The E&F Advocate: Five Pillars of Endowment Governance to Support Greater Liquidity, Transparency and Returns

Photo credit: Dreamstime

The “Yale Model” of endowment investment strategy created by David Swenson, successful for decades, may be nearing retirement. What was developed during a time of falling interest rates, less asset class ubiquity, and diminished premiums for exotics, may be a far less tenable model in 2025. Models like Yale’s with their reliance on complexity have really struggled to produce commensurate incremental returns, particularly when compared to peers with more traditional assets. Will a new era of dynamic macro and geopolitical risks, rising rates, narrowing private market illiquidity premiums and the proclivity toward a herd mentality call for a radically different approach?

If you are a fiduciary on an endowment investment committee, you have every reason to question your CIO/OICO/consultant … or their latest trip to exotic locales on “fact-finding missions.” We believe that success over the next 20 years will be determined by “robustness of governance” rather than “differentiation in investments.”

Now, more than ever, a transformative approach is required to address inefficiencies and ensure long-term sustainability. Highland suggests a framework centered on five pillars: Transparency, Illiquidity Risk Management, Staff Accountability, Fiduciary Empowerment, and Conflict Resolution.

Pillar One: Transparency: Aligning Complexity with Accountability

Transparency remains a shortcoming in the endowment model. Unlike public pensions which are legally mandated to disclose data on portfolios, costs, and staff compensation, endowment data often remains opaque. This obscurity undermines accountability and masks the true cost of complexity.

- Current Challenges:

Over the past decade, endowments have averaged annual returns barely equal to public pensions, despite significantly higher costs associated with complex portfolios and alternative investments.[i]

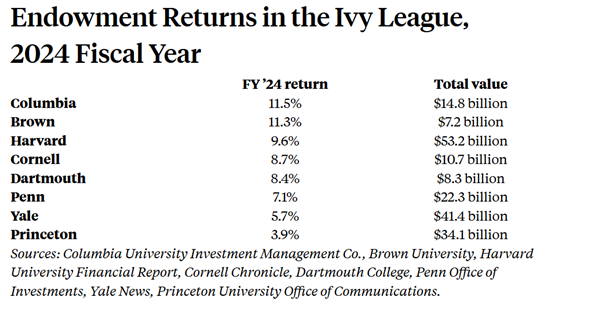

Princeton University released its own summary of Ivy League endowment returns. During 2024, when the S&P reported a 25% total return and an 18% return on a 70/30 mix of the S&P 500 and U.S. taxable bonds, the Ivies posted returns that fell short by multiples. [ii]

Source: Princeton Alumni Weekly October 24, 2024 [iii]

- Evaluate and Restructure:

Full public disclosure of portfolio structures, fees, and performance metrics. Institutions must demonstrate how complexity generates incremental returns over simpler, low-cost strategies.

Pillar Two: Managing Illiquidity Risk in Private Market Investments

Private market allocations have grown significantly in endowment portfolios, often under the assumption that they provide diversification and higher returns. However, as the NACUBO 2023 study indicates, returns from private assets increasingly mimic public market volatility, reducing their diversification benefits. [iv]

- The Illiquidity Challenge:

Illiquid assets, while promising high returns, lock up capital for extended periods, and often limit an institution’s agility in market downturns. This risk is exacerbated when these investments fail to outperform public benchmarks.

