Millennials Investing in a New(er) Millennia

Gone are the days of calling a stockbroker to hear the latest picks to then place a trade with a $50 commission for a mutual fund with a 2% expense ratio. Today, the average American 20-something with a phone and a brokerage account can place a zero-commission trade for any security on an exchange in under 30 seconds. (This 20-something timed it.)

What are younger generations recommending to each other? Browse almost any social media platform, as younger people often do when looking for guidance, and you’ll see a wide variety of advice from its users. Some platforms are more helpful than others, but some frequently mentioned investments include:

- The Fan Favorite: Passive investments like an S&P 500 Index fund and other index-tracking Exchange-Traded Funds (ETFs)

- An Honorable Mention: A few of their favorite growth stocks, like Tesla, Apple or Amazon, or tech-oriented ETFs (more commonly recommended pre-2022)

- The Rising (and Falling?) Star: Cryptocurrencies

Let’s take a look at the recommendation of passive investing.

Background

Established in 1993, the current largest ETF in the world is the SPDR S&P 500 ETF (SPY), with over $361 billion in assets under management (AUM).[i] It is the largest of hundreds of U.S. equity index-tracking ETFs available today. The top 20 U.S. ETFs by AUM passively manage almost $2.5 trillion with an average expense ratio of 0.10%.

Exceptionally low cost is one of many valid reasons for passive investments’ popularity. Index-tracking ETFs are typically straightforward ways to gain transparent and diversified exposure to entire markets worldwide. They typically do not have load, an additional expense associated with retail share classes of mutual funds, and are tax efficient. These benefits, together with the challenge of achieving consistent alpha (return above benchmark) associated with active management draw many investors to passive funds.

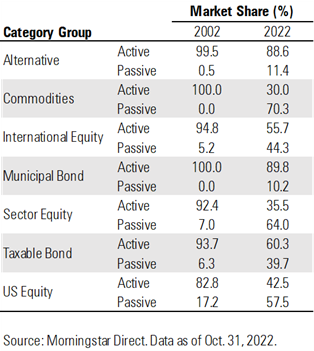

Passive funds are to Millennials and Gen Z what actively-managed mutual funds were to earlier generations, meaning the familiar option that makes the most sense. One key difference between these two types of strategies, however, is their age. The S&P 500 was created in 1957 as America’s first market cap-weighted index. The first passive index fund, created by John Bogle at Vanguard to track the S&P 500 with low fees, was launched in 1976. Index funds took another 20 years to gain recognition as a legitimate investment vehicle, around the time when Highland first advised on passive investments in client portfolios. Even then, they were largely limited to tracking U.S. equities (Figure 1).

Figure 1. (Source: Highland Consulting Associates; Morningstar Direct

While the concept of actively managing a portfolio of securities has changed little since its inception, actively managed investments’ share of investor funds has declined significantly. Meanwhile, passive’s market share has ballooned in the last 20+ years and is now almost 60% of all U.S. equity investments (Figure 1). , what impact has this had on the indexes tracked, many of which were constructed more than 50 years ago?

Trade Motivations

The S&P 500 and other commonly used equity indexes follow a market capitalization-weighting scheme. Companies with larger equity value receive higher weights in the index because they should, in theory, be more representative of American commerce. Larger companies draw more revenue from more consumers and are responsible for more economic activity; therefore, investing in these companies should provide an investor with an approximate exposure to the American economy.

Price discovery is the process by which the value of a company’s stock is determined. If investors believe a stock is worth more than the value the current price reflects, they will submit buy orders. When these orders are filled, the price goes up as the supply of stock available for sale (sell orders) is consumed. The market price of the stock will rise until the buyers no longer believe the stock is trading at a discount and supply and demand reach an equilibrium once again. The true price of the stock has been discovered by way of investor interactions. The concept is straightforward: Investors will pay more for “good” companies and less for relatively “worse” companies. It also represents an opportunity for active managers to earn alpha. If they can identify a company trading below what it is worth before price discovery happens, their portfolio can outperform the market when the stock price reverts.

How does an index fund trade? In short, investor money comes in and the fund purchases shares of every company of the index in the same proportion as the index in order to keep the investor’s exposure exactly the same as the index. The key difference between this process and active management is trade motivation.

