The E&F Advocate: Key Takeaways on Proposed Endowment Tax Changes

photo credit: ideogram.ai

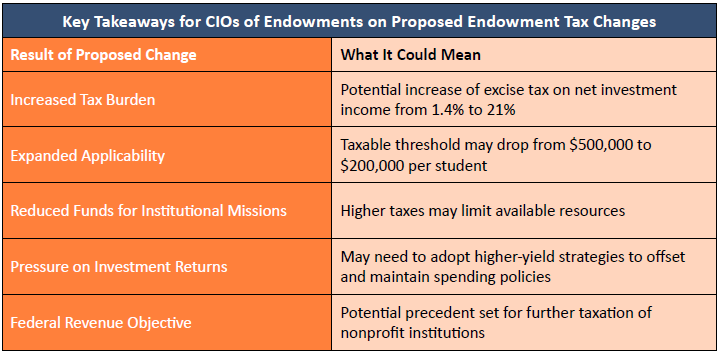

The proposed endowment tax changes aim to increase the current 1.4% excise tax on net investment income of certain private colleges and universities to rates as high as 21% or more. Additionally, there are proposals to broaden the tax's applicability by lowering the endowment assets per student threshold from $500,000 to $200,000. These changes could significantly reduce funds available for institutional missions, such as financial aid and operational budgets, and necessitate higher endowment returns to maintain current funding levels. The objective behind these proposals is to generate additional federal revenue to address the national deficit.

While these proposed endowment tax changes may feel like a shift in the environment, they don’t have to be a threat to the health of your institution’s financial future. The fiduciary and governance experts at Highland can help you consider the implications of these changes and recalibrate your investment strategies. Please contact Gaurav Patankar at gpatankar@highlandusa.net.

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and is not intended to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.