How Will Defined Benefit Plan Sponsors Deliver on Pension Promises?

Just a few months ago, UPS announced to 70,000 non-union workers that their pension benefits would be frozen. In order to manage a deficit in U.S. pension obligations of nearly $10 billion, affected workers will stop accruing pension benefits on January 1, 2023. On that date, the package carrier will instead begin contributing 5-8% of salaries into 401(k) savings accounts.

UPS is not alone in making difficult decisions that impact defined benefit (DB) plan funding, and in turn, corporate earnings, balance sheet stability, and the futures of thousands of long-serving employees. With collective unfunded pension obligations among S&P 1500 companies totaling $391 billion at the end of February 2017 (Mercer) and interest rates languishing at historic lows, a majority of employers are reckoning with the same dilemma.

Free Bonus Content: Download the 11 Essential Questions for Plan Sponsors to Ask Advisors in PDF format. Easily save it to your computer or print it for reference.

Defined Benefit Pension Plans – Only Change is Certain

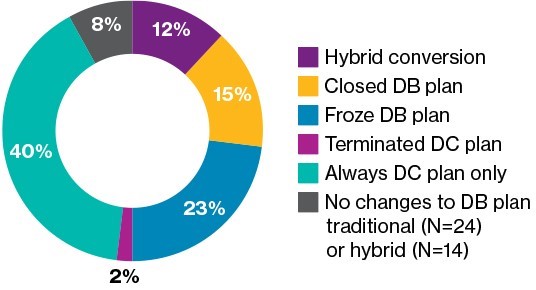

Clichéd and also true, in the defined benefit arena the only thing certain is change. Take a look at the findings of Willis Towers Watson below. Among other trends, the chart shows that nearly every plan sponsor had reconfigured its defined benefit plan in the 17 years between 1998 and 2015. Only 8% of Fortune 500 companies had left their pension plan unchanged during the period.

Most recent changes to retirement programs since 1998

Source: Willis Towers Watson, A Continuing Shift in Retirement Offerings in the Fortune 500 (February 2016)

Change is certain, but the pension plan funding solution is not as clear. It might seem that sponsors of defined benefit plans share the same playbook and that the management of pension plans is now a commoditized process—off-the-shelf answers for a universal problem. But no two pension plans are alike. Liability demographics, plan benefit provisions, and funding capabilities present unique challenges for sponsors charged with keeping retirement promises to hundreds of current and former employees.

Fully Funded Pension Plan Choices

Plans with funding levels near or in excess of 100% face a number of decisions:

- Will the sponsor be retaining the plan and winding it down naturally over a long time horizon?

- Is the goal to remove all or a portion of the pension obligation from the sponsor’s books?

- What is the appetite for future contribution risk?

These are a few of the questions that sponsors should ask when considering portfolio construction. Investment strategy should not be wholly dictated by the plan’s current status. Fully-funded or not, an end game must be a part of the conversation. Sponsors looking to transfer pension liabilities to a third party will need to attain a higher funding level than the sponsor retaining the obligation for the long-term. Sponsors with limited flexibility around contributions will have little appetite for tracking error and may choose a hibernation strategy that relies heavily on hedging interest rate risk inherit with the liability.

Underfunded Pension Plan Challenges

Citigroup estimated that the median S&P 1500 pension plan’s funded status was 76% at the end of 2016. More alarming (if not terribly surprising) is that among the 200 largest plans in the S&P 500 based on assets, 186 were underfunded. Plans with significant funding shortfalls face a number of hurdles to close the gap.

Consider just a few of the common quandaries:

- Plan assets are being tapped for benefit payments continually, while liability obligations keep edging up due to stubbornly low interest rates.

- Underfunded plans face increasing variable PBGC premiums, an implicit tax on a plan’s funding shortfall. (In 2017 plans are charged 3.4% of the unfunded liability, with the rate projected to grow to more than 4% by 2019) PBGC.

Sponsors can make contributions to close the gap, but not all companies are able to divert funds from core business activities to address pension funding issues. Absent contributions, returns on invested assets bear the brunt of the burden to improve funding. Tasked with outpacing the combined forces of liability returns, recurring benefit payments, mortality risk, and rising PBGC costs, sponsors must accept tracking error to generate outperformance, which has the potential of increasing the risk of additional funding losses.

Sponsors can engage in risk transfer activities, be it lump sum payouts to terminated vested participants, or segmented annuity buyouts covering groups of participants. The pension math involved is often the snare for this solution which naturally triggers a required influx of capital to maintain pre-risk transfer funding levels.

Generally, the larger the liability being settled, the larger the required contribution to render the transaction “funding-neutral” to the remaining plan. Nonetheless, the lump-sum option is being employed. The U.S. Government Accountability Office noted in one report that in 2012 alone, as many as 22 plan sponsors offered lump-sum options to 498,000 participants that resulted in payouts of more than $9.25 billion. (And yet that amounts to only 2% of what is currently underfunded as of 2017.)

One often-discussed but little-utilized option for underfunded plans is to tap the debt market to fund up the pension plan. In instances where a sponsor has access to affordable financing, this transaction may be appealing. For example, in February 2016, General Motors announced it would issue $2 billion in new debt to fund its plan for hourly workers. (GM’s total U.S. pension obligations for hourly and salaried workers were underfunded by $10.4 billion at the time.)

Sponsors may hesitate to convert “soft” pension funding obligations to “hard” debt on the balance sheet like GM did, but equity analysts have become accustomed to interpreting the various pension risk-related activities engaged in by sponsors, and borrow-to-fund activity as debt-neutral on a sponsor’s balance sheet.

Defined Benefit Plan Sponsors Obligations

In all likelihood, your company is not UPS (nor GM for that matter) but you share a common concern:

How do you meet significant obligations to your employees and other stakeholders despite their often incompatible objectives?

Each plan and sponsor must account for its unique circumstances to successfully navigate the pension landscape. One thing is certain: the status quo isn’t a viable solution. But there are sound options available and predictable pitfalls that can be avoided for informed plan sponsors who, like UPS, want to deliver on the benefits packages that once promised retirement security.

If you would like an objective point-of-view from an independent advisor who understands the issues and the opportunities in pension plan management, let’s connect and see if Highland might help.