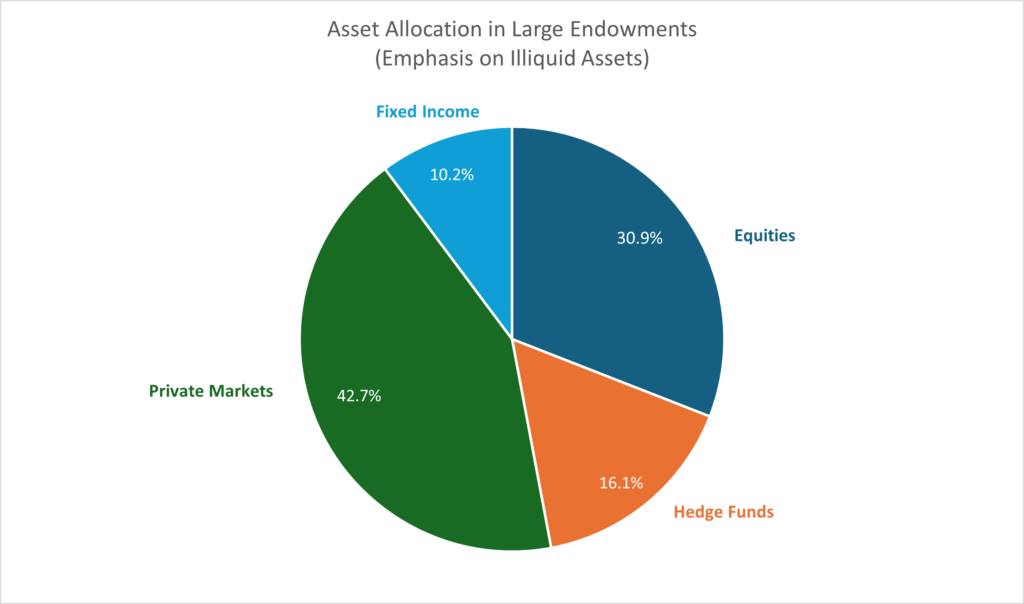

This chart below highlights the significant emphasis on illiquid assets in large endowments, with private equity, hedge funds, and real estate comprising over 60% of allocations.

Source: Highland and 2024 NACUBO Data

- Evaluate and Restructure:

Performance data suggests that institutions should reassess their allocation strategies, ensuring that the illiquidity premium justifies the risks. Greater transparency in valuation practices and timing discrepancies should also be prioritized. Investors might also anticipate a reduced premium for holding illiquid assets, because there are more assets chasing the opportunity set.

Pillar Three: Staff Accountability and Alignment to Long-Term Results

The proliferation of managers in endowment portfolios has diluted accountability, with many institutions employing hundreds of external managers and failing to measure individual contributions effectively. As highlighted in recent reports, this complexity has not translated into better outcomes. [v]

- Comparative Inefficiency:

Endowments would likely benefit by using fewer external managers and lower fees and achieve comparable returns while adhering to strict accountability measures. - Evaluate and Restructure:

Endowments should consider linking staff compensation with long-term performance benchmarks. Focus on streamlining manager rosters and holding them accountable for delivering above-market returns after fees.

Pillar Four: Fiduciary Empowerment to Overcome Insular Thinking

Fiduciaries are often unprepared to challenge the investment status quo, leading to widespread groupthink and resistance to innovative strategies. This lack of diversity in decision-making has perpetuated inefficiencies. [vi]

Evaluate and Restructure:

Provide fiduciaries with data-driven tools and training to evaluate complex portfolios effectively. Boards should also prioritize diversity in expertise and perspective to break the cycle of conformity.

- Fiduciary Responsibility:

Transparency and fiduciary training programs enable organizations to maintain oversight while minimizing costly missteps. Endowments should adopt similar approaches to improve governance.

Pillar Five: Proactive Conflict Management to Reduce Misaligned Incentives

Conflicts of interest in the endowment model are pervasive, particularly in fee structures and overlapping mandates. Without proper oversight, these conflicts diminish returns and erode trust.

- Evaluate and Reform:

Implement robust conflict management protocols, including independent oversight and streamlined manager relationships to minimize redundancies.

What Endowment Complexity Requires of Fiduciaries

Endowment portfolios have become increasingly complex, with some employing over 300 external managers. While this complexity was once celebrated for its potential to deliver uncorrelated returns, it has become evident that the model must evolve to meet the demands of modern investing.

This complexity presents a call to action for the endowment’s investment committee. The identified complexity must deliver clear incremental benefits. If a simpler, low-cost portfolio can achieve comparable outcomes, the rationale for maintaining complex strategies becomes untenable.

Despite operating under tighter regulatory constraints, certain institutions have shown that transparency and efficiency can lead to competitive returns. Endowments should take note of this example to better justify their cost and risk profiles. A useful starting point would be to compare performance against the results of these institutions.

Conclusion: Five Pillars Support a New Framework for Endowments

The time forhe endowment model is now. By embracing transparency, managing risks effectively, holding staff accountable, empowering fiduciaries, and addressing conflicts, institutions can align their strategies with long-term sustainability. As public pensions have shown, simplicity and transparency are not barriers to success—they are prerequisites.

By prioritizing these reforms, endowments can uphold their mission of supporting future generations while adapting to the complexities of modern financial markets.

How Highland Can Help

These recommended changes in endowment investment management don’t have to be overwhelming. Highland has the experience and resources to guide you and your investment committee through a realignment process. Let’s start with a conversation. Email Gaurav Patankar at gpatankar@highlandusa.net or call Highland at 440-808-1500.

[i] https://caia.org/sites/default/files/06_2017_endowment_4-2-18.pdf, page 62

[ii] https://www.barrons.com/articles/yale-harvard-endowments-trailed-sp500-stocks-ef8e0829

[iii] https://paw.princeton.edu/article/princetons-endowment-2024-39-return-lags-behind-peers

[iv] https://files.eric.ed.gov/fulltext/ED657625.pdf

[v] ibid

[vi] Ibid

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and is not intended to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.