An active investor buys a stock because they believe it is undervalued. A passive fund buys because of an inflow. Passive implicitly believes price discovery has already taken place and markets are efficient; the price to fulfill the order, whatever price that might be, is the correct price. Passive investing is dependent on active investing to work appropriately. In other words, passive investing needs price discovery to occur in order to make its underlying assumption of efficient markets valid. This is where important questions arise. Passive U.S. equity strategies had nearly 60% of all investor dollars in 2022. What would this look like if passive’s total share were to hit 90%?

Passive Implications

At 90% passive, we could see a version of the cart pushing the horse. As inflows come in from investors, passive funds buy more of the basket of stocks with an emphasis on the larger weighted names. The index constituents’ stock is bid up regardless of the health of the companies. It assumes, in a roundabout way, that all the companies in the index are performing well and that the price reflects that accurately. With only 10% market share, active managers may not be able to trade in large enough volume to impact stock prices in a way that improves their precision around true value, leaving index funds to continually pay for potentially overpriced stocks.

A strategy of investing based solely on flows could impact many trading-based aspects of financial markets with enough assets. Characteristics like momentum, systematic risk, and cyclicality, would all be affected. Momentum is already a byproduct of market cap-weighting. The higher weight a company receives in the index, the more money will flow to it from a passive fund. Correlations would rise among stocks in popular indexes, as money flows either into or out of all of the indexes at the same time, watering down any stock-specific events. Cyclicality could become an enormous factor as passive funds sell when investors take their money out of markets due to economic worries. Correlation plus cyclicality could give rise to bigger market-wide moves when sentiment is strong in either direction.

An asset is only worth what someone is willing to pay for it. At 90% passive assets, the remaining 10% may not be able to provide enough liquidity to dampen volatility. For example, take a hypothetical company with 100% publicly traded equity ownership. Let’s assume their stock is trading at $50 per share, and it trades in a market where 90% of assets are held by index funds. The remaining 10% of assets are held and traded by fundamental managers. If investor sentiment suddenly declined on worries of a seismic recession, huge outflows from the passive funds could occur, triggering sell orders to meet the redemptions. Ninety percent of funds are selling. Ten percent may or may not be buying, as they have recession fears as well. The stock price falls to $45. The passive funds must sell or they won’t have enough cash on hand to meet investor demands. The active managers are not buying, so the passive funds lower the price at which they are willing to sell to $40. Still, too few contrarian active traders are willing to buy in order to soak up all the sell orders. The price falls further: to $35, $30, $25, and it continues to free fall until the point that even the “growthiest” of managers have placed buy orders to gain exposure to a great company for a fraction of its fair value. The stock is now near worthless and, assuming this has happened to every stock in the index, the market has crashed. This may seem like an exaggerated scenario, but dramatic forced selling can be observed in history as recent as the Great Financial Crisis when banks were forced to sell mortgages from their books to meet equity capital requirements.

