Minimum Required Contributions: It’s Time to Pay the Piper

Photo credit: Unsplash

Rising rates and increasing economic pressures may surprise pension plan sponsors with MRCs not paid in years. But the gig is up. It’s time to pay the piper.

In recent years, fall has tended to be an unremarkable time for pension plan sponsors. The plan’s AFTAP (adjusted funding target attainment percentage) valuation report typically arrives, but the bottom line for many plans remains the same. No required contributions for the coming year. And the beat goes on. This year, unfortunately, the music is slowing and the bill is coming due. In the aftermath of steep asset losses in 2022, sponsors across the country are receiving the unpleasant news that they will be required to divert cash from business operations and contribute to the plan. The outcomes will impact plans regardless of the size of their risk hedging program and can be attributed solely to esoteric valuation regulations enacted more than a decade ago. (Which, it turns out, was a little like plying the band with a few drinks for playing another set.) The path that took us here is paved with good intentions, unintended consequences, and of course, politics.

When the Music (Almost) Stopped

In 2012, on the heels of the global financial crisis (GFC) that decimated the U.S. economy and subsequently birthed the novel policy tool known as ZIRP (zero interest rate policy, when a central bank sets its target short-term interest rate at or close to 0%), many corporate DB plan sponsors faced an especially dire situation. Equity markets had yet to fully recover the stark losses of the GFC and pension investors had found themselves on the front line of the drawdown. Adding to the pain, Liability Driven Investing (LDI) was still in its nascent stages, with many DB plans poorly hedged against interest rate risk. So, when the Fed opted to slash interest rates to stimulate the economy, pension plans absorbed huge funding losses (because lower interest rates mean higher liability values).

The Pension Protection Act of 2006 prescribed that any funding deficit be met with sponsor contributions to close the gap, specifically a minimum required contribution (MRC) schedule. In the wake of the GFC, as funding deficits rapidly ballooned, pension plans were handed larger bills at an inopportune time. Economic growth was still subdued, unemployment remained high, and tight credit conditions were squeezing sponsors’ core operations. Cash flow was at a premium, and in short order a large number of defined benefit plans were cascading into financial distress.

Let the Music Play

It was against this backdrop that the U.S. government interceded to provide relief for plan sponsors. The minimum required contribution rules remained, and instead, the liability valuation rules were modified, essentially reversing the negative effects of ZIRP on pension plans. Spot interest rates were replaced by long-term averages, providing an immediate boost to discount rates, and a quick cut to the MRC pension liabilities. Cashflow was freed from the pension plan to support businesses facing a widespread cash crunch, and stressed sponsors had one less thing to worry about. The government, for its part, was not entirely altruistic in its interests; as pension contributions are tax deductible, IRS was able to realize higher corporate tax revenues by diverting MRCs into the future.

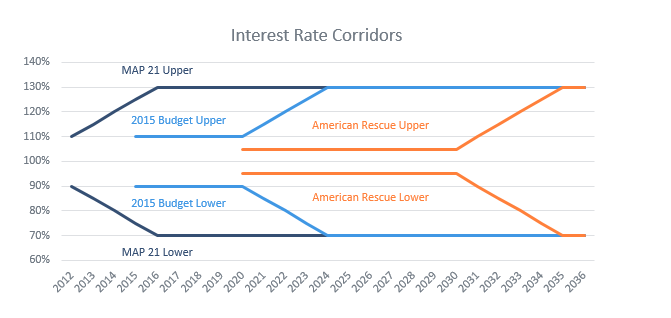

This funding relief measure was enacted in July 2012 as part of a highway and transportation spending bill and included a plan to phase out the relief slowly over the course of five years. This would be accomplished by means of a widening corridor around the 25-year average of the applicable interest rate. If spot rates were below the corridor, they would be adjusted upward to the boundary point; if spot rates were within the corridor, spot rates would be used instead of the 25-year average. As the corridor lengthened over time, the adjustment to rates falling below the boundary would become smaller over time and the magnitude of the relief would dissipate or disappear. But the lure of tax revenue, coupled with political infighting over budgetary issues, led to the resetting and extension of the corridors only a few years later in the 2015 Bipartisan Budget Act. And most recently in 2021, the American Rescue Plan narrowed the initial corridor, with any widening delayed until 2031! Temporary interest rate “relief” has become a permanent fixture for pension plans.

And the Band Played On

In terms of immediate consequences, relief was decidedly effective in providing breathing room to plans, and as global equities began to rebound, investors benefited and pension portfolios grew. Because there is no way to hedge interest rate risk tied to a growing (and shifting) corridor around 25-year average interest rates, sponsors moved their focus to funding measures reflected on their balance sheet and income statement, where spot rates still presided. LDI programs grew, and over the course of several years the accounting deficits eased as the stock market notched higher year after year. Amid these sweet sounds, MRCs became an afterthought as funding methodically improved and sponsors turned to lump sums or annuity markets to downsize plans.

Until…The Music Slowed

In 2022 something unexpected happened. Rapidly rising inflation prompted a swift and severe interest rate hiking cycle that has persisted into late 2023. As rates skyrocketed off exceedingly low levels, LDI programs realized losses in excess of 20%. Global equities saw slightly smaller losses, but pensions were faced with double-digit drawdowns. The pain was eased by the fact that accounting liabilities were reduced to the same extent as the plan’s LDI; sponsors that were underhedged were able to actually see funding gains despite the nominal losses. In spite of the market turmoil, pension asset allocation and liability hedging had been an effective funding risk mitigation strategy.

When the Music Stops, Someone Has to Pay the Piper

The recent run-up in rates, however, has created a disharmony that has roused the sleeping MRC beast. Because MRC interest rates were already artificially inflated, the jump in spot rates had no effect on AFTAP liabilities. From this perspective, sponsors realized 15-20% losses to assets while liabilities remained flat or in some cases increased modestly. Funding levels have sagged below 100% for many plans, triggering a cash call to corporations contending with some eerily similar circumstances (recession concerns, tightening lending conditions, increased expenses, and heightened economic uncertainty). While MRCs may be more manageable at the moment, for many sponsors they are an unwelcome year-end surprise.

Due to the unconventional methodology underlying AFTAP valuations, sponsors cannot address MRC volatility through investment strategy alone. Contribution policy is an important tool for holistic pension plan risk management. (In retrospect, the only way to avoid MRCs in 2023 would have been to commit to voluntarily contribute on a regular basis during the relief period.) Unfortunately, many sponsors were lulled into this state after a decade without a contribution requirement. Pension committee members who joined the industry after MAP-21 may be puzzled by the very existence of MRCs.

The bill, however, was going to come due eventually. In pension circles it’s common to hear the adage, “Pay me now, or pay me later.” Unfortunately for many sponsors, “now” has come. The gig is up. The music has stopped. And the piper must be paid.

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.