Reframing Our Perspective

“What I am looking for is a blessing not in disguise.” Jerome K. Jerome

In response to aphorisms like “adversity builds character,” and “what doesn’t kill you makes you stronger,” is the honest plea from 19th century humorist Jerome K. Jerome, “What I am looking for is a blessing not in disguise.” While hard to see in the performance of capital markets in 2022, there may be, in fact, a blessing for investors hiding in plain sight.

The last three years have been unusual, to say the least. COVID brought about a wide range of challenges for all of us – physical, behavioral, and economic. The good news within financial markets was that the highly stimulative monetary and fiscal policy response around the globe resulted in appreciation of asset prices well beyond underlying fundamentals and expectations established under pre-pandemic conditions.

Unfortunately, too much of a good thing, namely the unexpected extension of easy money and an economic recovery, coupled with labor shortages and supply chain challenges, sowed the seeds for today’s inflation problems. Geo-political events of 2022 added extra fuel to the inflation problem, prompting an abrupt change in the Federal Reserve’s interest rate policy. The steepest and fastest tightening cycle in nearly 100 years caught the markets off guard last year and resulted in double digit declines for both stocks and bonds.

While market corrections aren’t pleasant to endure, quite possibly 2022 was a blessing in disguise with the strengthening of monetary policy tools, better balance in asset values relative to underlying fundamentals, more attractive yields for less risky bonds, and ultimately enhanced future return opportunities.

Highland’s Looking Glass

Every year Highland’s research team undertakes the exercise of modeling forward-looking expectations of long-term capital market returns and volatility by asset class based upon a set of assumptions. This process is just one of the tools we use to ground our long-term perspectives. It also helps us to assess investment risks and opportunities within and among different asset classes.

Our capital market return expectations represent an average annual return we might expect an asset class or multi-asset class portfolio to return over a very long period (at least 10 years). This includes the compounding of both good and bad return years over time. These long-term expectations typically do not change significantly from year to year. In addition to the expected return, we also assess ranges of probable outcomes.

In the short-term, the range of portfolio returns are quite wide, and we have no foreknowledge of extrinsic events or market reactions to them. So, while we cannot predict the actual path of investment results from year to year, we can have confidence in the core drivers of long-term returns, and that after periods of below or above average returns, the pull of the reversion to the mean expected returns will be powerful.

Over the past several years, our long-term forecasts for future portfolio returns have declined each year as dividend and bond yields fell and equity prices rose more than earnings and growth prospects for future earnings would imply. Highland’s capital markets researchers had been fairly loud and repetitive with our “lower for longer” returns message, especially at the beginning of last year.

Incorrect Estimates, on Average

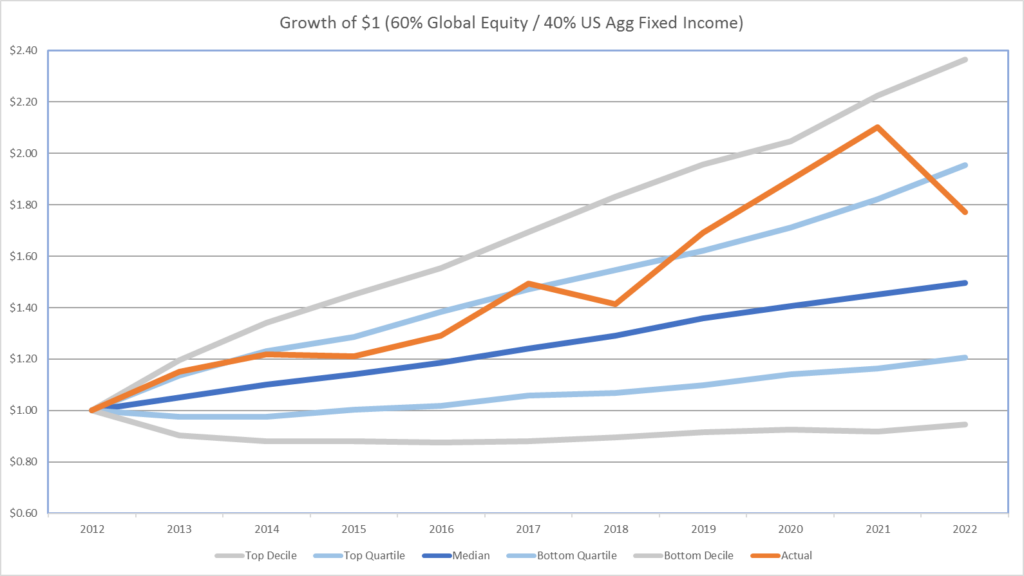

We acknowledge that the magnitude of portfolio declines last year makes the “lower for longer” message sound woefully inadequate. But, in reframing the perspective beyond a single year and aligning it with the intended long-term horizon, it becomes clear that the actual path of returns for a globally diversified portfolio (orange line in the chart) had been well above our expectations (dark blue line) for several years and remains above it in spite of the declines in 2022—blessings not in disguise.

Highland’s chart of “10-Year Multi-Asset Portfolio Growth Estimates, 2012 – 2022” demonstrates the range of expected appreciation in a 60/40 portfolio estimated 10 years ago.

We know our estimates will likely be incorrect in any single year. The path to achieve long-term returns is always less certain than the confidence we have in arriving at that ultimate long-term destination. Or, in the words of another (adapted) aphorism, “the course of 10-year average returns never ran straight.”

Expected Unpredictability

Helping clients maintain a long-term view is at the core of Highland’s investment principles. While that sounds simple, wide variance among investment strategies and bouts of downside volatility, in particular, can provoke investor reactions and responses that are understandable, but potentially detrimental in the long run. Determining appropriate, rational responses to fundamental change while quieting the natural, often emotional, reaction to market noise can be a challenge.

Knowing that unpredictability is a regular occurrence may not make market results easier to accept. It may be a stretch to characterize capital markets’ performance of 2022 as a blessing, and yet, it’s not unexpected and could still be that blessing for investors—a blessing of better future return opportunities hiding in plain sight for those investors with a long-term view.

If you’d like to learn more about Highland and our research practices and principles, call Joel Baker at 440.808.1500.

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.