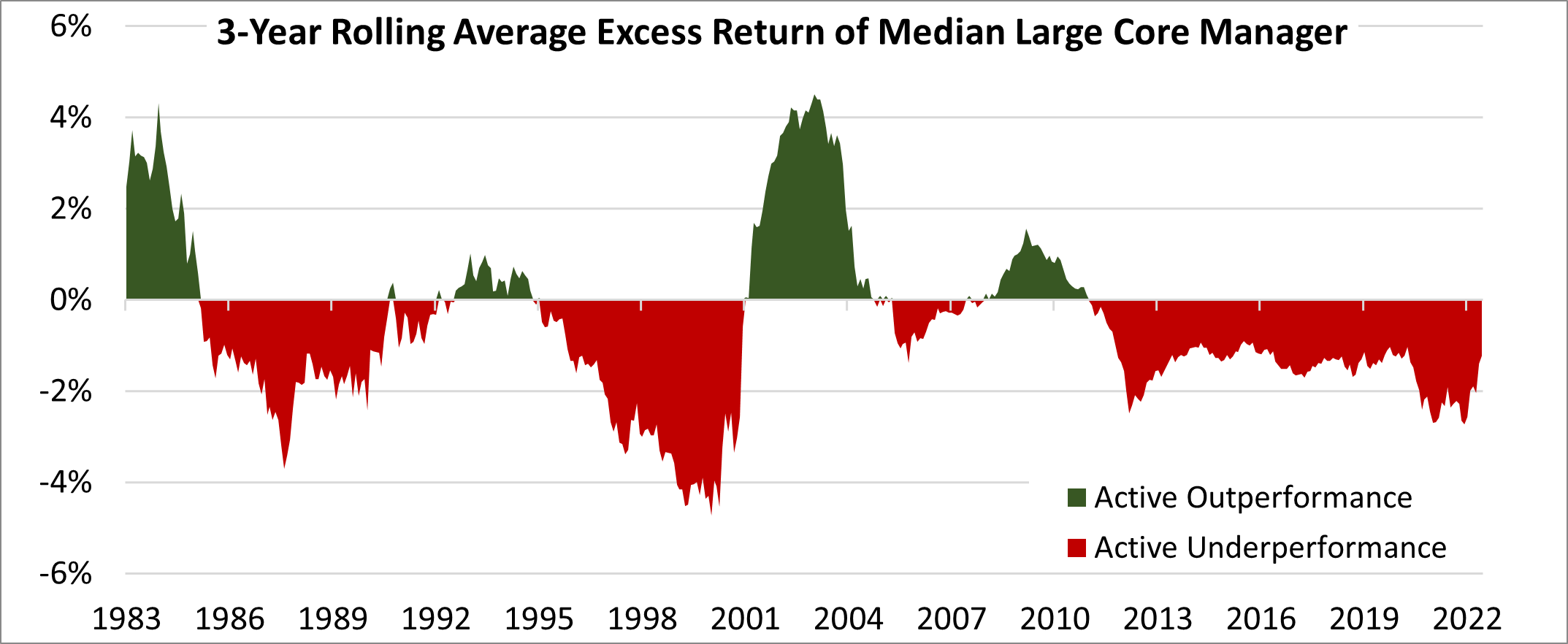

Active managers have found it hard to outperform “efficient” asset class indexes as it is (Figure 2), let alone runaway train versions of them. Many managers explicitly state they do not engage in market timing or macroeconomic analysis, but considering the possible outcome of significant assets flowing into passive, these outflows from active investments might have to become a new source of alpha for these active managers.

Figure 2. (Source: Highland Consulting Associates; Morningstar Direct data)

Figure 2. (Source: Highland Consulting Associates; Morningstar Direct data)

Examining the Calculus

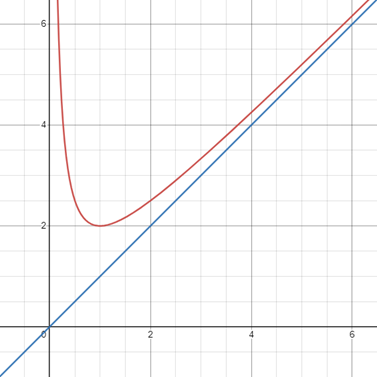

If you’ve taken a calculus class, you may remember the concept of analyzing the behavior of functions as the dependent variable is increased/decreased to infinity. Some functions plot in such a way that they approach an asymptote—a line they increasingly approach, but into infinity, they never actually touch. See Figure 3 below.

Figure 3.

What does the function of passive investing look like as it approaches its figurative asymptote? It seems that the more we believe in passive, and direct assets to those investments, the less reliable it becomes. How do markets react as increasing portions of inflows go to index-tracking strategies? For now, answers to these would be guesswork, but the questions are worth considering. Here are a few more like them for the next time you’re stuck in traffic:

- Will opportunities for active management to outperform increase or decrease as passive investing rises in popularity?

- What is the balance of active and passive management for optimal market efficiency?

- Does passive investing make sense for market cap-weighted indexes? And, further, how does this interact with value stocks, where the highest weight should be placed on the lowest valuation?

- How is the autonomy of company management affected when more shareholders are passive?

Traditionally, investors build up wealth to retirement, at which point their wealth decreases as they use these assets to meet their living expenses. This results in strategies pursued by younger generations to experience rising asset levels while assets in strategies followed by post-retirement generations fall. The average investor’s preferences have changed and target date funds, which are being increasingly adopted as a retirement plan-designated default investment option, often use passive investing as core positions of their portfolios. Passive investing has seen massive growth in assets over the last 20 years and its proliferation among the younger generations will only add to its strength, if generational wealth and investing patterns continue to hold. This might mean that passive investing could require your active investigation.

If you’d like to explore these trends in passive investing and how they relate to your portfolio, call us. Highland has been advising on index fund investments since 1994. We'd be happy to discuss the implications, what-ifs, and questions that may influence how you allocate your capital.

[i] Source: Morningstar Direct as of March 7th, 2023

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.