January 2024

Summary

Markets broadly got off to a poor start in 2024, punctuated by a final-day of January sell-off in U.S. equities. Economic indicators showed a sturdy jobs market and strong holiday spending from consumers. Inflation numbers for December came in slightly above expectations but remained moderate at 0.3% for the month. Interest rates carried 2023’s elevated volatility into the new year but finished little changed for the month. The month closed with the year’s first Federal Reserve Board meeting, and an unsurprising pause on rate changes. The markets remain focused on the Fed’s March meeting, which is priced as a coin-flip for the first rate cut of 2024.

Equities

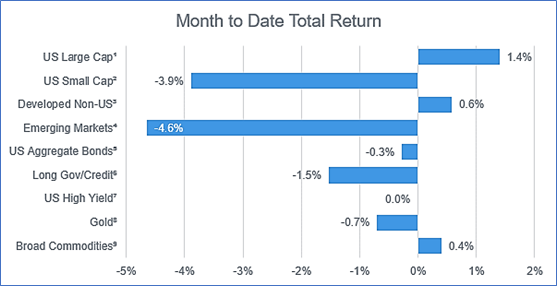

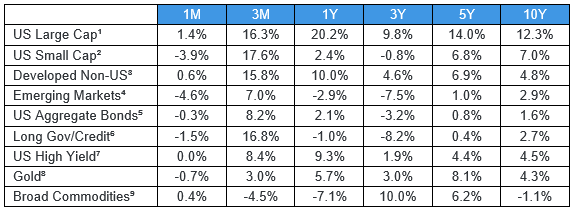

Stocks were mixed in January with developed large cap equities outperforming smaller and emerging markets. U.S. large caps returned 1.4% for the month led by the usual suspects, megacap tech names. Returns were rosier before a 1.6% drawdown on the last day of the month, sparked by unimpressive earnings and renewed worries for regional banks and commercial real estate. Outside of the U.S., developed markets recovered from earlier losses to finish slightly higher, while emerging markets sold off, as China continued to resist wide-scale intervention to assist its suddenly sluggish economy.

Fixed Income

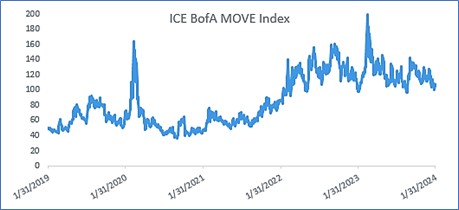

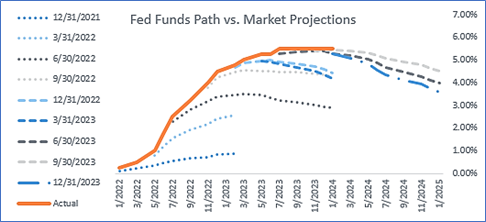

Bonds traded sideways as the 10-year Treasury yield bounced between 3.9% and 4.2% before finishing the month little changed from year end at 3.97%. Rate volatility is nothing new to bond investors as markets attempt to nail down the Fed’s path in 2024 after undershooting with their rate projections in 2023. Treasury rate volatility, as gauged by the MOVE index, has been elevated since the onset of the current Fed tightening cycle, and seems unlikely to abate in the near-term.

Source: Bloomberg, ICE

Rate movements negated carry for credit, which outperformed treasuries for the month. High yield returns were flat, and core bonds fell 0.3% to kick off the year.

1 – Russell 1000, 2 – Russell 2000, 3 – MSCI EAFE, 4 – MSCI Emerging Markets, 5 – Bloomberg US Agg, 6 – Bloomberg US Long Gov/Credit

7 – Bloomberg US Corporate High Yield, 8 – Bloomberg Gold Subindex, 9 – Bloomberg Commodity

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Disclosure Statements

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “ LSE Group” ). © LSE Group [year]. FTSE Russell is a trading name of certain of the LSE Group companies. “ FTSE®” “ Russell®” , “ FTSE Russell®” are trade mark(s) of the relevant LSE Group companies and are used by any other LSE Group company under license. “ TMX®” is a trade mark of TSX, Inc. and used by the LSE Group under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

Copyright MSCI 2017. Unpublished. All Rights Reserved. This information may only be used for your Internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. This information is provided on an "as is" basis and the users of this information assumes the entire risk of any use it may make or permit to be made of this information. Neither MSCI, any of its affiliates or any other person involved in or related to compiling, computing or creating this information makes any express or implied warranties or representations with respect to such information, or the results to be obtained by the use thereof, and MSCI, its affiliates and each such other person hereby expressly disclaim all warranties (including, without limitation, all warranties of originality, accuracy, completeness, timeliness, non- infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall MCSI, any of its affiliates or any other person involved in or related to compiling, computing or creating this information have any liability for any direct, indirect, special, incidental, punitive, consequential or any other damages. The MSCI information is the exclusive property of Morgan Stanley Capital International ("MSCI") and many not be reproduced or redisseminated in any form or used to create any financial products or indices without MSCI's express prior written permission. The information is provided "as is" without any express or implied warranties. In no event shall MSCI or any of its affiliates or information providers have any liability of any kind to any persons or entity arising from or related to this information.