It’s a Long Road. (But Look How Far You’ve Come.)

Don’t Let Emotional Biases Cloud Your Financial Outlook

The S&P 500 has declined 12.8% so far in 2022 (through May 2022). That’s hard to stomach, but with a shift in perspective we can see that maybe it isn’t as bad as it feels.

Humans are prone to a multitude of emotional biases and cognitive errors, most of which work against investors attempting to make rational decisions in times of market volatility. For one of the more applicable examples, take Kahneman and Tversky’s theory, “loss-aversion bias,” which suggests that humans feel more intense negative emotions from losing than positive emotions from winning. Or consider “availability bias,” which notes that people tend to emphasize more recent memories over older ones. Put these two together and a bear market can feel like a painful eternity.

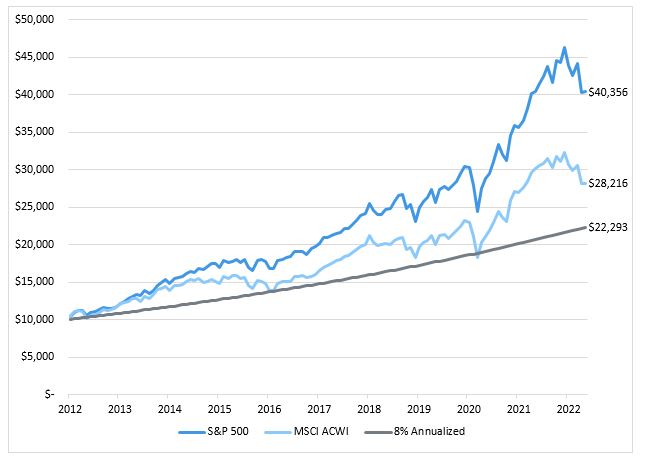

One effective way to fight this feeling is to take a long-term view (Take that, availability bias!), and observe just how well we’ve done in the market over the last decade (And that, loss-aversion bias!). The chart below shows the growth of $10,000 invested in the S&P 500 and the MSCI All County World Index (ACWI) against an 8% annualized return since 2012.

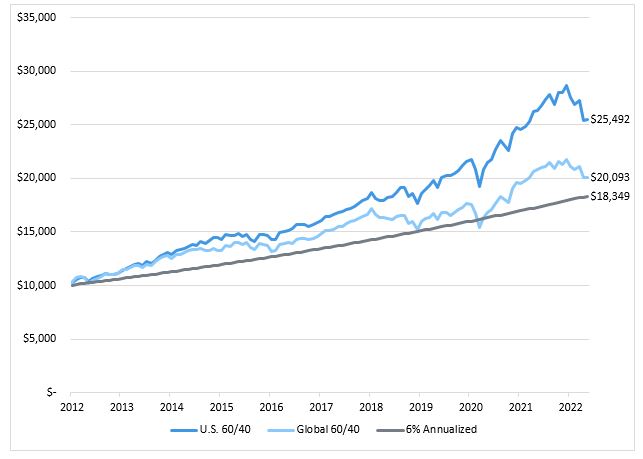

If you had been invested in the S&P 500 from the start of 2012 through May 2022, you would have nearly doubled what was commonly projected for long-term U.S. equity returns in 2012. If we apply this principle to a portfolio allocation of 60% – S&P 500 and 40% – U.S. Aggregate Bond Index and a global corollary alongside an adjusted 6% projection, we see results that are not quite as dramatic, but still striking.

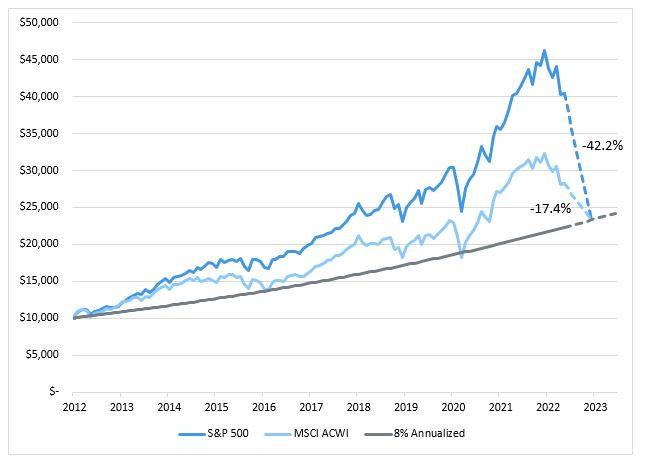

Both of these examples show that even after the year we’ve had so far, investors are still far ahead of where forecasters expected the market to be 9.5 years ago. This prompts a question: Exactly how much ahead? How much of the house’s money are we playing with? Perhaps the answer is more easily understood if we take advantage of our own availability bias and visualize what we can remember best—current losses. How much will equity markets have to lose through the end of 2022 to achieve that 8% projected return over the preceding 10 years? See below.

The S&P will have to decline 42.2% and the ACWI 17.4% over the second half of 2022 to reach the projected annual rate of return of 8% from 2012.

In the case of the S&P 500, your $10,000 investment would be worth approximately $23,300, less than its value at the low of 2020 (roughly $24,400). However, even after this enormous hypothetical loss, an investor would still achieve a respectable 8% equity return every year for the last 10 years.

So, the next time you think of this year’s returns and grimace, remind yourself that it’s your loss-aversion bias talking. Instead, talk yourself into the long-term, strategic view Highland encourages and remember the gains you’ve experienced along the way.

Highland Can Help

If you’d like to learn more about this topic or Highland’s long-term view on investment management, please get in touch. We’d love to have a conversation with you.

Highland Consulting Associates, Inc. was founded in 1993 by a small group of associates convinced that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.