June 2024

Summary

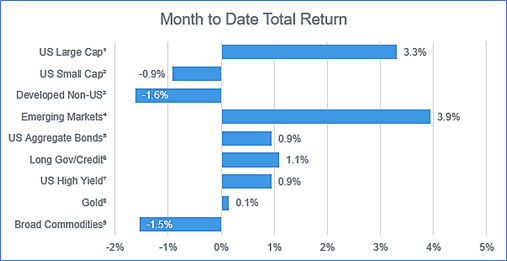

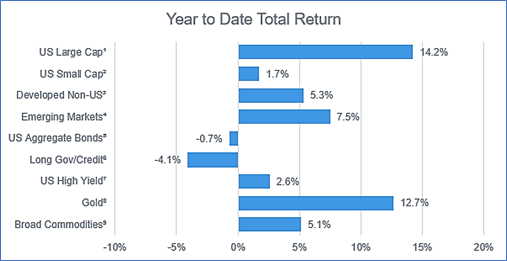

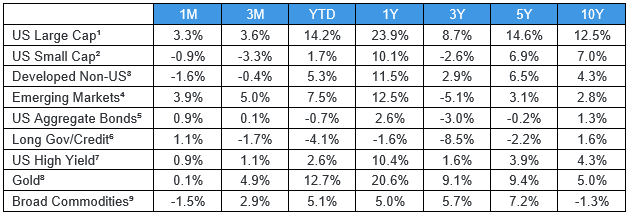

Stocks were mixed in June and interest rates rallied in the month to what’s becoming a familiar tune - data indicating a slowing economy and inflation that is gradually declining. In the U.S., unemployment ticked up slightly and the housing market continued to cool, leading markets to price in more optimism for a Fed interest rate cutting cycle kick-off in the second half of 2024. Overseas, the European Central Bank approved its first rate cut, while the Bank of England paused. The pressure on the Japanese Yen persisted. Emerging markets were a top performer in June while at the country level, results were mixed. Similarly, the broad commodities benchmark sold off despite oil prices rising more than 5% for the month.

Equities

U.S. blue chip stocks capped off a strong first half of the year with another positive month. Nvidia was in the spotlight once again as the AI bellwether saw outsized gains, followed by a steep selloff at the tail end of June. Large cap stocks returned 3.3% for June, while small caps were unable to capture that same momentum, declining nearly 1% for the month. Developed non-U.S. markets didn’t fare any better, falling 1.6% in June. While the ECB kicked off its easing cycle, snap elections in France tempered investor enthusiasm, and Japan continued to experience pressure on the Yen in foreign exchange markets. In emerging markets, Mexico’s election results were in-line with expectations, but the surrounding sentiment gave investors pause, while China equities also struggled through the month. EM index returns, however, were a top performer, with an assist from top holding Taiwan Semiconductor.

Fixed Income

Interest rates rallied and bonds generated positive returns in June, as investors digested optimistic inflation data and pessimistic economic data. The unemployment rate ticked up from 3.9% to 4.0% in May, and while the increase was small, jobs markets have historically been a leading recessionary indicator. Another favored indicator, the housing market, also cooled with existing home sales and housing starts both declining in the face of elevated mortgage rates and higher home prices. CPI came in at 3.3%, a touch below forecasts, while the Fed’s preferred measure of inflation, PCE, rose 2.6%, in-line with expectations. The 10-year Treasury yield dipped as low as 4.21% before finishing the month at 4.34%, 13 basis points lower than May levels. Bonds benefited from lower rates, with investment grade and high yield bonds each returning just under 1% for the month.

1 – Russell 1000, 2 – Russell 2000, 3 – MSCI EAFE, 4 – MSCI Emerging Markets, 5 – Bloomberg US Agg, 6 – Bloomberg US Long Gov/Credit

7 – Bloomberg US Corporate High Yield, 8 – Bloomberg Gold Subindex, 9 – Bloomberg Commodity

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Disclosure Statements

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “ LSE Group” ). © LSE Group [year]. FTSE Russell is a trading name of certain of the LSE Group companies. “ FTSE®” “ Russell®” , “ FTSE Russell®” are trade mark(s) of the relevant LSE Group companies and are used by any other LSE Group company under license. “ TMX®” is a trade mark of TSX, Inc. and used by the LSE Group under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

Copyright MSCI 2017. Unpublished. All Rights Reserved. This information may only be used for your Internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. This information is provided on an "as is" basis and the users of this information assumes the entire risk of any use it may make or permit to be made of this information. Neither MSCI, any of its affiliates or any other person involved in or related to compiling, computing or creating this information makes any express or implied warranties or representations with respect to such information, or the results to be obtained by the use thereof, and MSCI, its affiliates and each such other person hereby expressly disclaim all warranties (including, without limitation, all warranties of originality, accuracy, completeness, timeliness, non- infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall MCSI, any of its affiliates or any other person involved in or related to compiling, computing or creating this information have any liability for any direct, indirect, special, incidental, punitive, consequential or any other damages. The MSCI information is the exclusive property of Morgan Stanley Capital International ("MSCI") and many not be reproduced or redisseminated in any form or used to create any financial products or indices without MSCI's express prior written permission. The information is provided "as is" without any express or implied warranties. In no event shall MSCI or any of its affiliates or information providers have any liability of any kind to any persons or entity arising from or related to this information.