RFPs: Reframing For Productivity

Unlocking the Power of Unconventional Thinking in Your Next RFP.

Most pension plan sponsors engage in a “request for proposal” (RFP) process on a periodic schedule to fulfill their fiduciary obligations. Importantly, the RFP process helps to gauge the value of provider services to the plan and the reasonableness of those associated fees.

Very likely, your organization has been through the process with enough frequency that the review itself is familiar if not perfunctory. However, regardless of how familiar the process is, it may overlook opportunities to add greater value because the decision over governance and discretion is frequently binary rather than correctly viewing it as a sliding scale and highly customizable to your needs. Reframing the role of the investment advisor can help sponsors achieve efficiencies that may come with customized delegation.

Discretion in a Box: Because One Size Rarely Fits All

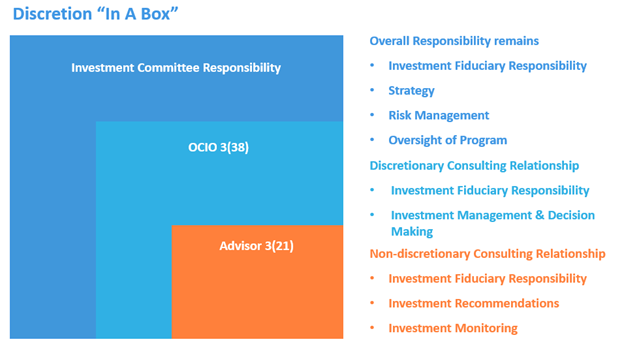

The sponsor’s role and that of its investment committee for overseeing pension plan strategy and risk management is generally understood. Most know that the selected investment advisor can serve in a more limited role of recommending investment lineups (only) as a 3(21) advisor. Other sponsors choose a relationship that allows for full discretion according to ERISA’s 3(38) Investment Manager definition. This Investment Manager can search for and evaluate fund managers and actually execute trades. What sponsors may not recognize or leverage fully is the opportunity to tailor-make the role of the investment advisor outside of these traditional boundaries.

The diagram above illustrates the areas of responsibility often delineated for investment advisors. The boxes frame up the limits of those roles. The reality is advisors who accept a co-fiduciary role can operate virtually anywhere inside the larger “discretion box” based on sponsor needs. We are aware that while business environments have changed in recent years and are changing again in a post-pandemic era, many plan governance and discretion models have not.

For example, it may be true for you and your organization that your resources are stretched thin. You’re busier than ever with a staff team that is also asked to do more with less. The RFP process is then an ideal time to reconsider the role of your advisor—to adjust their role within the box, to take on some additional responsibilities while alleviating the day-to-day stress of managing your plan.

As a co-fiduciary for all of the plans we serve, and a fully independent advisor, we counsel our clients to choose the service model that best suits their needs. We don’t recommend one model over another. What matters most is what serves our clients best.

If you undertake a periodic review, your RFP may be the opportunity to “Reframe For Productivity.” We’re here to talk with you about that process and how your plan might benefit from a fresh perspective on a governance model suited for your organization and plan objectives. Just call Mike Paolucci, 440.808.1500.

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.