The E&F Advocate: Impact of H.R.1 OBBBA on Endowments and Foundations

H.R.1 OBBBA will cause significant changes to endowment and foundation taxes in terms of a transition from flat to tiered tax rates, with various potential implications and impacts for universities and foundations.

University Endowments

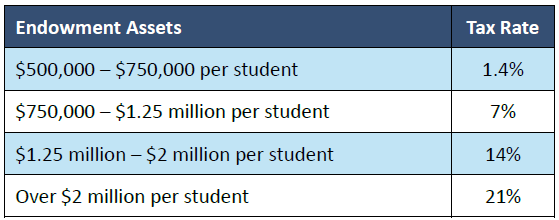

The current flat 1.4% excise tax on net investment income for private colleges and universities would shift to a tiered structure based on the institution's "student-adjusted endowment"—essentially, the endowment assets per eligible student. The proposed tiers are:

Notably, the calculation of eligible students excludes international students on temporary visas, potentially placing institutions with significant international enrollments into higher tax brackets.

Private Foundations

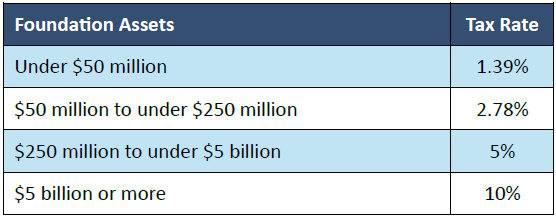

Similarly, the existing 1.39% excise tax on net investment income for private foundations would be replaced with a tiered system based on total asset size. The highest proposed rate is 10%, and the calculation includes assets of certain related organizations. The proposed tiers are:

Implications for Affected Institutions

Financial Impact

- The increased tax rates could significantly increase the tax burden of endowments and foundations. For instance, institutions moving from a 1.4% to a 14% or 21% tax rate would experience a substantial decrease in funds available for operations, scholarships, research, grant-making, and other mission-critical activities.

Strategic Adjustments

- Investment Strategies: Institutions may need to reevaluate their investment portfolios to mitigate the impact of higher taxes.

- Budgeting and Spending: Reduced net returns could necessitate adjustments in spending policies, potentially affecting programs and services funded by endowment income.

- Enrollment Policies: The exclusion of international students from the student count in tax calculations may influence admissions strategies, as a higher proportion of international students could inadvertently increase an institution's tax liability.

Broader Considerations

The Joint Committee on Taxation estimates that these tax changes could generate approximately $22.6 billion over the next decade. While this represents a significant revenue increase for the federal government, it also imposes additional financial burdens on institutions that rely heavily on endowment income to fulfill their educational and philanthropic missions.

Conclusion

The proposed changes in H.R.1 OBBBA represent a substantial shift in the taxation of university endowments and private foundations. Institutions affected by these changes will need to carefully assess the financial implications and consider strategic adjustments to their investment, budgeting, and enrollment practices. As the bill proceeds through the legislative process, stakeholders should remain engaged and informed to effectively navigate the potential challenges ahead.

Highland’s E&F consultants are available to guide you through these challenges. Please contact Gaurav Patankar, PhD at gpatankar@highlandusa.net or Joel Baker, CFA at jbaker@highlandusa.net.

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and is not intended to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.