November 2025

Summary

Markets wavered throughout November but finished mostly higher as investors weighed the AI trade, the end of the longest U.S. government shutdown in history and softening economic data. Interest rates oscillated during the month as well, with markets flip-flopping on the Fed’s next move at December’s meeting. Data releases were limited due to the government shutdown, with survey data from the private sector filling the gap. Trading concluded early due to a late Thanksgiving holiday; with the government re-opened, investors will turn a watchful eye towards employment data, inflation, and consumer holiday spending into year-end.

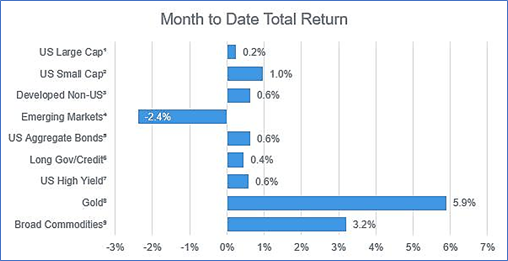

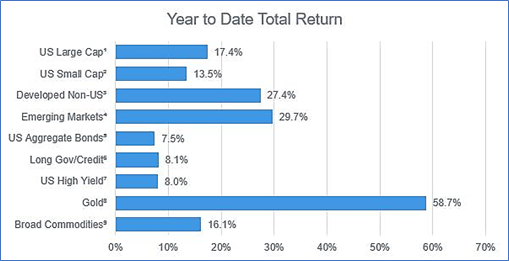

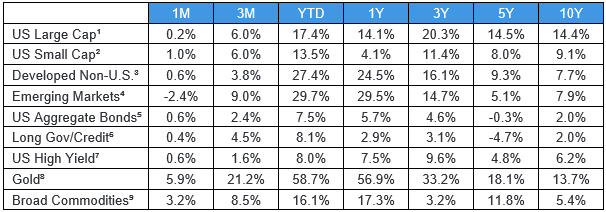

Equities

Developed markets managed to eke out meager gains in November while emerging equities weren’t as fortunate. U.S. stocks were streaky, with major tech CAPEX and a shifting AI landscape driving markets lower mid-month to erase earlier gains before rebounding into Thanksgiving. Small cap equities led the way in November with a 0.96% gain. Despite a 2.4% drawdown during the month, emerging markets continue to lead their developed counterparts year-to-date.

Fixed Income

The yield on the U.S. 10-year Treasury traded below 4% late in November before finishing the month at 4.02%, a month-over-month drop of 8 basis points. While weaker employment data and souring consumer sentiment may incline the Fed towards cutting the policy rate at next month’s meeting, inflation remains a potential fly in the ointment. With no official CPI release in November due to the government shutdown, the Oval Office cited data from DoorDash to attempt to quell concerns over rising prices. Against this backdrop, markets priced in a December cut as a coinflip and bonds treaded water. Spreads widened slightly and credit underperformed for the month, with higher quality, shorter duration issues holding up best in November.

1 – Russell 1000, 2 – Russell 2000, 3 – MSCI EAFE, 4 – MSCI Emerging Markets, 5 – Bloomberg US Agg, 6 – Bloomberg US Long Gov/Credit

7 – Bloomberg US Corporate High Yield, 8 – Bloomberg Gold Subindex, 9 – Bloomberg Commodity

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Disclosure Statements

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “ LSE Group” ). © LSE Group [year]. FTSE Russell is a trading name of certain of the LSE Group companies. “ FTSE®” “ Russell®” , “ FTSE Russell®” are trade mark(s) of the relevant LSE Group companies and are used by any other LSE Group company under license. “ TMX®” is a trade mark of TSX, Inc. and used by the LSE Group under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

Copyright MSCI 2017. Unpublished. All Rights Reserved. This information may only be used for your Internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. This information is provided on an "as is" basis and the users of this information assumes the entire risk of any use it may make or permit to be made of this information. Neither MSCI, any of its affiliates or any other person involved in or related to compiling, computing or creating this information makes any express or implied warranties or representations with respect to such information, or the results to be obtained by the use thereof, and MSCI, its affiliates and each such other person hereby expressly disclaim all warranties (including, without limitation, all warranties of originality, accuracy, completeness, timeliness, non- infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall MCSI, any of its affiliates or any other person involved in or related to compiling, computing or creating this information have any liability for any direct, indirect, special, incidental, punitive, consequential or any other damages. The MSCI information is the exclusive property of Morgan Stanley Capital International ("MSCI") and many not be reproduced or redisseminated in any form or used to create any financial products or indices without MSCI's express prior written permission. The information is provided "as is" without any express or implied warranties. In no event shall MSCI or any of its affiliates or information providers have any liability of any kind to any persons or entity arising from or related to this information.