DC Insight

The Buffett Indicator

Photo credit: ID 336907040 © Yaroslaf | Dreamstime.com What do lizards, Blizzards, and underwear have in common? Warren Buffett and Berkshire Hathaway. And do the lizard and the DQ Blizzard (and Berkshire Hathaway holdings, in general) predict a freeze in an exceedingly hot investment market? Possibly. More on that later. The Omaha-based conglomerate counts GEICO, Dairy Queen, and Fruit of…

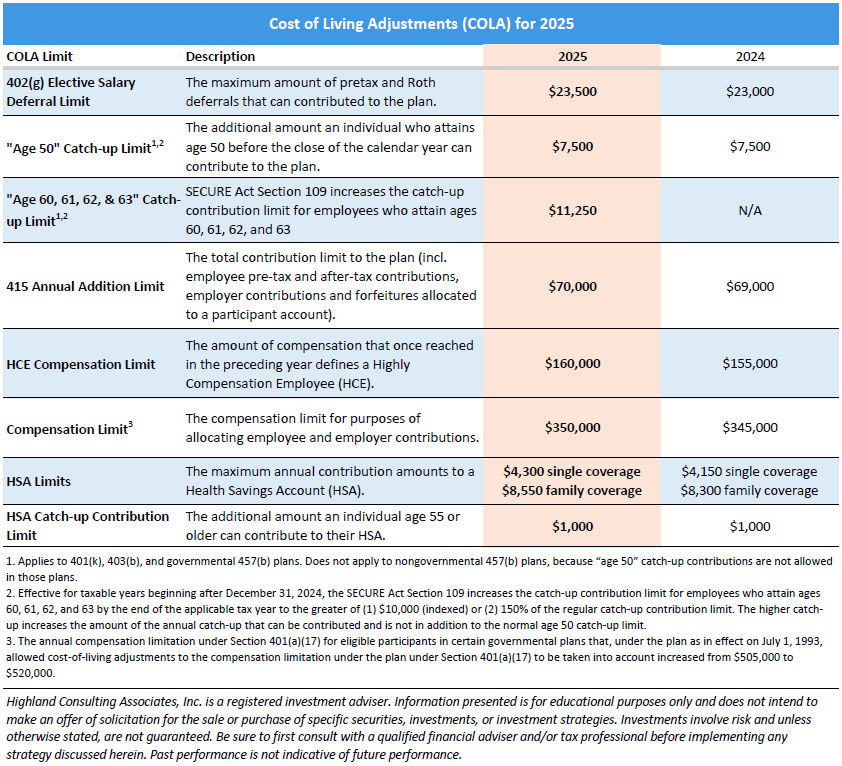

Read MoreCost of Living Adjustments 2025

The IRS recently released the Cost-of-Living Adjustments (COLA) for 2025 related to 401(k) and Health Saving Accounts. This table provides these and other limits that are of interest to many plan sponsors and their participants. If you would like more information please call us at 440-808-1500. Highland Consulting Associates, Inc. was founded in 1993 with the…

Read MoreThe Elusive 5%: Is It Making a Comeback?

photo credit: Pixabay For over a decade, we lived in a world of near-zero interest rates, making it incredibly challenging for plan sponsors and corporate asset managers to create low-risk portfolios yielding 5%. But as market dynamics shift, the landscape is changing, bringing new opportunities—and new decisions—to the forefront. The Challenge of the Last Decade…

Read MoreSecure Act 2.0 Student Loan Match – Lightening the Student Debt Load to SECURE a Better Retirement

photo credit: istock “A hundred wagonloads of thoughts will not pay a single ounce of debt.” – Italian proverb As of 2023, 43 million Americans held $1.6 trillion[i] in student loan debt. That’s a wagonload of debt accumulated in the pursuit of higher thought. That burden of student loan debt is hindering retirement savings. Case…

Read MoreHappy 5/29 Day!

photo credit: Unsplash Happy 5/29 Day! Today we celebrate the 529 Plan, a college savings vehicle with tax-free withdrawals. What Is a 529 Plan? What Are the Benefits? This beneficial tax treatment comes with a few strings attached: While not federally tax deductible, contributions in certain states are state income tax deductible The money must…

Read MoreForecasting Equity Returns – What Can I Count On in 2024? Part Three: Smoke and Mirrors Day – A Celebration of Small Caps, Global Funds and Emerging Markets

Photo credit: Pixabay A three-part conversation with Highland Consulting Associates. Over the past several weeks we have been considering what you can expect from investment returns in 2024—or, rather, whether you can count on 2024 predictions at all. We’ve organized this series into three parts (see Part One and Part Two) to cover the major…

Read MoreForecasting Equity Returns – What Can I Count On in 2024? Part Two: What are the Pieces of the Pie? (And Is Your Pie Getting Smaller?)

Photo credit: Pixabay A three-part conversation with Highland Consulting Associates. In the next several weeks we’ll consider what you can expect from investment returns in 2024—or, rather, whether you can count on 2024 predictions at all. We’ll break this series into three parts to cover the major areas of investment opportunities beginning with historical returns,…

Read MoreThe 401(k) Forfeiture Kerfuffle and What it Means for 401(k) Plan Sponsors

photo credit: istock On February 21, 2024, yet another lawsuit was filed against a 401(k) plan sponsor over alleged misuse of forfeited retirement plan savings of terminated participants. This is the seventh lawsuit filed by the Pasadena-based law firm of Hayes Pawlenko LLP in federal district courts throughout California. This latest claim against Tetra Tech…

Read MoreForecasting Equity Returns – What Can I Count On in 2024? Part One: Normalized Distribution – Ring a Bell (Curve)?

Photo credit: Pixabay A three-part conversation with Highland Consulting Associates. In the next several weeks we’ll consider what you can expect from investment returns in 2024—or, rather, whether you can count on 2024 predictions at all. We’ll break this series into three parts to cover the major areas of investment opportunities beginning with historical returns,…

Read MoreAuld Lang Syne: Some Things Remain the Same (including Retirement Plan Committee Best Practices)

photo credit Pixabay As 2023 ends and a new year begins, in Scotland’s highlands and lowlands you’re likely to hear the familiar “Auld Lang Syne,” a Scottish expression meaning “old long since.” It’s a tribute to times past or a longing for old times. If you’re a plan sponsor fatigued by the pace of change,…

Read More