The Latest ERISA Lawsuit Target: Hidden Fees

The central complaint of lawsuits filed against ERISA plan sponsors since 2006 has shifted with the financial markets like a seesaw.

When the markets were anemic and participants’ savings suffered, lawsuits alleging failures in diversification and offerings of poor-performing funds soared. When participant accounts began to benefit from bull-market returns, complaints shifted to allegations of excessive fees.

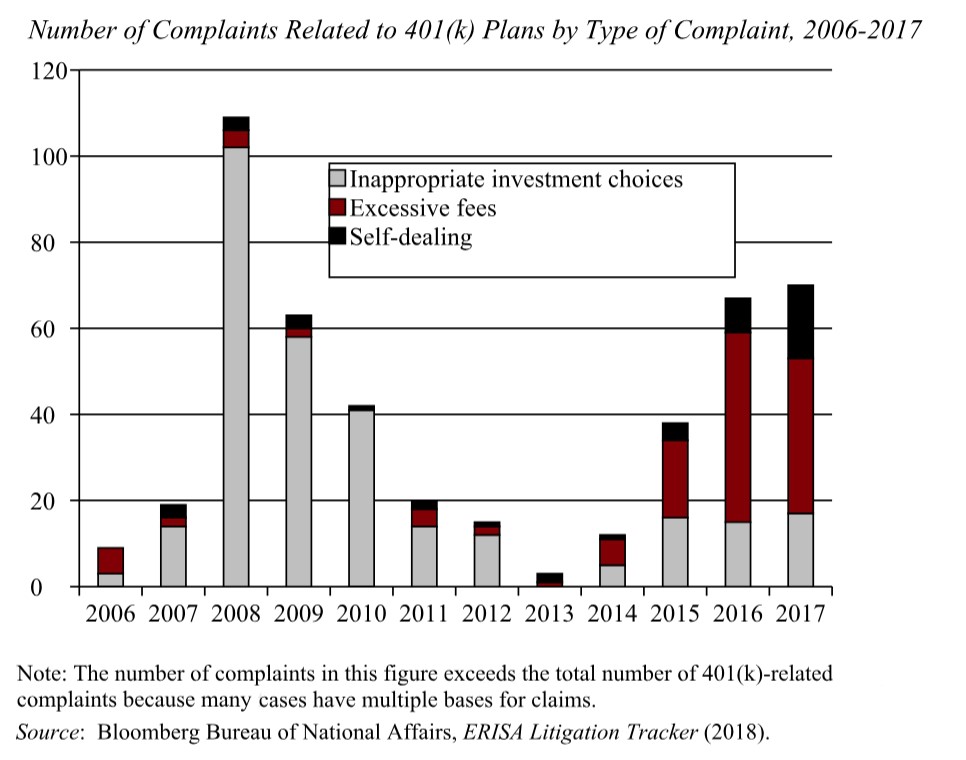

The below Bloomberg chart illustrates the trend.  Through 2012, performance was the issue and complaints peaked, as you might expect, with the 2008 financial crisis. Along with Service Provider Disclosures under Section 408(b)(2), excessive fees moved into the spotlight in 2014 and 2015.

Through 2012, performance was the issue and complaints peaked, as you might expect, with the 2008 financial crisis. Along with Service Provider Disclosures under Section 408(b)(2), excessive fees moved into the spotlight in 2014 and 2015.

Nancy Ross, partner and head of the ERISA litigation practice at Mayer Brown, a Chicago law firm, commented on these continuing shifts and plan sponsor reaction to them saying plan sponsors “are trying really hard to manage risk in this environment. It’s like the game of Whack-a-Mole trying to manage all the different correlated risks.”

Follow the Money

Plan sponsors need to identify and manage expense levels and fee arrangements to assure reasonableness and what is paid serves plan participants and beneficiaries.

Case in point: A complaint was raised against Home Depot that claims the company permitted the charging of unreasonable participant fees while ignoring fees paid between an investment adviser and the plan’s recordkeeper. The complaint reads in part, “To add insult to injury, Home Depot condoned an arrangement in which Financial Engines kicked-back a portion of its fee to the plan’s recordkeeper. Although Home Depot replaced Financial Engines with Alight Financial Advisors in July 2017, Alight simply re-hired Financial Engines as a ‘sub-advisor.’”

This April 2018 lawsuit highlights the need for informed fee management, something a majority of plan sponsors have been more engaged in lately than ever before.

According to the 2018 Defined Contribution (DC) Trends Survey report issued by the institutional investment firm Callan, the number of employers that calculated 401(k) and similar plan fees in 2017 rose to 83%, up from 79% in 2016.

Furthermore, the research showed that four in 10 of those employers got busy—renegotiating fees with plan administrators or replacing high-cost investment funds with lower-cost alternatives. Another 50% expect to renegotiate administrative recordkeeping fees in 2018, while 40% plan to examine and renegotiate investment management fees this year.

Let’s Be Clear

Some analysts suggest that the number of ERISA lawsuits filed will drop as cases are rebuffed or dismissed in court (e.g. Xerox ), as the largest plans (with the greatest potential settlement) have already been targeted, and as fiduciary practices improve. But prospective plaintiffs will be trolled, even on social media, by lawyers looking for a win or simply a generous settlement.

Ms. Ross believes ERISA litigation will continue and the best defense continues to be good offense. “My advice to plan sponsors,” says Ross, “is complete disclosure.”

We Can Help

Marking 25 years of service as an independent, fee-only fiduciary to defined contribution and defined benefit plans, Highland Consulting can untangle fee structures and evaluate those against benchmarks. We can advise you on a retainer or project basis.

Please get in touch by phone or email and let us see if we can bring greater clarity and confidence in your retirement plan management.