impacts different asset classes differently;

- Portfolio and asset allocation reviews to identify what investors own and how those investments tend to perform in high inflationary or deflationary periods; and

- Strategy reviews and manager selection shifts which may introduce new exposures to better achieve client goals relative to inflation.

Highland Can Help

The cost of filling your gas tank and grocery cart this summer may be alarming, but investors don’t have to panic. A well-formed plan can help preserve the purchasing power of the dollars you save today to so that you can pay yourself in the future. Highland is prepared to help.

Highland Consulting Associates, Inc. was founded in 1993 by a small group of associates convinced that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.